They Want Your Property: Hearing Oct 12 on Right of First Refusal

| . Posted in News, policy - 2 Comments

Read our latest on right of first refusal (TOPA).

Senate and House bills to be heard Tuesday, Oct. 12, 2021, would allow renters to conduct “small amounts of demolition” for the purposes of delaying the sale of your building for half a year or more. So-called “Right of First Refusal” is designed to beat you and your property into the ground and collapse the local market for multifamilies. These outrageous bills are benign in title, but are the latest reincarnation of the nightmare they’ve been pushing for years:

- 192 890 An Act to guarantee a tenant’s first right of refusal

- 192 1426 An Act to guarantee a tenant’s first right of refusal

No Seriously, What are They After?

Advocates for these two bills will argue the following: our housing market does not work. Rental housing is sold contingent on being delivered vacant. Elderly and low-income households are being displaced far from where they started. There is no affordable housing nearby. This is an awful situation.

Their solution? Let’s help elderly and low-income renters become their own landlords! “Workers of the world, embrace capitalism!” We ought to be applauding them.

But instead of giving a hand up, our representatives are swinging a hammer down. Landlords are consistently blamed and punished for the price of a state overwhelmingly zoned NIMBY single-family with a minimum lot size. Here is their latest Orwellian torture for us.

Delays for Half a Year

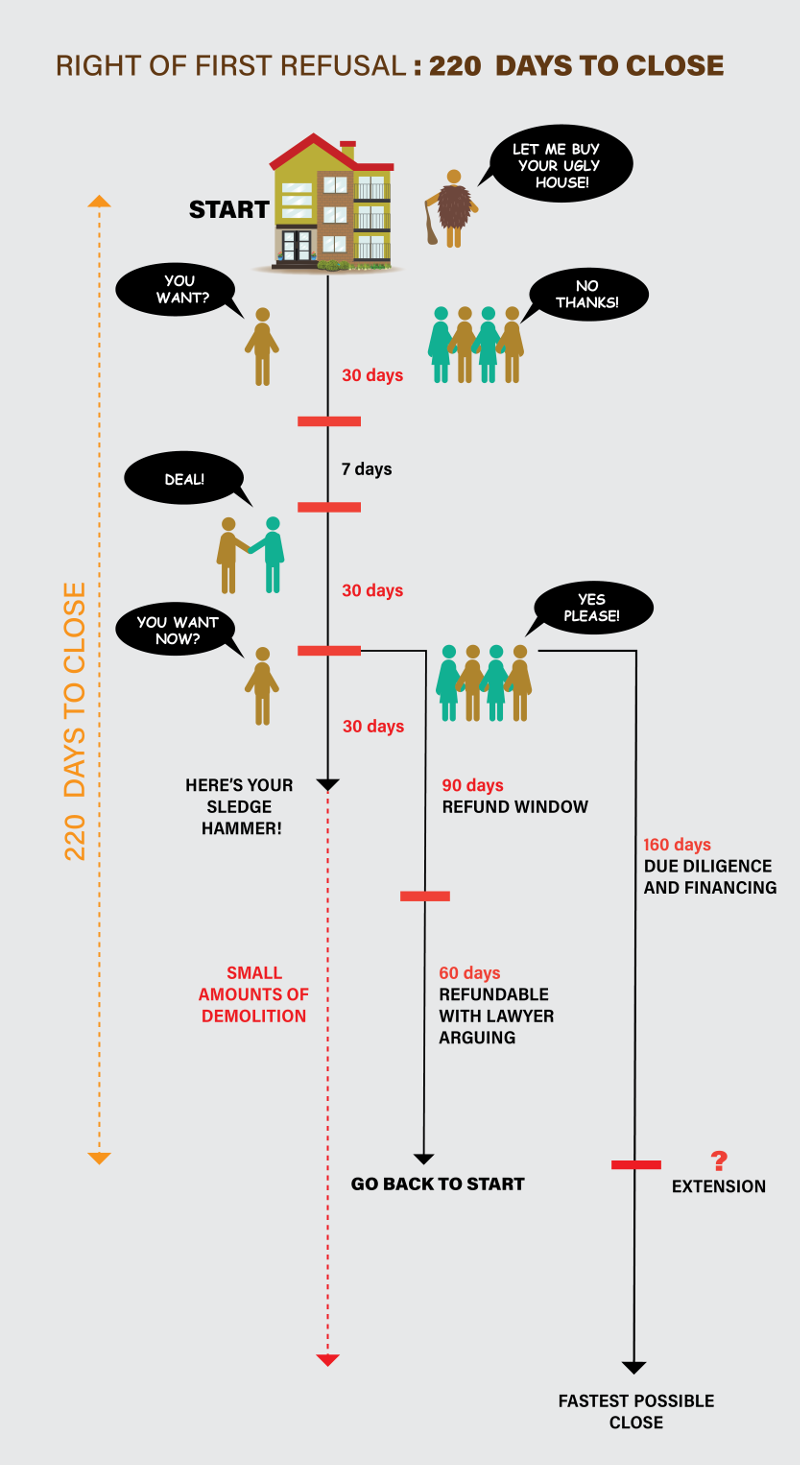

The majority of multifamilies must be subjected to right of first refusal. Here is the process:

- The moment you so much as “entertain” an ad such as “we buy ugly houses” or try to sell, you must notify your renters.

- Your tenants have 30 days to decide if they want your place. They will say “no thanks.”

- If you do sell at any point after, your renters get another 30 days to decide if they want to erase the buyer’s name on your purchase and sales agreement. This law would let them write their own name in. Your buyer did all the work; they get the deal. Now your renters will say “maybe, sure.”

- At this point, there are three tracks:

- The demolition track. If they need to test your property for lead or asbestos, or both, they have 30 days.

- The “no” track. If the renters decide not to buy your place, you will wait 90 days to find out.

- The “yes” track. If the renters decide they want to buy your place, you will wait 160 days to get financing.

By now, your previous buyer has almost certainly decided to shop elsewhere. And any of these deadlines can be extended by mutual agreement. Hard to say no when the renters are your only willing buyer! Let’s continue with the process:

- If your property isn’t sold, you’ll go back to step one.

- When you eventually die (may it be peacefully and decades hence), your heirs may have to go through the same thing, unless they are all already on the deed or in the LLC.

Small Amounts of Demolition

Want to know how we can tell the drafters of this bill are unfit for their job? Just read it:

We hope they meant to write “destructive testing.” What they actually wrote is something much different and leaves you open to a potential nightmare scenario:

“I wonder what’s behind these cabinets!” ::sawing noises:: “No lead here, let’s check upstairs!” ::smash::

If you have ever had a prospective buyer destroy your home looking for lead or asbestos, please tell us! We’ve never heard of such a thing, and we could use a good laugh.

The bill says the demolition “will be restored.” It does not say by whom. Surprise! Under Massachusetts law, it’s you!

105 CMR 410 makes the landlord responsible for maintaining the rented premises, including common areas, free of defects and other hazards including lead and asbestos. Sure, you can sue the renter if they don’t pay to restore their demolition. But in the meantime, you have to get it done.

This is a Power Grab

We’ve got good news for anyone who supports a tenant opportunity to purchase: tenants already have an opportunity to purchase. All they have to do is work together to offer to buy their building from its owner, just like everyone else in the world!

True, renters don’t commonly do this. And there’s the rub. Who wants this? Read the bill to find out. Tenants have a right to name a successor in ownership:

This means your tenants won’t own the building. Someone else will. Who will that be? Someone who has money to lobby the legislature.

The last time this bill was advanced, we howled at the nonprofits advocating for it, calling them out for writing themselves into the law as the eventual owners. Lest we attack them again, they now openly corrupt themselves by allying with large for-profit developers. Now anyone can own and dispose of your property – except you.

And you can’t buy your property back unless you have the “requisite experience in developing, owning, and/or operating residential real estate.” Bad news for all of us: you don’t get to decide what counts as experience.

Angry? You should be. And we haven’t even told you yet how this could help the cartels (are you kidding me?):

Different from D.C.: Worse

Renter advocates have worked hard to distance the proposed right of first refusal from the experience of Washington, D.C. The proposed bill is not the same as in D.C. It’s worse!

In D.C., the so-called Tenant Opportunity to Purchase Act has created a system of legalized extortion:

- Renters almost never end up residing in the property post-sale;

- Owners end up paying up to $100,000 per unit to buy the rights; and

- No one wins but the TOPA-chasing lawyer.

At least in D.C., money can end the suffering. In Massachusetts, there is no escape. The bill would make it unlawful to sell or receive any consideration for transferring the right of first refusal. How noble!

Washington D.C. has endured right of first refusal for so long there is one attorney whose full-time job is to transact rights. Massachusetts would be different: the person doing the extracting would be working in dark alleys. TOPA Mobile originally from https://www.nbcwashington.com/

If we could speak to the drafters of this bill, though, we might say: “Sweet summer children. The laws are only followed by good people. Bad people don’t follow the laws.”

Massachusetts has the same system of anonymous real estate ownership that permitted gangs to launder $5 billion through Vancouver, as reported by the BBC May 11, 2019. The gangs would buy rental properties, over-declare their income, and launder as much money as they needed.

In Massachusetts under right of first refusal, it would be easy for a nefarious would-be purchaser to make under-the-table cash payments to renters in exchange for their rights. It could be Vancouver all over again, except Massachusetts would be holding open the door.

If you find all this overstated, just think about any unscrupulous real estate salesperson, developer, or landlord you may have had the misfortune of meeting. Right of first refusal seems poised to create an unregulated black market for rights. Is there really no one in Massachusetts who would stoop to this to avoid half a year of delays?

Anyone concerned with good governance should be very concerned with right of first refusal. And we landlords are especially concerned.

When A Landlord Wants Out, We Want Out

Think about it like a landlord: is it possible to have too much rent? Not really, no. We always want more. That’s what we do. So why should a landlord sell? Sellers are trying to get out of a situation they don’t want to be in.

Perhaps they are close to retirement or ill. Perhaps they cannot afford to make repairs or are being foreclosed on. Or maybe they’re bad at conflict resolution, too busy with their day job, or just not enjoying plunging toilets late at night. Whatever the reason, the market has a way for landlords to quit: it’s called selling out.

Any law that forces people to be landlords against their will, even if temporarily, cannot create better rental housing. It cannot get the long-term lead problem corrected. It cannot get the boiler replaced with a zero-emissions heat pump. It cannot stabilize those of us who desperately need safe affordable housing. That will require new ownership. On this, at least, perhaps we can agree.

Real solutions require working with all stakeholders. Massachusetts landlords want no part of right of first refusal. It ought not pass into law.

What You Can Do

1.) Use our talking points to get this heinous policy stopped.

(Word and PDF files here, along with instructions for calling your Representative and Senator)

2.) Please join or become a property rights supporter:

3.) Tell at least three others about this

We can directly message only approximately 10% of the landlords and renters in Massachusetts. You almost certainly know many people in the business who don't know us.

4.) Submit your own testimony

Help us deal with the aftermath and defend against Right of First Refusal.