Can Massachusetts Landlords Charge for Solar?

| . Posted in best landlord practices - 3 Comments

Massachusetts is in many ways a leader when it comes to solar power incentives, but we have paid little attention to landlord-tenant solar. Yes, landlords can charge for solar, but indirectly.

This article goes in-depth on the legal and regulatory framework under which Massachusetts landlords can charge for solar. This article also gives insight on how to monetize solar in a rental property specifically, as opposed to most articles which discuss single families. This article has not been written in consultation with an attorney. Always consult an attorney before taking any action that could affect your rights or obligations.

Ashley Arms in West Springfield is one landlord who has gone solar successfully using “Method One,” utilities included. https://www.greatapts.com/ashley-information

Reasons Landlords Should Want Solar

MassLandlords has written about the falling cost of heat pumps per-BTU, the mechanics of a deep energy retrofit, and potential for heat pumps and retrofits combined to replace natural gas as the primary heat source for New England housing. The Columbia Gas Explosions and anthropogenic climate change are two more reasons some owners have left combustion and have moved toward electricity.

Solar panels have the potential to offset a considerable amount of electrical usage. Consider, for instance, a typical three-decker, oriented east-west in a neighborhood where it is not dwarfed by neighbors. This building will have enough roof area to produce roughly 10,000 kW-hr per year. This will cover: 1.) heating and cooling of three moderately insulated units using air source heat pumps; or 2.) three households’ worth of non-heat electrical demand, or 3.) two electric vehicles’ worth of annual mileage.

A landlord who can generate electricity with solar therefore has several ways to monetize free sunlight for their renters, if only the way to charge for solar can be determined.

A Theoretically Ideal Way to Charge for Solar

In an ideal world, a Massachusetts landlord would be able to monetize solar directly. Acting like an alternative supplier, landlords would sell kilowatt-hours of electricity to renters at some agreed-upon market rate. Renters would still connect to the grid to purchase electricity beyond what the panels could provide (think cloudy winter days). The landlord’s rate could be set to repay the investment in the panels.

Direct sale at retail/market rates would satisfy goals for all parties. Renters would have access to renewable energy generated on-site for no more than they’d pay for grid energy. Landlords would have a way to recoup their investment in capital-intensive panels and possibly make money, counting the value of tax credits. Utilities would still be able to sell to renters as demand exceeds local generation.

Unfortunately, at time of writing, this setup is not allowed, as will be discussed.

Massachusetts Landlord Restrictions on Charging for Electricity

The first restriction comes from landlord-tenant law and regulation. In Massachusetts, a landlord must provide unlimited electricity included in the rent unless the premises are separately metered and a written rental agreement says that the renter will pay for their usage (105 CMR 410).

Having separate meters is a best practice, and many properties have now been separately metered for years or decades. So this restriction is straightforward and/or already overcome.

The second restriction derives from an engineering consideration. Because panels are of a fixed size and orientation, and because there is different usage between households and units, depending on the particular demands of the renters and the appliances they are using, it is not possible to connect “the right amount” of solar to each renter meter. For this reason, all panels are usually tied into a single meter (the owner’s meter or a dedicated solar meter). The electricity is then redistributed on-paper in the form of billing credits. This is less desirable than real-time load balancing, and brings us to the net metering law.

Landlord-Tenant Complications of Massachusetts Schedule Z

The third restriction comes from the Massachusetts net metering law. On the one hand, this law is liberating, as it permits “Host Customers” to pump electricity back into the grid using “Class I Net Metering Facilities” under 60 kW in size. Such Host Customers will be reimbursed by the utility for their generation. (Larger sizes are also allowed with different restrictions.)

Under the net metering law, Schedule Z allows generation from panels behind one meter to be credited to accounts of other meters in the same load zone. For instance, if the panels are all on the owner meter, an owner can allocate a percentage of the solar net metering credits to each renter.

Although net metering and Schedule Z might work well in theory, in practice landlords will find it disagreeable to administer. Landlords must collect electrical account numbers from their renters. The schedule can only be updated twice per year, which will leave new renters without solar credit as they wait for the next update window. Credits will be distributed according to forecasted supply rather than actual usage. Credits can only be allocated as percentages of total generation, not dollar or energy amounts.

Schedule Z also results in waste. Consider the following example. Assume the panels on a building generate enough electricity to cover the entire building’s usage, and that Schedule Z is used to distribute credits equally between all renter accounts in the building (four units, 25% each). Because of variation between households, one renter will use consistently less than their allotment of credits while another will use more. The renter who uses less will accumulate credits on their account until they eventually leave their apartment and close their account with the utility. Then those credits will be lost. The renter who uses more than their allotment, meanwhile, will have purchased extra electricity from the grid. The building did, in aggregate, generate enough solar to cover everyone in the building. But Schedule Z did nothing to balance loads between units, and some credits were wasted.

Schedule Z was designed to be used by a single owner who owns all beneficiary meters for the life of the solar panel system. It would seem, therefore, that the solution for landlords is to avoid Schedule Z credit shuffling. Landlords should want to charge renters for their electricity, in the way a landlord can charge for water directly under the water submetering statute. Unfortunately, this brings us to the fourth and final restriction.

Massachusetts Public Utilities Restrictions on Landlords Charging for Solar

The fourth regulatory restriction requires we leave landlord-tenant law and water submetering and enter the world of regulated public utilities. MGL Ch 164 Section 2 clearly defines what constitutes an electric company:

“Section 2. In construing [the] sections [regulating construction of new powerplants, prices, forecasting, and operations of electric companies] the terms … ''electric company'' shall include … all persons, firms, associations and private corporations which own or operate works or a distributing plant for the manufacture and sale… of … electricity, within the commonwealth.”

“Works” are not defined, and therefore, must be interpreted to include solar panels and converters. The net metering law does not permit “Host Customers” to sell electricity, period. It creates a refund from the utilities.

There are hopeful sounding exceptions for “alternative energy property, “on-site generating facility,” and “competitive suppliers,” but none of these offer a path forward. A landlord who wants to sell electricity to consumers (renters) would be a public utility and would have to do everything that National Grid, Eversource, and other utilities must do to avoid claims under MGL Chapter 93A, the consumer protection statute. This is a non-starter.

The “competitive supplier” roadmap is close to being open to landlords, but it does require purchasing electricity at wholesale rates under the guidance or expertise of someone with two years’ industry experience. Since most landlords do not have resources for staff or dedicated contract labor, this is also a non-starter.

SREC, SMART Credits No Longer Abundant

Various state incentives over the years have helped some landlords install solar and get outsized returns, sometimes treating the panels as a revenue stream entirely separate from rental income or any renter. You may have talked to landlords who got these. SREC is fully over. The SMART program was built with declining incentive rates, such that by 2023 it was paying roughly a penny per kilowatt-hour. This means for a landlord new to solar, your best option is to monetize via renters.

Summary of Ways Landlords are Allowed to Charge for Solar or Monetize Solar

We know from the above analysis that landlords are not allowed to sell kilowatt-hours directly to renters without achieving full compliance as an electric company, a very big lift for even the largest landlords. So what can a landlord do?

Assuming the landlord has separately metered each unit and drafted a rental agreement specifying how electricity is to be charged, a Massachusetts landlord can charge for or monetize solar in the following ways:

Method 1a: “Electrical Included”

Include electrical in the rent. Set base rent higher to account for expected usage. Keep the meters in your own name. Use Schedule Z to credit each meter equally. Because you are keeping the meters in your own name year after year, there is little risk that credits will be assigned to a unit and remain unused. It will all average out over the next 20 years, or if it doesn’t, you can adjust Schedule Z for yourself. Monitor each renter meter for usage. Exceeding “reasonable” usage would be specified as grounds for termination.

Pros: This method conserves credits and earns higher base rent. There is no ongoing administration beyond the initial setup.

Cons: Renters have little incentive to conserve electricity. The nearly-prohibitive cost of an eviction means that enforcing the “reasonable usage” clause would only happen for egregious abuse of electricity.

Method 1b: “Electrical Included. Conservation Credit Applies.”

Use the Method One metering arrangement. The rental agreement will include electricity in the rent. You will increase the base rent to account for what you think of as the "worst case" electrical consumption for that unit. Each month, you credit the renter for their conservation. For instance:

- You want to get $1,500 for the apartment.

- You assume the "worst case" electricity bill will be $200/mo in the summer with air conditioners.

- You set the base rent at $1,700 with electricity included.

- The bill for the unit after your solar credits comes in at $50.

- You credit the renter a $150 "conservation credit" that month.

- The renter is happy to pay less rent than expected.

- You are happy because you got your asking rent.

- The renter effectively paid for the electricity.

Pros: It is much easier to over-collect and refund a renter than to charge utilities separately. This fixes the Method One "con" by creating an incentive to conserve.

Cons: Landlords have ongoing administrative work to track and enter credits. A renter who repeatedly overconsumes will cause you to earn less than planned until the next tenancy renewal, at which time you must increase their rent to cover their average consumption.

Method Two: “Up to X kW-hr of Electrical Included”

Use the Method One metering arrangement. Instead of the rental agreement specifying unlimited usage, the rental agreement will permit electricity to be used by each unit up to a cap, defined in kilowatt-hours per month. Beyond that amount, the landlord requires reimbursement from the renter. In this case, the electric company is the one charging per the kilowatt-hour. The landlord is not setting kW-hr prices or acting as an electric company. The rental agreement would say that failure to reimburse the owner for electrical overage would be grounds for termination.

Pros: This method conserves credits and earns higher base rent. Renters have some incentive to conserve.

Cons: Renters have little incentive to conserve electricity below their cap. Landlords have ongoing administrative work to collect reimbursements, as they would with water submetering.

Method Three: “Long-term Residents Get a Solar Benefit”

Use a standard “renters pay” metering arrangement, with renters starting and stopping service on their own and putting accounts in their own names. Have the rental agreement say that renters will pay for electricity, can submit their account number to the landlord, and will receive solar credits starting in about six months. As the landlord, you will need to complete a new Schedule Z, but since the state requires utilities to take new Schedule Z’s at most twice per year, it may be up to six months before your new renters can be onboarded. In the meantime, renters will incur their full electricity bill. Also, you will make no assurances that the solar credits will be meaningful. You will just assign them proportional to each unit and let the utility company do the work.

Pros: This method encourages longer-term residents and earns higher base rent.

Cons: Credits will be wasted if any remain on a renter’s account when they move out. Credits may be under-assigned for up to six months after each vacancy, leaving new renters disappointed.

Method Four: Bypass the Renters

Use a standard “renters pay” metering arrangement and don’t mention solar in your marketing, as renters will receive no benefit. Sell electricity directly to the grid under the SMART standalone wholesale arrangement.

Pros: This is a separate revenue stream that can be managed without renter involvement or landlord-tenant implications.

Cons: Wholesale rates are much less beneficial than retail rates, so the benefit to you and renters is diluted/nonexistent. This method is not often used on buildings that have electricity demand that can be offset at retail rates.

Recommended Method: Refined Variant of Method Two

Each of the methods above has a serious drawback:

- Method One gives no incentive to conserve. When owners offer "unlimited electrical included," especially where they use electric heat, they have to walk around their buildings each week in the winter to keep doors and windows shut. We need renters to see and pay their bills.

- Method Two gets into kilowatt hours, when what we're used to dealing with is dollars and cents. Such caps are confusing to renters and landlords. We need to stick to dollars.

- Method Three wastes credits. Schedule Z is not instantaneous, pretty much the opposite, so any new renter account won't receive Schedule Z credits until up to six months after move-in. Any outgoing renter account will waste its allocation when they close their account. Schedule Z credits need to remain in the owner's name.

- Method Four monetizes at the much lower wholesale rate. SMART credits don't last forever, and we want to be monetizing renters based on comparison to their normal retail rates.

So here's the recommendation we've developed based on several intensive sessions with owners across the state:

- Put the panels on the owner meter, and keep all the unit meters in your name, too.

- Assign solar credits to each unit equally.

- Have each lease require renters to pay 100% of the electrical. But renters don't sign up with the utility. You act like the utility, same as under the water submetering law.

- Bill the renters whatever the utility bill nets to, after credits.

- Do not bill for kW-hr, which would be unlawful for anyone other than a public utility.

- Do not double-dip and bill for usage before credits, which could be an MGL Chapter 93A consumer protection violation.

- Do not add an admin fee, which would be an MGL Ch 186 Section 15B violation.

Bill what the utility bills you, if anything.

If the renter's average electrical usage is below average production for their unit, it will be like electrical is included in the rent. Schedule Z credits will carry over, but won't be lost at turnover because you will continue to own that meter's account even after the renter leaves.

If the credits are not adequate, renters will owe the balance and will feel the incentive to conserve. This eliminates the moral hazard of "electrical included."

Charge a higher base rent for "electrical included up to a cap." The higher base rent is your monetization and covers the increased cost of administration. This same approach extends to heat pumps, in which case it's "electrical and heat included up to a cap." This is the better monetization, because the premium renters pay for "heat included" will be based on an expectation of fossil fuel heat with little or no insulation. With solar, heat pumps, and insulation, your building will have a competitive advantage over the older infrastructure.

The "cap" on usage is equal to your solar generation for that unit. To be the most helpful to prospective renters, you should write "Average savings $X per month" based on average solar production.

Conclusion: Can a Massachusetts Landlord Charge for Solar?

The answer is yes, but not directly. Massachusetts landlords have a complex legal and regulatory framework to navigate in. And the laws clearly were not developed with rental housing in mind. Your only monetization will be via base rent.

Did we get anything wrong? Send us your feedback at hello@masslandlords.net, this article will be updated.

External Links

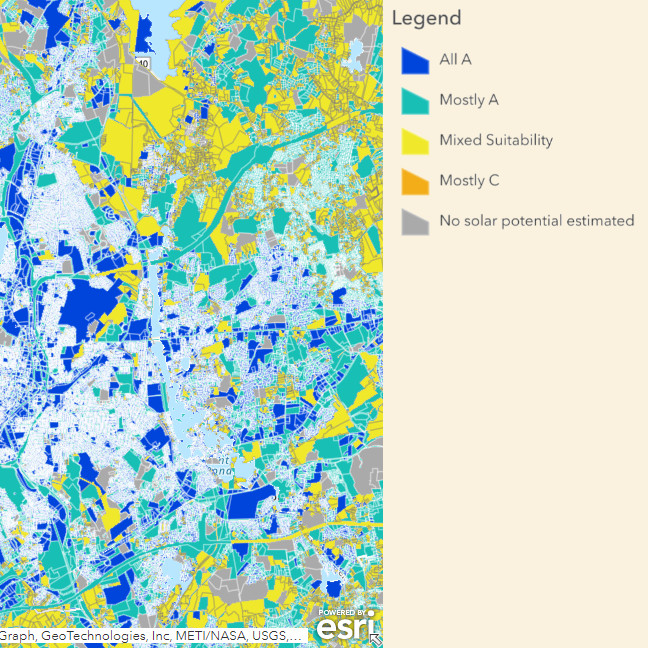

Massachusetts Technical Potential for Solar (official state site)

The MassLandlords Helpline can power you through. Purchase hourly or prepaid bundles of help.