Security Deposits

Massachusetts security deposit law is one of the most dangerous areas for landlords to enter into, so much so that we are close to recommending that no landlord take a security deposit. This article will explain what must be in a security deposit receipt, how to make a security deposit return, and how to avoid a security deposit demand letter.

This page provides advice for dealing with the law as it stands currently. For proposed changes, see our related page:

- Related Pages: Changes Needed in the Security Deposit Law

Jump to

- What if my renter doesn't have a social security number?

- FAQ about Security Deposits from our Webinar

- Past Presentations

Introduction to Massachusetts Security Deposit Law

What makes the Massachusetts security deposit law so difficult? Principally, it's two things.

First, the law calls for mandatory penalties of three times the deposit amount if certain procedures are not followed. This can eliminate the last year's profit from the rental unit and thensome.

Second, the Massachusetts security deposit law has been used to overturn otherwise lawful evictions. In one case, a landlord's security deposit violation resulted in a two year delay, with his case ending up losing before the Supreme Judicial Court.

To take a MA security deposit, you must:

- Always remember that the security deposit belongs to your renters.

- Complete all required paperwork by all required deadlines.

- Store the deposit in an interest-bearing bank account under your tenant's social security number.

- Deduct only for actual damage beyond reasonable wear and tear, or unpaid rent, and only with receipts.

Massachusetts Security Deposit Receipt

Massachusetts landlords who want to take a security deposit must issue a security deposit receipt. This receipt serves two important purposes. First, it tells the renters where they can get their money if, heavens forbid, you should become incapacitated or unable to return their deposit. Second, it tells judges and tenant attorneys whether or not you are following the law.

The receipt must specify certain things. If you mess up the receipt, or don't give one, you owe the renter three times the amount of the deposit. See the checklist to avoid triple damages.

Checklist to Avoid Security Deposit Triple Damages

Sometimes people say "triple damages," but really the law specifies penalties in terms of the deposit amount because, frankly, these cases often don't have any damages (i.e., the landord has not cost the tenant any real money). Landlords will owe tenants three times the deposit amount, plus 5% interest, plus attorney's fees, plus other court costs, unless they do all of the following:

- Put the security deposit into a bank account

- The bank must be in Massachusetts

- The account must earn interest

- The account must be under the tenant's name and social security number only, with landlord as signatory (specifically, a landlord-tenant account)

- Note: credit unions are not banks (we are looking for the case, but it was Western Housing Court circa 2001)

- Within 30 days of signing the rental agreement, give a receipt that lists

- The name and location of the bank

- The amount of the deposit

- The account number

- Each year,

- Pay interest

- Either 5% or the actual amount of interest received (if less than 5%)

- Either cash or check or deducted from the rent

- Give an annual statement that lists basically all the same information again

- The name and location of the bank

- The amount of the deposit

- The account number

- Plus the interest earned

- Pay interest

- Within 30 days of the end of tenancy (possession, not original agreement),

- Pay all interest

- Provide an itemized list of damages

- This list must be signed by the landlord

- The form must say "Signed under the pains and penalties of perjury"

- Receipts, invoices, or photographic evidence are required for each deduction

- No deduction can be made for damaged items identified at move-in

- Return the original deposit plus remaining unpaid interest less damages

Any single failure of any bullet point or part of a bullet point above will entitle the tenant to receive three times the amount of the deposit. It doesn't matter how nice of a person you are, or how hard you tried to follow the law.

The only reason you haven't run into trouble with security deposits in the past is because you weren't taken to court. Read that list and tell us you did everything perfectly, and you'll be one in a thousand. If you get to court and you have a security deposit violation, odds are good the legal services folks will find it and make you pay.

- Read the law for yourself: MGL Ch 186 Section 15B

- When reading for triple damages, start with "(7) If the lessor or his agent fails to comply with clauses (a), (d), or (e) of subsection 6, the tenant shall be awarded damages in an amount equal to three times the amount of such security deposit" and parse it from there.

Important note: Because the attorney general has used the power of MGL Chapter 93A to make it an unfair and deceptive practice to violate any law, any other violation of the security deposit statute (even for things not listed above) may result in triple damages under 93A.

Conditions Statement

You cannot withhold from a security deposit for repairs unless you have a signed conditions statement.

The conditions statement is the only rental form whose font size is regulated by law. It must disclose all the defects in the apartment and get the tenant's acknowledgment. The statement must be signed within 15 days of the start of tenancy. Many landlords walk through the apartment during lease-signing and fill out the conditions statement with their tenants.

Read the law to be sure you are complying. It is section 2(c).

Eviction with Security Deposit Violations

Security deposit violations are tied into a "silver bullet" that tenants get. If a landlord violates any law, an eviction can be stopped.

The case Meikle v Nurse proved this as recently as 2016.

- Related Article: Security Deposit Law Reverses Evictions? (August, 2015)

- Related Article, same story: Tenant overstays by 18 months beyond lease because of the $3.26 owed to them (November 2015)

We filed an amicus briefing for this particular case in December 2015, but our side lost.

Security Deposit Return in Massachusetts

Security deposit return in Massachusetts is tightly regulated. If you mess it up, you may be presented with a security deposit demand letter. We profiled a real life security deposit story in December 2017. In this story, the landlord tried to deduct what they thought was right, and ended up paying his renters roughly twice the deposit.

Security deposit withholding is allowed only with a Conditions Statement.

To deduct from a security deposit, you must first have a conditions statement from the beginning of the tenancy. If you don't, sorry! But you cannot deduct from the security deposit no matter how badly your apartment has been trashed. Give the whole deposit back.

The conditions statement lists things that were broken on move-in. You can't deduct for anything on this list. You can't safely deduct for anything mentioned, even if the renters made it worse. For instance, if a door was listed because it had loose hinges, and now the door has fallen off entirely, you cannot deduct for that. The door was already presumed trash.

Reasonable wear and tear gives lots of damage a pass.

Massachusetts security deposit law has a standard for deductions. You can only deduct for things that are beyond reasonable wear and tear. This means that a carpet stain for a renter who lived in the unit for several years might be considered normal. It's open to litigation. Some landlords treat carpet, paint, miniblinds, and even garbage disposals as breakable consumables that they replace each vacancy.

What are examples of reasonable vs unreasonable wear and tear?

| Item | What might be reasonable wear and tear? | What's probably unreasonable and can be deducted? |

|---|---|---|

| Carpet | Wine or ink stain | Cut with utility knife. |

| Door | Fell off hinges, screw holes stripped but surrounding wood intact. | Hinges ripped out of wall and surrounding wood splintered. |

| Window | Vinyl frame on 10 yo contractor grade window cracked. | Glass cracked. |

| Plumbing | Sink drain clogged with grease. | Sink drain clogged with cat litter. |

| Electrical | Lightbulb missing. | Ceiling fixture fell off. |

| Walls | Dented and crushed plaster where doorknob hit. | Fist-shaped hole at eye level. |

Deductions must have receipts.

If you have unusual damage, you may want to fix it yourself. If you do, you may not be able to deduct the value of your time for it. The Massachusetts general law talks about only hourly rate for wages, and that's the minimum wage. You also need to prove how many hours you worked. If you purchase a new doorknob to replace one that has gone missing, save the receipt, because that will be deductible.

In general, it is far easier to effect a Massachusetts security deposit return by paying a contractor to fix what's broken, and then using their invoice as your receipt. You must give receipts for everything.

There are strict deadlines for evaluating damage and returning the deposit. You must follow these and send the deposit back, less deductions. You must always add back interest. It doesn't matter if the damage is more extensive than the entire value of the deposit. The interest can never be taken by the landlord.

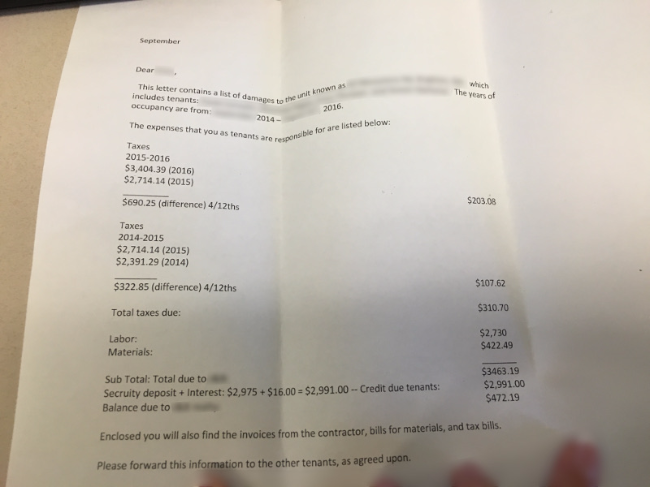

This letter from Larry to Ashley (see The Ashley Story, below) was a good effort to disclose withholding and comply with the Massachusetts security deposit law. But it lacked key verbiage and cost the landlord thousands.

List of Banks Offering Security Deposit Assistance Services

Security Deposit Case Law

Castenholz

If you return a deposit mid-tenancy because you haven't complied with the law, you are not liable for triple damages.

See David J. Castenholzvs. Mary Caira & another 21 Mass. App. Ct. 758.

Taylor

If you return a deposit more than 30 days after the end of a tenancy but prior to the start of litigation, you are still liable for triple damages.

See John C. Taylor vs. J.P. Beaudry. 75 Mass. App. Ct. 411.

Following the Money: Security Deposits Beyond the Reach of Landlord’s Creditors, not DOR

By Peter Vickery, Esq., Legislative Affairs Counsel

Members of MassLandlords know that they have to put security deposits in a separate, interest-bearing account beyond the reach of the landlord’s creditors. But what about the tenant’s creditors, e.g. the Commonwealth? More specifically, if the Massachusetts Department of Revenue (DOR) wants to collect from a tenant for unpaid taxes or child support, can it reach into a security-deposit account? The answer is yes.

Massachusetts law allows DOR to levy bank accounts in order to enforce child-support payments (c. 119A) and taxes (c. 62C). First, the department has to issue a levy notice to the bank, which must then search its records looking for a match with the name or tax identification number on the DOR notice. If it finds a match – even if the person owing taxes or child support is listed as a joint or co-owner of the account – the bank must suspend activity for 21 days. During this period, the account owners can ask the department to review the decision.

The statutes exempt certain accounts from levy, but security deposit accounts are not among them. This may come as a surprise to some, but it is consistent with the purpose and rationale of the security deposit law, M.G.L. c. 186, §15B.

Money in a security-deposit account belongs to the tenant, not the landlord. As the Supreme Judicial Court has made clear, putting the money in a separate account means that “tenant monies are protected from potential diversion to the personal use of the landlord, earn interest for the tenant, and are kept from the reach of the landlord’s creditors.” Neihaus v. Maxwell, 54 Mass. App. Ct. 558, 561 (2002).

Landlords are, in effect, trustees of their tenants’ security deposits, holding the money in a fiduciary capacity. That is how the US Bankruptcy Court interprets the statute. In re. Bologna, 206 B.R. 628 (1997).

Because the money is the tenant’s, and it is not in one of the categories exempt from seizure, the DOR can (and sometimes does) levy it. If a landlord learns from the bank that DOR has frozen the security-deposit account, what can the landlord do? During the 21-day holding period, the landlord may ask DOR, in writing, to reconsider (a phone call is not sufficient). After that, if DOR has already taken the money, landlords may challenge the levy as wrongful and apply for a refund.

In the event that a landlord only learns about the levy after the event, e.g. when trying to lawfully use the security to pay for repairs after the tenancy has terminated, but the bank refuses to disclose the reason for the zero balance, a landlord could seek equitable relief and judicial review. Specifically, the landlord could ask a court to compel the bank to explain what happened, and then ask the court to review the DOR decision.

Can I Put a Security Deposit in a Credit Union?

The credit unions vehemently argue "yes," but the literal wording of the law requires a "bank." Banks and credit unions are legally not the same. "Credit unions" are not chartered the same way as banks, and have a different governance structure and insurance. Arguably if the legislature had intended for credit unions to be valid holders of security deposits, it would have written "secure depository," "financial institution," or similar.

We have never heard of this being litigated or brought up in court.

Can I Get a Security Bump?

It's common practice with long-term tenancies for rents to increase, and for landlords to ask for additional money to add to the existing security deposit. For instance, consider an apartment renting at $1,500/mo where after two years the rent has increased to $1,600. The landlord may wish to get an additional $100 to bring the existing security deposit from $1,500 to $1,600. This is not allowed.

MGL Chapter 186 Section 15B reads:

(d) No lessor or successor in interest shall at any time subsequent to the commencement of a tenancy demand ... a security deposit in excess of the amount allowed by this section. The payment in advance for occupancy pursuant to this section shall be binding upon all successors in interest.

The amount authorized in this section of the law is:

(iii) a security deposit equal to the first month's rent

We recognize that standard business practice may include security bumps, but we have to teach the conservative interpretation, which is that the statute bars payments in excess of the value of the first month's rent, however long ago that may have been.

If you wish to collect a larger security deposit, terminate the old tenancy and sign a new tenancy with all new paperwork at the higher rent.

What If my Renter Doesn't Have a Social Security Number?

Visa holders and others may not have a social security number and yet may still be both qualified for your housing and here legally.

Instead of form W-9, which is typically how a renter would provide their social, a bank should also accept W-8BEN, to create a landlord-tenant account with your renter as beneficiary. This form requires the renter to assert that they have not yet been able to get a social security number. If your bank cannot do this, find a different bank.

When filling out the W-8, make sure to list the permanent residence address (e.g., international address) first. The apartment being rented should then be listed as the mailing address.

Can I Deduct for Cleaning?

No, read the law carefully. It says you may deduct for:

a reasonable amount necessary to repair any damage caused to the dwelling unit by the tenant or any person under the tenant's control or on the premises with the tenant's consent, reasonable wear and tear excluded

Cleaning is not damage, unless the filth is so pernicious as to damage or permanently disfigure the underlying apartment. In that case, you are deducting for damage, not cleaning.

Can you send a bill for cleaning or sue in small claims for extreme cleaning? Yes, but you cannot deduct from a security deposit for cleaning.

A renter may be legally responsible for cleaning fees. A landlord may not obtain repayment via the security deposit.

Alternatives to Taking a Security Deposit

If you are disheartened by the legal exposure that comes with taking a security deposit, you might want to consider an alternative.

Some insurers or state subsidies offer a guarantee or an insurance policy for unpaid rent, property damage, and attorneys fees for certain renters in certain conditions. Generally, if this is offered in lieu of a security deposit, take it.

Renters who damage your unit are still liable for the damage. If they do not receive public assistance, you may file in Housing Court Small Claims for the balance owed.

You can raise the rent proportional to the amount you would have withheld from a security deposit. For instance, if your average tenancy is 18 months, and your average renter loses their entire deposit, you would increase the rent by 1/18th, or 5.6%, and come out even, on average.

Massachusetts Security Deposit Law Conclusion

So how much "security" does a deposit really provide? If you're a tenant, you should positively want one. If you're a landlord, think carefully. Only take a security deposit if you're sure you can meet all the paperwork requirements.

- Related Page: Changes Need for Security Deposit Law

- Related Page: The Ashley Story: A Real-Life Example of Security Deposits Gone Wrong

Past Presentations

To view all of this presentation, you must be logged-in and a member in good standing.

Log in or join today and gain access all presentations and videos

Presentation: Lunch and Learn Help Session on Security Deposits

Slides are available only for members in good standing who are logged in.

Video: Forms Review

To view all of this presentation, you must be logged-in and a member in good standing.

Log in or join today and gain access all presentations and videos

Further Reading

- The Legend of Security Deposit Hollow, Halloween 2021 adaptation of The Legend of Sleepy Hollow

We'll help you get out of it. Contact us to schedule a helpline consult.