How to Properly Consider Applicants with Permanent Rental Assistance Using an Applicant Qualifier

| . Posted in News - 5 Comments

By Eric Weld, MassLandlords, Inc.

The Massachusetts law is clear: it is illegal to refuse to rent to an applicant because they receive rental subsidies through state or federal government permanent housing assistance programs. Participants in programs known as Section 8, MRVP, AHVP or HUD-VASH are protected from any discrimination based on their receiving rental assistance.

If you are asked by an applicant, “Do you accept (Section 8, MRVP, AHVP, HUD-VASH)?” There is only one correct answer: “Yes, I do.”

But what does this mean in practice? Are you required to approve tenancies because they participate in rental assistance programs? (No.) Do you have to alter your screening process specifically for such applicants? (Again, no.)

We include a detailed description of each of these rental assistance programs at the end of this article.

A Difference Between Permanent and Temporary Rental Assistance Programs

For the purpose of this article, we are referring to permanent housing assistance or subsidy programs, as distinct from temporary or short-term rental assistance, such as HomeBASE, RAFT, ERMA, ERAP and others.

There is a clear distinction between these temporary programs and permanent assistance programs, and requirements differ as well. We will specify these distinctions when pertinent.

What Does ‘Yes’ Mean?

To be clear, answering “yes” when asked if you accept Section 8 and other permanent rental assistance programs does not commit you to accepting that particular applicant at that time. It only verifies that you do not turn away applicants because of their participation in such a rental subsidy program. That is the law.

But landlords are certainly free to reject applicants who do not qualify for other reasons, such as inability to pay a security deposit, a criminal or sex offense record, eviction history, smoking or owning a disallowed pet. Read an overview on avoiding discrimination based on public assistance.

How does this legal protection bear on the screening process? And how can you most effectively screen applicants receiving rent subsidies while steering far clear of any discrimination snags?

Extra Points for Receiving Rental Assistance

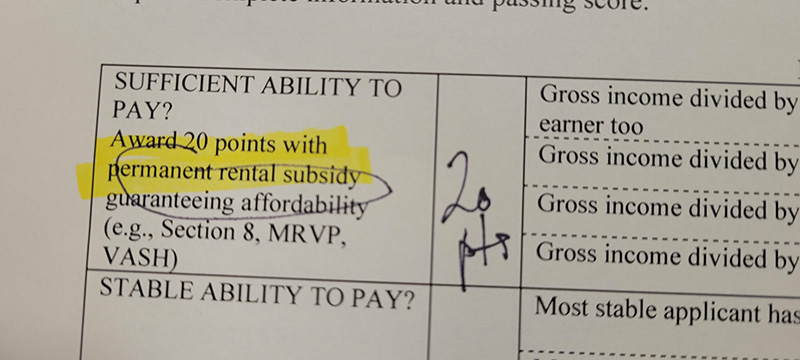

MassLandlords provides an applicant qualifier form, included with membership, that applies a point scoring system for screening prospective tenants. This form removes the guesswork from the screening process by providing a by-the-numbers approach to applicant approval or rejection.

Our applicant qualifier is suitable for and takes into account applicants who receive permanent rental subsidies. In fact, given the government-backed dependability of these assistance programs, our system awards 20 points to any applicant receiving Section 8, MRVP, AHVP or HUD-VASH.

These programs guarantee that your tenant will receive a government payment covering the majority of their rent. Section 8 and MRVP recipients pay between 30% and 40% of their income toward rent, with subsidies covering the remainder. AHVP recipients pay 25% to 30% of their income toward rent and receive a subsidy for the remaining rent. For HUD-VASH participants, 30% of their income goes to rent; the remaining amount is covered by the program.

Points Awarded, Points Subtracted

Aside from an applicant’s ability to pay rent, you should apply the remaining sections of the MassLandlords applicant qualifier, or other screening systems, to those receiving rental assistance the same as you do with other applicants.

For example, a tenant who receives a permanent rent subsidy (+20 points) but who habitually paid their share of rent a week or more late in the past will get docked 10 points based on that history. Someone participating in MRVP (+20 points) but whose current landlord says they would not rent to them again gets 20 points subtracted from their score, offsetting the gain from their rental subsidy.

If you have an applicant receiving Section 8, but who claimed bankruptcy in the past two years, they would lose 15 points off their score to compensate for the risk posed by their financial history.

To qualify as a renter, your applicant needs a score of 90 total points, or 80 points with a cosigner. An applicant who does not reach a score of at least 80 points should be either rejected or counseled on ways to raise their score.

Automatic Disqualifications

We also recommend several automatic applicant disqualifiers. Giving false information on the application automatically disqualifies a rental candidate in our screening process. Also disqualifying: if they fail to sign necessary paperwork, or have been evicted in the past two years for cause or nonpayment.

A past conviction record for violent crimes or sex offenses (levels 2 or 3) could be grounds for disqualification.

Other disqualifiers include past convictions for manufacturing and/or distributing illegal drugs. Be careful around this issue, however. You are within your legal rights to refuse to rent to a prospect with a past conviction for the illegal manufacture and distribution of a controlled substance. But a conviction for possession of drugs is a gray area and may not be a sound legal reason for disqualifying an applicant, especially if it was determined to be only for personal use.

Also, importantly, be certain to apply this qualifier/disqualifier to all applicants equally, without regard for national origin, race or other protected classes. And if you do disqualify someone based on criminal record, be sure it’s specifically for the manufacture or distribution of a controlled substance. A criminal record in general, for other offenses (such as a level 1 sex offense, for example), may not be considered a nondiscriminatory reason for disqualification, depending on the crimes.

What Not to Say to Your Applicants

When communicating with an applicant in a rental subsidy program, take care to be very clear on your reasons for approving or denying their application.

Whether approving or denying, there is no reason to mention their rental assistance at all, so you’re better off steering clear of the subject. “That Section 8 seems like a good deal,” or “How long have you been receiving MRVP assistance?” are both examples of very risky commentary. Even asking a HUD-VASH recipient anything seemingly innocuous about their military service is best avoided. Too many off-hand comments can be misinterpreted in ways that could land you in court.

And discrimination lawsuits can be very costly.

In 2020, several real estate agents in Boston’s South Shore agreed to pay up to $110,000 and go through fair housing training just in order to settle allegations of discrimination against prospective tenants based on their Section 8 assistance.

Or consider the well-documented case of Linder v. Boston Fair Housing Commission, in which Paul Linder, a Boston rental agent, was originally fined more than $60,000, including court costs, for asking a prospective tenant, Gladys Stokel, “Gladys, where are you from?” (She answered, “Venezuela.”). Stokel and her husband were denied a rental based on Gladys Stokel’s lack of a credit record. Linder was charged even though it was determined by the BFHC that their application denial had nothing to do with Linder’s question, but rather was legitimately based on the lack of a credit record.

A Few Applicant Qualifier ‘Don’ts’

There are benefits to renting to Section 8 and other permanent rental subsidy program participants, foremost the stability of a government payment for the bulk of the rent. However, landlords should be aware that the initial lease up can take some time, even up to two months. Regional Administering Agencies (RAAs), which coordinate local rental assistance programs, are often busy and sometimes backed up. They may take a few days to respond to queries and to finalize paperwork. Whenever possible, build in extra time to lease up with rental assistance tenants to allow for bureaucratic lag.

Meanwhile, here are a few “don’ts” to keep in mind when using the MassLandlords applicant qualifier:

Don’t apply an income-to-rent ratio

Rental subsidy recipients are participating in assistance programs because their income is significantly below AMI, so their income will not be close to the standard 3:1 or 4:1 income-to-rent ratio. Instead, landlords receive a guaranteed government payment for the amount of rent not paid by the tenant. Therefore, the income-to-rent ratio qualification is inapplicable and should not be used for applicants receiving permanent rent vouchers.

Note this does not apply for recipients of temporary rental assistance such as RAFT, ERAP, ERMA and HomeBASE. In those cases, income-to-rent ratios may be applied, and you should consider applicants’ income when their assistance payments expire.

Don’t dock points for income in general; award full points

Given the stability of permanent rental assistance payments, you should award full points to participants in these programs for the qualifier that measures ability to pay once you have verified their program voucher. Participants in permanent rental assistance will not pay more than one-third of their income toward rent.

Again, in the case of temporary rental assistance, awarding full points is NOT required.

Don’t refuse rental assistance applicants based on their unwillingness to accept your lease duration

Some RAAs require rental subsidy recipients to procure agreements with a minimum lease duration, such as two years. This requirement is due to the disproportionate amount of bureaucratic administrative labor it takes to get a rental assistance participant squared away in a dwelling.

Applicants who are receiving this aid will be required to accept the RAA terms, so you should not refuse their application because they are unable to accept a different lease duration from the RAA requirement.

For this reason, our applicant qualifier does not include unwillingness to accept rental agreement terms as a disqualifier for rental assistance program participants.

Further, recipients of temporary rental assistance may also be subject to required lease terms, especially if you are reinstating their tenancy. Read an article detailing how to screen tenants with temporary income sources.

Don’t decline inspections or say, “This apartment is not approved for Section 8”

If a tenant receiving rental assistance qualifies to rent from you and you approve their tenancy, you are required to allow an inspection by an RAA agent. These inspections are not optional. If your unit fails the inspection, you must make repairs and undergo a follow-up inspection. There is no other approval process.

Don’t decline to work with a specific administrator

Once you’ve approved a participating Section 8 tenant, they will contact their RAA and a case worker will be assigned for the completion of paperwork and a required inspection of your rental unit. You will be working with this case worker, too, especially at the beginning of a tenancy.

Getting to know the case worker is in your best interest. Having a contact and knowing whom to call when issues arise with a rental subsidy tenant can be invaluable and may save hours of phone time, not to mention headaches.

DO Keep Records on File

You are perfectly within your rights to inform an applicant why you have rejected their application, and you should. But there is no need to discuss their rental assistance program. You should also make a copy of the applicant qualifier for them to demonstrate that you awarded points for rental assistance, even though they did not qualify for other reasons.

Be absolutely certain to keep the completed applicant qualifier on file in case of any potential court litigation. If you use digital records, keep it indefinitely. If you use paper, keep it on file for at least three years, the statute of limitations period for discrimination lawsuits.

Legally Not Allowed

Of course, it is up to you and your judgment as to whom you decide to contract with as renters. If smoking, having a waterbed or pets are allowed in your rental, then you may ignore those automatic disqualifications on the qualifier.

You, as owner or manager, are free to decide which positive and negative points to award and penalize for your applicants as long as you don’t discriminate against a protected class.

That means that treating an applicant differently because of their participation in a rental subsidy program like Section 8, MRVP, AHVP or HUD-VASH is a legal breach, and could result in a substantial fine, or worse.

Rental Subsidy Programs

Below we describe the federal and state rental subsidy programs in Massachusetts. Some cities may offer local rental assistance programs specifically for their residents.

Section 8, aka HCVP

Section 8, also known as the Housing Choice Voucher (HCV) program, is named after the section of the federal Housing Act of 1937 that authorized government rental payments to private landlords on behalf of low-income renters. Section 8 participants receive a permanent subsidy (unless their income increases over the eligibility threshold or they violate program rules), paid directly to landlords. Program vouchers typically cover between 60% and 70% of participants’ fair market value rent. Most Section 8 participants earn income equal to or less than 30% of area median income.

Section 8 participants are free to seek and procure their own residences, without any requirements except that the rental be priced at or below fair market value, determined and published by the Department of Housing and Urban Development (HUD). Nationally, this HUD program serves more than 2.2 million families.

Landlords who accept a Section 8 applicant must agree to abide by program requirements, including allowing an inspection by program officials to make sure the unit meets sanitary code requirements.

Section 8 does not pay participants’ security deposits. If an applicant cannot procure funds to pay the security deposit, a landlord has grounds for declining their application.

Read this MassLandlords article for a dive into the details of Section 8.

MRVP and AVHP

The Massachusetts Rental Voucher Program (MRVP) operates largely like Section 8 except program funding is administered by the state government, Department of Housing and Community Development (DHCD). Like Section 8, MRVP provides a tenant-based rent supplement, known as a mobile voucher, to landlords on behalf of low-income renters. MRVP also issues project-based vouchers for specific housing developments and units.

MRVP participants are free to apply for tenancy at any rental unit as long as it meets state sanitary code requirements.

In response to the COVID-19 pandemic, the DHCD waived some regulations for MRVP compliance. Proof of a rental unit inspection was one of the waived regulations still in effect as of November 2021. Though proof of successful inspection is waived temporarily, any MRVP housing unit is still legally required to be in compliance with the state building and sanitary codes.

AHVP, the Alternative Housing Voucher Program, is similar to MRVP except it is specifically for people under age 60 who qualify to live in elderly and/or disabled state-assisted public housing. Participants in AHVP typically pay between 25% and 30% of their income toward rent, the remainder covered by program vouchers.

HUD-VASH

The Veterans Affairs Supportive Housing (VASH) program is a collaboration between federal government agencies HUD and the Veterans Administration (VA). HUD-VASH combines housing vouchers from HUD with supportive services from the VA to help find and procure permanent housing for homeless veterans and their families.