A Landlord’s Guide to Massachusetts’ Residential Assistance for Families in Transition (RAFT) Program

By Kimberly Rau, MassLandlords, Inc.

Residential Assistance for Families in Transition (RAFT), a short-term Massachusetts rental subsidy program, is designed to help families who are at risk of becoming homeless transition into stable housing. The program can also be used to help families who are already homeless pay for necessary costs to get into a house or apartment. RAFT, which has been around since 2005, has helped many families with things like security deposits, rent and furniture since its inception.

Please Note: Information changes quickly! Articles about Raft and HomeBase may not reflect the latest information. Check the state website for current limits.

Jump to:

- How to apply for RAFT

- A Brief History of RAFT

- Webinar: Rental Assistance Application Process RAFT ERMA

- Can a renter get RAFT directly and then not give it to the landlord?

- External Links

- DHCD Announces New RAFT Application Portal Pilot Began Nov. 14, 2022

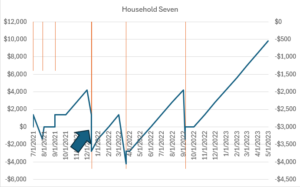

RAFT can assist families with emergency rental situations, but it lacks the long-term stability of permanent rental subsidies. RAFT became the primary housing safety net during COVID-19. CC BY-SA 4.0 MassLandlords

In this article, we’ll look at what RAFT is, who it is designed to benefit, how it affects landlords and the areas where it could be doing more for families in need.

A Brief History of RAFT

Funded by the Massachusetts Executive Office of Housing and Livable Communities (EOHLC, formerly known as the Department of Housing and Community Development, or DHCD), RAFT is described as “a homelessness prevention program…[that] provides short-term financial assistance to low-income families who are homeless or at risk of becoming homeless.” In other words, it is flexible funding that can be used for a variety of housing-related expenses, depending on the needs of the individual family.

RAFT was first piloted in 2005, with a budget of $2 million for that first year. The state officially adopted the program in 2006, and since then, RAFT funding has continually gone up, with funding for the 2019 fiscal year hitting $20 million.

Initially, families accessing RAFT funds received between $1,500 and $3,000 as a one-time payment, according to literature published by Metro Housing Boston. Eventually, that number increased, and families were able to access up to $4,000 in funds, with the possibility of reapplying after 12 months if they needed additional assistance. In 2020, this limit was increased to $10,000, but was decreased to $7,000 within a rolling 12-month period on Jan. 1, 2022.

In August 2022, the limit changed again. Applications processed on or after Aug. 1, 2022, were eligible to receive up to $10,000 in RAFT funds. Then in 2023, the EOHLC announced that the amount of RAFT assistance would be reduced to $7,000 in a 12-month period, due to the proposed state budgets for Fiscal Year 2024. That change took effect July 1. Besides the benefit reduction, the EOHLC announced that RAFT could no longer be used for future rent stipends, and that homeowners would once again be able to access RAFT benefits. Read more about the 2023 changes to the RAFT program.

Given how quickly things have been changing, we always recommend you visit the official RAFT website for the most up-to-date information.

What Does RAFT do?

Residential Assistance for Families in Transition could pay for moving costs, paying owed rent or utilities, security deposits or first/last month’s rent, among other uses. This could be in the form of emergency rent assistance to avoid eviction (or help paying rent going forward, if the family applying is in search of housing or has already been evicted). RAFT funds could go towards paying a security deposit, first/last month’s rent, even furniture, though there are caps on how much RAFT money can be used for those purchases. For instance, prospective rent payments are capped at one month's payment, as long as the household communicates this need on the application or to the person processing the application. Households that already receive income-based rental subsides are ineligible for prospective payments, and payments may not exceed the maximum benefit limit.

As of April 16, 2022, the state also allowed for partial payments on behalf of the primary tenant to the landlord or utility company, for those entering co-housing situations.

Who is Eligible for Assistance?

First, according to mass.gov, families must be homeless or at risk of becoming homeless. This could include families who are facing eviction. Families must meet income guidelines as well: as of April 16, 2022, this was 50% of Area Median Income (AMI), or 60% of AMI for those at risk of domestic violence.

If a family meets the income guidelines, they must then be screened using an assessment developed by DCHD. Those administering the screening have some discretion in determining eligibility based on the tool. Administrators will also look at why the family is homeless or at risk of becoming so. This could include loss of income or increased expenses for those families in the higher income group (30–80% AMI depending on funding source).

If a family is eligible at this point, they must prove that the assistance they receive from RAFT will “stabilize the current housing situation.” In other words, a family applying for RAFT must show that after the funds are applied, they have enough income to either obtain new housing, remain in their current housing or “otherwise avoid homelessness.” MassLandlords interprets this to mean that a family who was facing eviction could, for example, obtain RAFT funding to get current on their rent and remain in housing, rent a new place, or use the money to pay court-ordered debts and then move in with family.

Though mass.gov is not completely clear on whether current participants in the Massachusetts Rental Voucher Program (MRVP) or Section 8 are RAFT-eligible, wording from the 2020 RAFT administrative plan states that “If a family is using RAFT to move into a unit with a subsidy, proof of the total contract rent and of the tenant’s rent share must be provided. Depending on which agency or housing authority administers the voucher or subsidy, this may take the form of a lease or a rent share letter.”

This verbiage implies that families who receive rental vouchers may also receive RAFT funds, at least under certain circumstances.

How Does RAFT Work?

As discussed earlier, families who receive RAFT funding can use that money for a variety of purposes to avoid becoming homeless or to find housing if they are currently homeless. They can use it for first and last months’ rent, a security deposit or even furniture (furniture expenses are capped at $1,000). They can also use the money for utility bills, or to get current on owed rent/utilities.

Prior to COVID-19, families could obtain no more than $4,000 from RAFT within a 12-month period. They were eligible to reapply after that time, but had to wait 12 months from their first received payment.

As of July 1, 2023, households can obtain up to 12 months of assistance, capped at $7,000. Households must have been served a notice to quit or eviction notice, or have a court summons for owed rent in order to be eligible.

How to Apply for Rental Assistance:

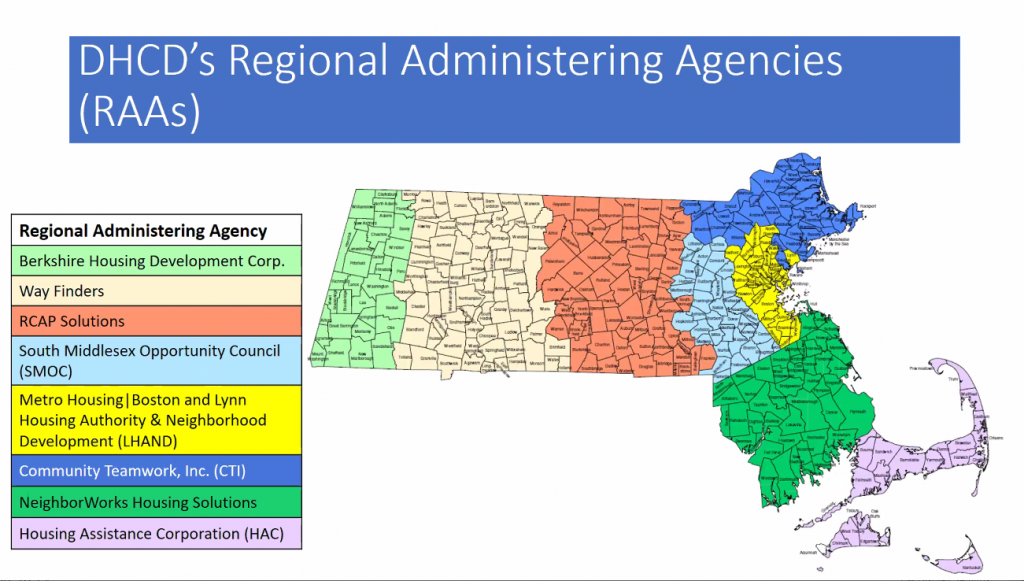

People applying for RAFT must do so in the region where they intend to use their RAFT benefits. Therefore, going through a regional Housing Consumer Education Center to complete an intake assessment is the first step to accessing RAFT funding.

If the link above does not work (please notify us using the "Need a Hand" widget below and right), then go to the regional directly. A list of regional agencies can be found at the Massachusetts Housing Consumer Education Centers site.

Since each HCEC has its own website, we have tried to list the RAFT application links here:

- MetroHousing Boston RAFT application for Greater Boston residents

- NeighborWorks RAFT Application for South Shore, New Bedford, Taunton residents

- Housing Assistance Corporation RAFT Application for Cape and Islands residents

- Community Teamwork RAFT Application for North Shore, Lowell, Lawrence link coming soon

- South Middlesex Opportunity Council RAFT Application for MetroWest link coming soon

- RCAP Solutions RAFT Application for Worcester County residents

- WayFinders RAFT Application for Greater Springfield and Holyoke link coming soon

- Franklin County Regional Housing and Redevelopment Authority RAFT Application for Franklin County residents

- Berkshire Housing Development Corporation RAFT Application for Berkshire County residents

If any link doesn't work, visit the Housing Consumer Education Centers site, find the regional HCEC page, and then tell us which link to change.

The intake form does not need to be completed in person, however. If an individual needs assistance in completing their form, mass.gov reports that the regional agencies can provide help.

Once someone receives initial approval, they can complete an application. Applicants must bring photo identification and proof of current income for all adult members of the household. Additional documentation that backs up the applicant’s claim for needing funding may also be required.

If a family is determined to be ineligible for benefits, they may reapply after 30 days.

A map of EOHLC's (formerly DHCD) regional administering agencies throughout the state with names in key.

CC-BY SA 4.0 MassLandlords

Note that you as the landlord must provide information for the RAFT application. Work with your renters to provide your part of the information as soon as requested.

Frequently Asked Questions

When can someone apply for RAFT?

A renter can apply once they have received a court summons or a notice to quit for owed rent.

If someone is approved for assistance, when will they get funds?

There does not appear to be a clear answer for when funding is received, however, the first payment of the benefit must be used within 60 days of an applicant being determined eligible for RAFT money (barring documented administrative delays or extenuating circumstances).

Some regionals are releasing funds within three weeks of receiving a complete application. Others need 12 weeks or longer.

If someone is at risk of being evicted, do they have to give their landlord RAFT funding?

The answer is no, RAFT funding can be spent on any housing needs that will keep someone from becoming homeless. A tenant who is late on rent could sign up for the program, receive funds, and use it to put down a security deposit on another housing unit elsewhere.

Can a renter get RAFT directly and then not give it to the landlord?

The short answer is: No. The long answer is a bit more complicated. John Fisher, author of the Massachusetts Rental Owners Property Management Manual, said that RAFT regional agencies make direct payments to “participating vendors” (meaning landlords, utility companies, etc.). The tenant does not receive funding directly.

However, Fisher went on, “there doesn't appear to be any language to the effect that an existing landlord with an arrearage would have any priority over a successor landlord if the tenant chose to move into a new property. Since RAFT monies can be used for more purposes than just late rent...what may have happened in situations where the tenant got RAFT support but the landlord never saw any money was that the tenant directed the payment to an additional vendor as well as to a new landlord.”

In other words, no, your tenant did not just keep their RAFT funds. But if they are moving out, any number of circumstances could have kept those funds from being directed towards you.

For more information, visit the state’s RAFT guidance page.

Is RAFT Different than Section 8? What about HomeBASE?

Section 8 is permanent (as long as the recipient remains eligible for funding), and it guarantees the landlord will receive rent. Subsidies resulting from RAFT applications during the COVID-19 pandemic were capped at 15 months total benefit. This was much higher than previously and since. The two programs also serve different purposes. Section 8 is a housing subsidy, and RAFT is meant to be a short-term cash infusion to help families in a temporary difficult spot. Prior to COVID-19, RAFT monies were only awarded if the applicant could demonstrate a way to remain in housing after the RAFT funds has been expended. During COVID-19, the sustainability requirement was removed (Jan. 11, 2021), and then after it was reinstated.

HomeBASE is a program for families who are experiencing homelessness and are living in shelters. It can provide funds for the same housing-related expenses that RAFT covers. However, there is a $10,000 cap in funding, and any money that a family has received from RAFT counts towards that. If a family had used RAFT funds to stave off becoming homeless, but in the end were not able to remain in housing, they could see less HomeBASE funding later on.

Families living in emergency shelters are not eligible for RAFT funds, and in theory, RAFT is the superior program, as the goal of the Commonwealth is to keep families out of shelters in the first place. Families who have received HomeBASE funding may also be eligible for RAFT.

Residential Assistance for Families in Transition Conclusion

RAFT is a one-time or as-needed subsidy currently in vogue, with none of the long-term stabilizing power of permanent rental subsidy, but with more responsive application timeframes. If your renters are in a tough spot, it is worth checking to see if RAFT funds are available and if your renters qualify.

New RAFT Application Portal Pilot Began Nov. 14, 2022

The Massachusetts Department of Housing and Community Development (as it was then called; DHCD is now known as the Executive Office of Housing and Livable Communities, or EOHLC) announced the pilot program for its new application portal for the Residential Assistance for Families in Transition (RAFT). The program started Nov. 14 in two regions, with statewide rollout expected sometime in mid-December.

The two pilot regions are Way Finders in the Greater Springfield region and the Housing Assistance Corporation, serving Cape Cod and the islands. Starting Nov. 14, landlords or tenants in these areas were able to file new RAFT applications through the portal. Applications already in progress continued to be processed through the system already in place.

The new application portal is designed to replace the current central application process. It will include enhanced features expected to create a more user-friendly experience and increase processing efficiency. One of the biggest features is the addition of a “save and resume” function. This gives applicants 21 days to complete and submit their application once it has been started.

Landlords and property managers will be able to create a profile on the portal with their W-9 and payment information. They will also be able to register multiple properties under one profile, as long as all of the properties have the same tax identification number. Landlords will be able to log in and see all applications for their properties at once, as well as check application statuses in real time.

Either a landlord or a tenant may begin the RAFT application process by going to the existing landing page. Applicants who have not already done so will be prompted to create a new profile and account. Each assistance application will have two parts, one for landlords and one for tenants. If the tenant is the one applying, the application will ask them for their landlord’s contact information (email or phone number). Once the application is in, the landlord will receive an email or call informing them an application has been started by one of their tenants. The landlord will receive a special code they must enter in the portal before completing their portion of the application. The system will automatically match the codes and bring the two parts together.

If the landlord applies on behalf of the tenant, the tenant will receive the code and a prompt to begin their part of the application.

If a tenant does not have an email address or access to a computer, they can still go to their regional administering agency (RAA). The RAAs can either assist the tenant with setting up an email address or can act as a tenant advocate to get the application process started. Paper applications will still be available at RAAs if tenants need them.

If you think RAFT could help your renter and you apply on their behalf, you will need to provide their email address. If you do not think your tenant has access to email, EOHLC recommends you have your tenant initiate the application with their local RAA.

Under the current system, landlords applying on behalf of their tenants must include a signed tenant consent form, but the dual nature of the new portal application removes the need for this. Consent is implied when the tenant fills out their portion of the application.

Once submitted, applications cannot be edited, but additional documents can be attached if necessary. Landlords and tenants can see their application status change as it moves through the system. “Not submitted” means an application has been started, but not completed and turned in. “Submitted” lets the landlord or tenant know that the application has been submitted but is still waiting for the other party to match with the application using the specialized code. “Under review” tells the landlord or tenant that the application portions have been matched up, and it is being reviewed for eligibility. The final four steps are “pending final approval,” “approved – pending payment” and then “approved” or “denied.” Tenants will be able to see why their application was denied. Landlords will see it was denied but will not be given tenants’ private information.

Once it launches statewide, the portal will be available in eight languages. Community-based organizations will also get training in how to use the new portal.

External Links

- Official: Information for landlords on emergency housing assistance

- Find your regional agency and income eligibility

- Using the new RAFT portal: The Housing Assistance Application Reference Guide

Historical Covid-19 Information

COVID-19 Clawback Deadlines

The extra RAFT funds from the federal government were meant to be used within a specific amount of time. States that did not use all of the federal money they were allocated were at risk of having that money "clawed back" by the U.S. Treasury.

Of the approximately $400 million allocated to Massachusetts in the December 2020 Consolidated Appropriations Act of 2021 (CAA 2021), 65% had to be spent by Sept. 30, 2021, to avoid clawback.

Of the approximately $400 million allocated to Massachusetts in the March 2021 American Rescue Plan Act (ARPA), 50% had to be spent by March 2022 to avoid clawback.

These deadlines were shared with MassLandlords and others by a state official over the March 25, 2021, stakeholder zoom.

What is RAFT COVID?

As a result of the COVID-19 pandemic and response, the state of Massachusetts initially made an additional $5 million available for RAFT. This additional funding program had slightly different eligibility standards than the regular RAFT program, and was used for mortgage foreclosures and loss of utilities, not just evictions. This funding source no longer matters. All funding sources are now merged behind one single RAFT application.

Because the eligibility standards for this program are evolving, tenants who may not have previously been eligible for RAFT are encouraged to re-apply. One way of proving eligibility can be by providing a month’s worth of pay stubs, or self-certification that this source of income is gone.

To document COVID-related income loss, applicants may provide a letter from their employer showing lost or reduced hours, or documentation of loss of childcare (requiring the applicant to have to stop working). They can also provide a copy of their application for unemployment insurance, documentation of loss of insurance or documentation of the death of a household member who contributed to the household’s income. If none of these are available, the applicant can self-certify.