Housing Court Rules: “Hold Fees” Unlawful in Massachusetts

| . Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

The Eastern Housing Court reinforced state law when it informed a property management company that retaining a “hold fee,” when a potential tenant decided not to sign the lease, was unlawful. The only fees a landlord may collect under state law are a security deposit, first and last month’s rent, and a lock-changing fee.

80 The Fenway, where one prospective renter found herself out $3,400 when she decided not to sign the lease after all. The courts decided otherwise. (Image: Google Earth)

This story centers around a large property management company and landlord, and a tenant who had to sue to get her first month’s rent back. The court decided in her favor and told the property owners and managers in strong language that they should have known better. The court awarded the tenant triple damages plus fees.

Tenant Changes Mind, Property Managers Retain $3,400 “Hold Fee”

In May 2020, Yerkaterina Merkulova was looking for a place to rent. She saw a listing for an apartment at 80 The Fenway in Boston, which is owned by LDJ Development and managed by Premier Property Solutions (PPS). She told her rental agent she was interested in applying.

Merkulova’s agent submitted her application, a $60 application fee and $3,400, which was equivalent to one month of the advertised rent. Several days later, an agent from PPS confirmed receipt of the application fee and $3,400. PPS called this a “hold fee” that was reportedly “necessary to reserve the unit.” The parties negotiated the lease terms and the $3,400 was sent to the property owners, but no lease had been signed. The notation on the check that PPS wrote read “80 The Fenway #41 – First Month Rent.”

Approximately a week after, Merkulova told her agent she would not be going through with the lease, and requested the $3,400 be returned to her. PPS reportedly said the hold deposit had already been released to the owner and would not be returned, as the rental application terms allowed it to be retained as damages.

Merkulova filed a civil action to recover her money. In response, PPS and LDJ filed for a summary judgment, claiming they had a right to the hold fee under contract law and stating they took the apartment off the market anticipating Merkulova would be signing the lease. Further, they stated, they had been unable to re-rent the apartment at the initial advertised rate, and were not able to get an occupant in the apartment until Sept. 1 of that year, for $3,000 a month.

LDJ claimed its damages amounted to $11,600, including the “lost” rent from June, July and August, plus the “lost” $400 a month from having to lower the rent to get a tenant in place at all.

Defendants Cite 19th Century British Case Law; Court Denies Damages

The court ruled in favor of Merkulova, stating that the laws that govern money exchanges pre-tenancy between landlords and tenants are summed up in MGL Chapter 186, Section 15b. This law states landlords may collect only four amounts: first and last month’s rent, a security deposit that may not exceed the first month’s rent, and the costs to re-key the apartment.

These laws, the court stated, supersede any claims to contract law from the defendants.

“In this Court’s view, any pre-rental contract between a lessor (or its agent) and any prospective tenant which purports to alter or waive the application of G.L. c. 186 15b is void as a matter of law,” the court’s finding reads.

Further, court documents state, the rental application that Merkulova filled out and submitted does not mention a hold deposit. It does have a clause that states the first month’s rent may be retained as damages. The defendants argued that only applicants who intend to lease a unit should fill out an application, and cited an English Court of Appeals case from 1879 to further back up their claim.

“This Court need not point out that the British Court of Appeals in 1879 was not construing a circa 2022 Massachusetts statue [sic] intended to offer very particular protections to Massachusetts landlords and tenants,” the court’s finding continues. (We assume they meant a “circa 2022 court case,” not “statute,” as Chapter 186 Section 15b goes back much further than that.)

The court stated that since the “hold fee” would have been applied as the first month’s rent when the tenancy commenced, it should be returned since no tenancy began.

Regarding the breach of contract claims, the court determined that there could not be a breach if no contract had been signed.

Plaintiff Receives Triple Damages Plus Attorney’s Fees, Defendants Dressed Down

The court awarded Merkulova $10,200, three times the amount of the initial $3,400, in accordance with the state’s consumer protection laws. It further ordered the defendants cover her attorney fees and costs. And, in its decision, the court did not mince words.

“This Court finds the failure of PPS and LDJ to return Merkulova’s $3,400 deposit to be an unfair and deceptive practice, proscribed by the Massachusetts Consumer Protection Statute,” Associate Justice Irene Bagdoian wrote in the decision.

“These defendants purport to be in the real estate business; PPS purports to be in the real estate rental business [emphasis original to the court document]. These defendants knew or should have known there is no provision for a non-refundable “hold deposit” under Massachusetts law…[and] that the payment obligation of a tenant commences at the inception of a tenancy – and not beforehand.”

Avoiding Triple Damages for Hold Deposits Is Easy: Don’t Collect Them

Fortunately for you, the ruling the housing providers here received is easy to avoid: Don’t assess extra, unlawful fees. Call what you are collecting the right thing (first month’s rent, last month’s rent, and/or security deposit), make it refundable, and never take your unit off the market until the agreement is signed. It’s really that simple. The defendants lost their “hold fee” because there’s no such thing as a lawful hold deposit in Massachusetts.

The fact that this company couldn’t re-rent the apartment at the original rate of $3,400 a month tells us the rent was probably too high. In such a competitive housing market, if your unit is in good shape and your pricing is at market rate, you shouldn’t have much trouble renting to a qualified tenant. If you are, take a closer look at how you are running your business. Do you need to perform renovations? Lower the rent?

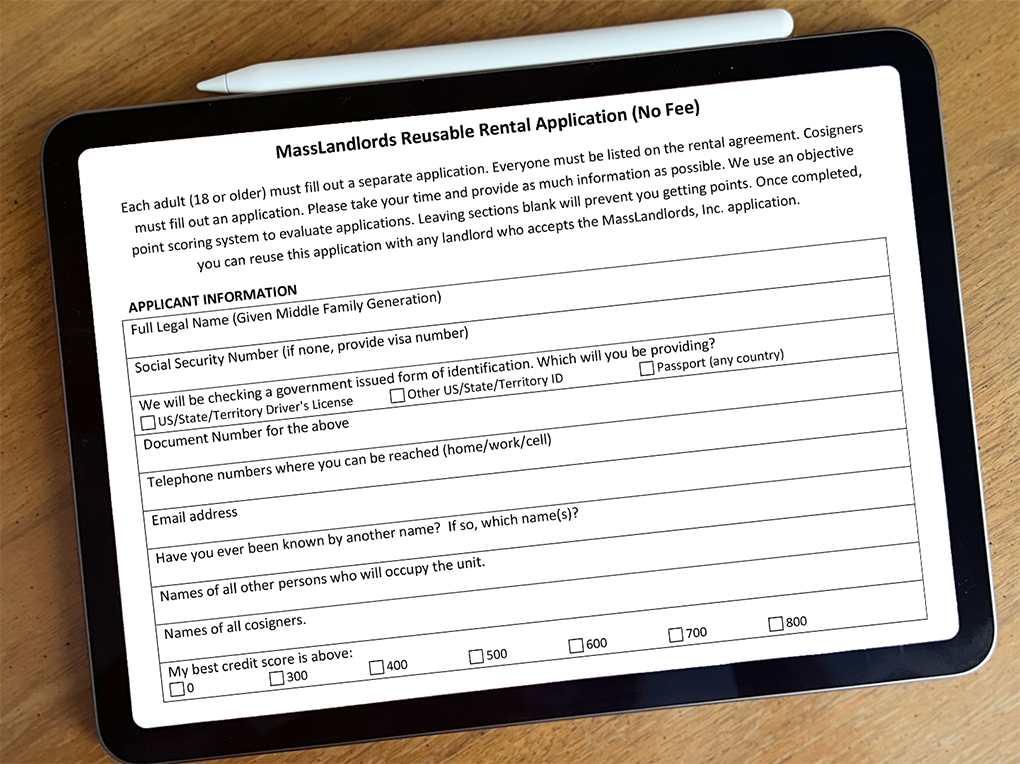

An approved application is not a binding contract. All move-in monies are refundable until the lease is signed. (Image: CC-BY-SA Jennifer Rau MassLandlords)

Protect Yourself: Wait for Payment to Clear Before Signing the Lease

Once you have an approved application, you can collect your move-in monies from that tenant. You should do so before the lease is signed.

When you collect money from your tenant, wait for payment to clear before sitting down and signing the lease. A bank check or money order will clear faster than a personal check, which may be subject to a hold if it is in a large amount. No matter what method of payment is used, issue your renter a receipt when you collect those move-in amounts from them.

Once payment clears, you can confidently sign the lease and take your unit off the market. If your renter changes their mind before lease signing, refund them (but wait for payment to clear before doing so).

Security Deposits and Last Month’s Rent

You can collect both a security deposit and last month’s rent for a new tenancy, but you should be well-informed before making that decision.

Security deposit law in Massachusetts is complicated (see our explainer for a plain-English version) and can cost you triple damages plus fees if you make an error. There are very specific ways to handle every aspect of it, from placing the deposit in the proper bank account to the conditions statement and proper withholding. It’s a lot, and it’s easy to miss a step. We do have a security deposit checklist that can help you step-by-step.

How to handle last month’s rent can also be tricky, especially if you renew the lease and increase the rent. The last month’s rent may not lawfully exceed the first month’s rent. If you don’t want to offer the last month at a discount to the new higher rent, you will need to credit it in the last month of the previous agreement and collect a new last month’s rent that reflects the new rate when you sign the new agreement. Make sure you document any and all communications surrounding this move-in payment.

We don’t necessarily recommend you collect both amounts. For instance, if you are not very organized, it may be smarter for you to forgo collecting a security deposit. We do suggest you collect one or the other and speak with an attorney about which is best for you.

As an alternative, the Housing Bond Bill passed in August 2024 includes the provision that landlords may collect a monthly fee in lieu of a formal security deposit. What this will look like in practice remains to be seen, but we will keep you updated as things progress.

Conclusion

This court case shows that even large, professional housing providers and their management companies can mess up. It’s important to stay current with landlord–tenant legislation and court cases and only operate within the scope of the law.

Whatever you choose to collect at move-in, make sure you apply your policies evenly to all renters. Don’t invent extra fees or deposits, and always consider running any changes to your practices by an attorney before moving forward.

Hold Deposits Unlawful Under Mass. Law: Landlord Response

The court case Merkulova v. Premier Property Solutions and LDJ Development determined that it was unlawful for landlords to charge prospective tenants hold fees or deposits when looking to rent an apartment. When we wrote about this case earlier in 2024, members submitted some interesting questions surrounding hold fees and move-in monies.

Make sure payment clears before you sign a lease or rental agreement and turn over the keys to your apartment. (Lic: Tierra Mallorca for Unsplash)

Here, we will go over the top questions we received. Please note that these questions have been edited for clarity and, in certain cases, to remove identifying information. Also remember that we are not attorneys, and the answers we provide should not be considered legal advice.

Q: Why did the court order triple damages if no security deposit was collected?

A: We talk a lot about security deposits and the triple damages penalty that may be invoked if a landlord mishandles the deposit, but under MGL Chapter 93A, triple damages may be ordered for violating any law, not just the security deposit law.

Q: If a tenancy at will agreement is signed the same day as the first month’s rent is collected, would this be lawful?

A: Yes, this is lawful, but risky for you. You want the funds to clear before you sign the agreement. Our suggested best practice is to collect the move-in monies and issue a move-in monies receipt that clearly states the agreement/lease will not be signed until payment has cleared.

Remember, the property managers in this case didn’t get in trouble for collecting first month’s rent. They lost their case because they called it a hold fee/deposit (unlawful) and refused to refund it when the tenant did not move in (also unlawful, because there was no signed agreement).

The main message here is to only collect lawful move-in monies, and call them by the right names (and return them when indicated).

Q: What happens if the lease/tenancy agreement is signed but the tenant does not have the funds on the day the tenancy begins?

A: We suggest you wait for the funds to clear prior to signing the rental agreement.

If you do collect move-in monies on the same day you sign the agreement, you need to have a clause in your lease that states the agreement is void if the funds have not cleared by move-in day.

Otherwise, you’d be at risk for any scammer who wants a free apartment for a little while (remember the eviction process in Massachusetts is long and expensive). Getting the keys and having the first check bounce is literally the first page of the professional tenants' playbook.

Q: What if the shoe were on the other foot?

Say I showed an apartment to a potential tenant, collected their application and a deposit of first month’s rent, and then emailed them later to say they were accepted. Isn’t that considered a contract (offer and acceptance) under law? What would happen then if I changed my mind and said I wouldn’t be renting to them after all? Would the housing courts say a tenancy had been created at that point?

A: On its own, the receipt of move-in monies does not create a tenancy. The attorneys in our crash course teach that possession + consideration = tenancy. In other words, an applicant must have both received the keys and paid something of value to be considered a tenant.

Our move-in monies receipt supports this process of collecting money up-front. It reads, “We are collecting these funds on the basis of having received a satisfactory rental application from you. We will not sign a rental agreement or give you the keys until these funds clear and settle. You are not a tenant yet.”

The court decision described and linked to in the article supports this. It reads in part, “any pre-rental contract between a lessor (or its agent) and any prospective tenant which purports to alter or waive the application of MGL Ch. 186 Section 15B is void as a matter of law.”

This implies there can be valid and enforceable pre-rental contracts, so long as they are consistent with 186 15b (which says we can only charge first, last, security and locks).

In the hypothetical scenario provided in your question, we assume that first month’s rent would be refunded when you changed your mind about the tenancy. In that case, the renter's claims would depend a great deal on whether you had a contract around the move-in monies, whether that contract was consistent with existing law, and what it said about either party's ability to change their mind. Our default move-in monies receipt would not cover you, but we imagine that a different contract could, which is why it’s important to speak with an attorney regarding special situations like this.

The reason Merkulova v. Premier Property Solutions and LDJ Development was decided in favor of the tenant is not because the company accepted money before a lease was signed. Rather, it’s about a property management company that wasn't even trying to follow 186 15B.

Q: Do I need to do anything differently?

A: Yes, probably. If you require any payment other than first, last, security and locks, you need to rename it or stop taking it. Broker fees, application fees, credit check fees, pet fees and pet deposits (pet rent appears to be lawful, however), and more are unlawful for lessors to charge.