Urgent: Contact your Senator to Oppose Tenant Opportunity to Purchase aka Right of First Refusal

. Posted in News, policy - 8 Comments

Read our latest on right of first refusal (TOPA).

Last Wednesday June 5 the Massachusetts House voted overwhelmingly to maim the housing market by adding bill text for the tenant opportunity to purchase act (TOPA), also known as the right of first refusal, to the housing bond bill H.4726. Although the bond bill is sure to pass into law, you can get TOPA removed by contacting your senator now. If you cannot contact your senator, you should be prepared to lose a significant fraction of the value of your property as soon as July.

TOPA Summary

Under the bill text adopted by the house, TOPA would:

- Allow any town or city to delay each multifamily sale for up to 220 days after listing;

- Destroy an important source of municipal funding; and

- Make it much more expensive if not impossible to finance the construction or operation of rental housing.

The house listened to the wrong people. Make the senate listen to you! Use the Find My Legislator link and tell them to remove TOPA from the housing bond bill, and keep out eviction sealing, too!

TOPA Detail

First, TOPA collapses the market by delaying closing, in some cases, indefinitely. Compared with a normal 30 day close, TOPA would require 220 days from listing to close any market property, 300 days to close any short sale, and 240 days to foreclose. This creates structural uncertainty forever after with each proposed transaction. Long, uncertain closings will predictably lead investors will shop elsewhere. TOPA will sharply reduce or eliminate private investment in rental housing.

Second, TOPA shuts off the engine of municipal funding, which is local real estate taxes. Reduced market prices lead to reduced assessments and reduced municipal tax revenue. The only ones who can operate in a TOPA town are the tax-exempt community development corporations (CDCs). (The CDCs wrote the bill!) If they own the property, they will pay zero tax. Allowing a town to enact TOPA is as bad as allowing them to enact rent control: either action is equivalent to shooting themselves in the foot. We estimate a 10% to 20% reduction in total municipal levy by analogy with rent control. Our State Aid redistribution system puts all non-TOPA towns on the hook. TOPA eliminates municipal tax revenue in both TOPA and non-TOPA towns.

Third and even worse, if some of the notices or carbon copies are incorrect or not received in foreclosure or short sale, even if the tenant did not win their bid, the tenant can still go to court to steal the property after-the-fact. The law grants damages equal to 3x the value of the property and explicitly authorizes compelled deeding to tenants. It will take six years for the average short sale or foreclosure deed to clear statute of limitations. The uncertainty about whether you can foreclose or short sell will result in no one wanting to lend against Massachusetts rental property.

TOPA is a gift to NIMBY towns who will enact it to stop the financing of new rental housing.

Why did the CDCs draft and file this?

Unlike for a private investor, where there are fast market processes for pre-approval and financing, community development corporations (CDCs) often require very long financing periods of up to a year to align funding sources and guarantees. Because the CDCs feel unable to fix this part of their process, they intend to drag the market down to their speed.

Call to Action: Contact your Senator

Please remove the TOPA provisions from the Senate version of the housing bond bill. Ensure they are removed during conference committee! And remember that eviction sealing needs to stay out, too!

Watch the Washington, D.C. TOPA Disaster Unfold

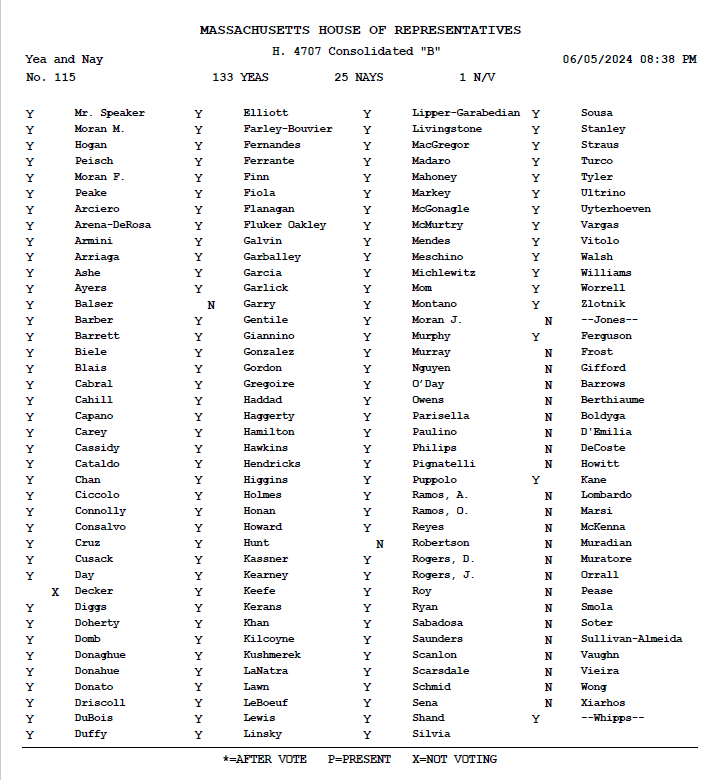

Who voted for this mess?

This is the roll call vote for TOPA. We need to contact our senators to stop this, but after you have done so, you can give your representative a piece of your mind.

The house voted overwhelmingly for H.4726. They listened to the wrong people. The senate can stop it. Make them listen to you.

This article sounds desperate and panicky. If we just pay higher property taxes to our local reps and higher income taxes to our state reps we will never have these problems. We need to give them more power. Does sarcasm get the point across?

Please remove the TOPA provisions from the Senate version of the housing bond bill. Please ensure they are removed during conference committee! Eviction sealing needs to stay out, too!

What’s the Bill Number? That’s how all staff people for Senators track bills.

What’s the Bill Number? That’s how all staff people for Senators track bills.

Is it S. 626 and H 1162?

TOPA will delay the selling of one’s property over 7 months! Any mistake in the sale damages up to 3 times the value of the properties? Do the representatives understand this?

Every Democrat voted for it with exception of 2, and every Republican voted against it except for 3.

What is it with these people?? This neither creates more housing or lessons demand for it …if any bill does not do one of those two things it’s useless

I’m 72 on SSI with serious health issues in need of surgeries and tests as well as biopsies under anesthesia…a person who is NPD (narcistic personality disorder..psychopaths etc) has caused me total financial devastation as well as property destruction not to mention fmotional etc Har. Last year’s nor this yrs property taxes haven’t been paid and every cent I’ve ever had is hone!! This is he’ll. Im order to save my home and attempt to sell n move from a deadly aka toxic environment ( fly ash from nearby incineration facility has fills mu home every time they burn) it’s caused death of most of my pet birds caused fatal I’ll esz I. my dog and myself. Soooo I applied for RAFT but keep needing to reapply for invalid reason DM RAFT submitted the proper documentation for me…my credentisls…id..proof of ownership…deed etc. demand notice and last years tax bill with lien and amt. well the funding source asked RAFT for additional proof from me..document that I have a lien on the property n the amount proving I’m in dire need of funds for the overdue taxes. Well everyone sends them exactly what I did..thevbill stating ” lien.and amt”..on reverse it says they can take any . Allegan means including sale of property if not lf within 15 days… “.so why am I being asked for addled documentation that doesn’t exist?. I’ve done research..contacted my Assesdors and Treadurers many times without response. finally assesdorscsaid its for treasurer to give..treasurer called the NPD not me..not at number I left..he relayed her message that she emailed me the tax bill its enough. Well zi checked every email account and nothing from her is there. But it doesn’t matter as it would be duplicate bill right?

There are deadlines..Im going to lose my house I’m afraid. What should I do? I’ve mobility issues.