To Collect a Security Deposit or Not? Worcester Housing Authority No Longer Does, Joining Other Agencies

. Posted in News - 0 Comments

By Eric Weld, MassLandlords, Inc.

The Worcester Housing Authority (WHA) announced in August 2024 that it will no longer collect security deposits or last month’s rent from new housing clients, citing prohibitive administrative costs and financial barriers to people who need housing.

M.G.L. Ch. 186 S. 15B outlines the Massachusetts security deposit law, including its strict requirements to 1) issue a receipt within 30 days of receiving a security deposit, 2) deposit the fee in an interest-bearing account in a Massachusetts bank, and 3) pay interest generated from the account to your tenant annually. An error on these or other security deposit steps could mean liability for triple damages plus attorney and court costs.

The WHA administers rental housing for nearly 10,000 residents of the city of Worcester and Worcester County. It joins both Cambridge Housing Authority and Boston Housing Authority in shifting its policy to not taking these pre-tenancy payments.

The policy was rescinded by the WHA Board of Commissioners, based on a recommendation by the authority’s CEO Alex Corrales. It took effect on August 17.

Cost, Labor and Liability

Processing, monitoring and communicating on security deposit and last month’s rent payments cost the agency more than the total monies collected for those purposes, noted Corrales to the board in arguing for the policy shift. Annual deposits equaled around $82,000, but the total administrative costs to manage the deposits totaled about $88,000, according to a WHA press release announcing the policy change.

This is a non-lateral comparison. Security deposits are, and remain, renters’ money, not landlords’ income. So comparing costs of holding security deposits against landlord (WHA) income is inaccurate. A more accurate contrast would be the costs of collecting security deposits against the potential cost of damages to a rental unit or nonpayment of rent, which security deposits are intended to protect against. That projected cost, or an amalgam of past years’ damage costs, should at least be added in when calculating the cost-benefit ratio.

On top of administrative costs, the press release adds, the monitoring and payout of interest on each security deposit – a legal requirement – consumed inordinate staff labor hours, and left the agency vulnerable to liability for exorbitant legal damages in the case of errors.

Regarding staff hours, we wonder, how much is WHA really saving by eliminating administration of these two move-in fees, unless the agency plans layoffs? Very little, we imagine. And with even a slight spike in rental unit damages or nonpayment, the policy could backfire.

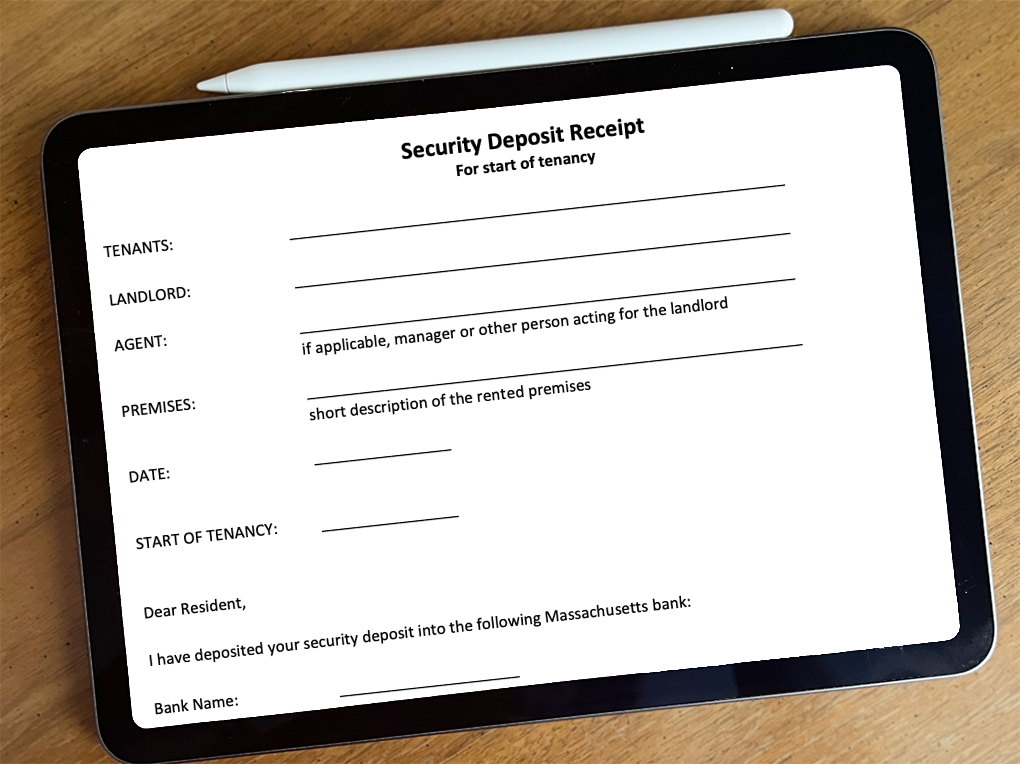

One of the most important steps, when collecting a security deposit, is issuing a receipt to your tenant within 30 days. Use the MassLandlords security deposit receipt (excerpt shown) for your convenience. Need other forms?

MassLandlords Security Deposit Training Videos

Still, mathematics aside, potential processing errors are a fair concern with Massachusetts’ complicated security deposit law, especially if one is dealing with hundreds of leases and move-in fees.

The law requires money collected for this purpose to be deposited in an interest-bearing account in a Massachusetts bank under the tenant’s name, separate from landlords’ credit responsibilities, within 30 days of receiving the deposit. It also requires a receipt be issued to the tenant stating the date of reception, name of the bank and amount of deposit. It further requires that interest on the account be paid to the tenant (or removed from rent) annually. Finally, in the event security deposit funds are withheld by the landlord at the end of tenancy, for whatever reasons, the landlord must provide thorough documentation, including pictures, detailing the nature of any lease violations, damages to the unit or nonpayment.

Any divergence from tenets of the Massachusetts security deposit law opens housing providers up to legal liabilities such as paying the tenant triple damages – that is, three times the amount of the deposit, and interest in some cases – plus covering attorney and court costs.

Regulations around collecting last month’s rents differ from security deposit policy. If you collect last month’s rent, you, as landlord, may spend the money as you wish. However, if you opt to deposit it in an interest-bearing account, the law suggests you should pay your tenant the interest on that deposit.

Watch our training videos (for members only; join MassLandlords here) on collecting security deposits to learn all aspects of the policy and how best to manage pre-move-in monies.

Burden for Prospective Renters

In addition to administrative costs, collecting security deposits and last month’s rent posed a prohibitive burden to some WHA clients, Corrales cited. And though assistance is available for tenants based on income, applying for such assistance could delay their move-in to approved housing, he said, costing the agency in lost rental income.

“The policy has created additional stress and burdens for tenants, and has strained our resources as well,” Corrales said.

Following Other Agencies’ Lead

WHA’s shift in move-in money policy reflects a similar policy change by Cambridge Housing Authority (CHA) in 2020. After estimating that the CHA was spending more than five times the amount of money in administrative costs as it was holding in deposits, it stopped the practice of collecting security deposits and refunded deposits to tenants collected that year. CHA held nearly $300,000 in security deposits at the time.

Boston Housing Authority also does not collect security deposits from tenants.

What About Your Security Deposit Policy?

Other housing authorities, as well as other landlords and property managers, ask for security deposits before tenants move in. It’s not only a way to protect against repair costs if a tenant damages the rental unit, or lost rent if they don’t pay. It’s also, increasingly, a final test of a rental application: Has your new tenant managed their cash flow sufficiently enough to pay standard up-front move-in fees? If not, it could be a red flag.

What is your security deposit policy, and how do you feel about it? Let us know by taking the survey at the end of this article.

In rescinding security deposit collections, these three housing authorities are the exception, not the norm. They have made the calculation that any potential rental unit damages or nonpayment costs will equal less than the annual management costs of security deposits and last month’s rent. They are also taking the gamble that the added cost of rental repairs due to above-and-beyond damage caused by tenants, plus any unpaid rent, won’t surpass what they had been paying annually to process the fees.

Considering Massachusetts’ particularly stringent and complicated security deposit law, the draconian penalty of triple damages for any breaches, and the time and cost of managing security deposits, we wonder, too, if taking security deposits is always the most prudent policy. Some landlords, who ended up with five-figure penalties, might not think so.

Many landlord-tenant attorneys might also recommend you not collect a security deposit due to the policy’s high risk of legal damages.

“I tell landlords that the security deposit law is too complicated for most landlords (and even many attorneys) to understand,” says attorney Adam Sherwin, founder of the Sherwin Law Firm, Charlestown. “There are many, many nuances that can get landlords into problems, and most are better off avoiding it altogether. Landlords can avoid liability by selecting quality, reputable tenants and staying on top of the responsibilities for managing rental property.”

A New Alternative

Security deposit laws differ among all 50 states. Only about half of states have a security deposit law at all. Those states leave security deposit policy up to municipal governments. In 2024, the Massachusetts legislature made a change to the security deposit law, allowing landlords to charge a fee (paid monthly or on a different, agreed-upon schedule) instead of an up-front security deposit. That might be a more palatable option for some tenants. It might also hold less risk for landlords. We are still watching for specific regulations, but our initial read of this policy change is that triple damages penalty will not apply when you collect the fee monthly. To be safe, if you opt for that option, be no less adamant about following the law.

To be sure, many landlords continue to collect security deposits as the most feasible option for protecting against rental unit damage or rent nonpayment. The way to make certain you don’t end up on the wrong side of a court case is to follow to the letter the steps required in the Massachusetts security deposit law.