Should You 1099-MISC a “Cash for Keys”?

| . Posted in News - 0 Comments

At a recent MassLandlords event on the “cash for keys” alternative to eviction, the question was raised about whether or when a landlord must issue an IRS form 1099. Conducting a “cash for keys” agreement, also known as a relocation assistance agreement, involves compensating a renter to move to more affordable housing. This compensation could involve forgiving debt, paying a small incentive, or even paying first, last and security for a new apartment. Can this payment constitute a reportable payment under US tax code, such that you would need to file something? Yes, you may need to file form 1099.

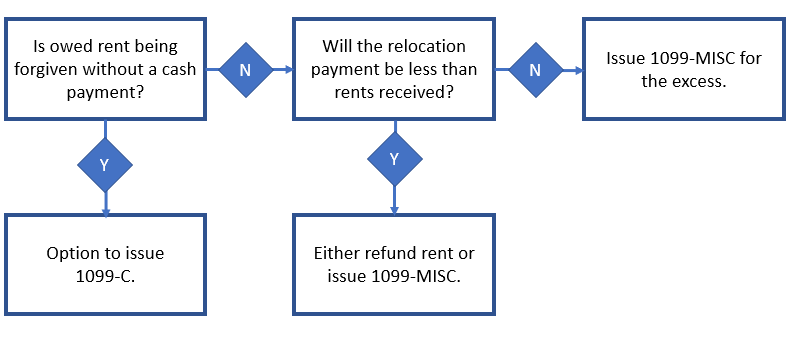

Should you 1099 a “cash for keys” relocation assistance payment? The answer depends on which form of payment is made and whether the payment exceeds rents already paid. Always consult with a tax accountant before taking any action that could affect your return. CC BY-SA 4.0 MassLandlords.

Note: MassLandlords staff are not accountants. What follows is our best understanding of the tax regulations as published at irs.gov. If you know otherwise, please write to us at hello@masslandlords.net.

In General, What is a 1099?

Per IRS instructions for form 1099-MISC and 1099-NEC, anyone engaged in a trade or business must report, among other things, all trade or business payments in excess of $600. Generally, payments to corporations are excluded. Landlords must file a 1099-NEC for all our independent subcontractors. Property managers must report rents paid to owners on 1099-MISC. And under many circumstances, landlords who pay relocation assistance to renters should file 1099-MISC.

Issuing 1099s can be a good thing for you. It’s a major determining factor as to whether you will be subject to hobby rule disallowance or eligible for the qualified business income deduction. So issuing 1099s is expected and not something to be avoided.

Cash for Keys Scenario 1: Amounts Paid Do Not Exceed Rents Received From Renter

Suppose you file taxes on a calendar year basis. It’s July and you have a rental agreement that has been in effect and fully honored for months or more. July rent is the first month your renters have been unable to pay. Whatever the particulars of the scenario, you have decided it’s time for these renters to find more sustainable housing at a lower rent elsewhere. You feel the best way to encourage a prompt move is to help these renters by returning an amount of rent equal to first, last and security for the new apartment once they have moved out of yours. (It doesn’t matter from a tax perspective whether the renter will save the funds and move in with family, or if they will spend the funds to obtain a new apartment.)

In this scenario, you will be refunding the renters less than what they have so far paid you in this calendar year. You may wish to consider the relocation payment a refund for tax purposes. This would allow you to offset your income, but there would be no reportable transaction for you or your renter. If you choose to file a 1099 for this anyway, that is also fine, but it will create taxable income for your renter. Please try not to make things any worse for someone already unable to afford living expenses.

Cash for Keys Scenario 2: Amounts Paid Exceed Rents Received from Renter

Consider Scenario 1, except in this case March rent is the first month of missed payment, and you don’t decide to offer a cash for keys until April, at which time your taxes for the prior year have already been filed. Should you refile your prior year to implement the refund procedure? No. There is no accounting method (neither cash nor accrual) in which your current year’s decision to pay relocation expenses can change the prior year’s accounting. This is true even if you late file.

You might be tempted to account for the relocation payment as a refund of all rent from all renters. That might be a stretch. This one customer didn’t pay you so much as would justify treatment of their payment as a refund. Speak with your accountant if you wish to apply an excessive refund.

In this scenario, you could approach the transaction in two steps. First, refund all rents paid by that one household so far. Second, if the excess of your payment over the refund is $600 or more, treat the excess as the 1099 reportable event. This will minimize your renter household’s future tax burden.

How to Report a Cash for Keys Relocation Payment

If you paid the tenant money to move out as described above, the safe thing is always to issue a 1099-MISC to report the payment. Our best understanding of the instructions is that this should be reported in Box 3, a catch-all for settlements, awards, and all other payments.

If you conducted a thorough rental application for this household, you would already have the name and social security number needed to issue the form. Their address can be your apartment address if they haven’t yet provided you with their forwarding address.

Scenario 3: Forgiving Debt

What if you aren’t making a payment, but merely forgiving a renter’s debt? In this case, you may wish to issue form 1099-C. This form forgives a renter’s debt, but it creates an income tax obligation for them.

Per the 1099-C instructions, landlords need not issue a 1099-C. This report is required only of businesses engaged substantially or primarily in lending. Landlords generally are not included.

If you choose to issue a 1099-C, you cannot collect whatever was owed. A 1099-C is formal and legal debt forgiveness.

Cash for Keys 1099 Conclusion

Always speak with an accountant before taking any action that could affect your tax liability. That said, work with your accountant to minimize the income tax burden being placed on this household. They clearly have a difficult road ahead. They don’t need to be penalized where a simple refund is possible. Refunding is still consistent with the spirit of the 1099, which is to help the government fairly tax the income of independent contractors and prize winners. Your renters are not independent contractors and surely have not won any prize by becoming unable to sustain their current dwelling.