Should I Issue a 1099-C Form if My Ex-Tenant Owes Rent?

| . Posted in News - 14 Comments

By Kimberly Rau, MassLandlords writer

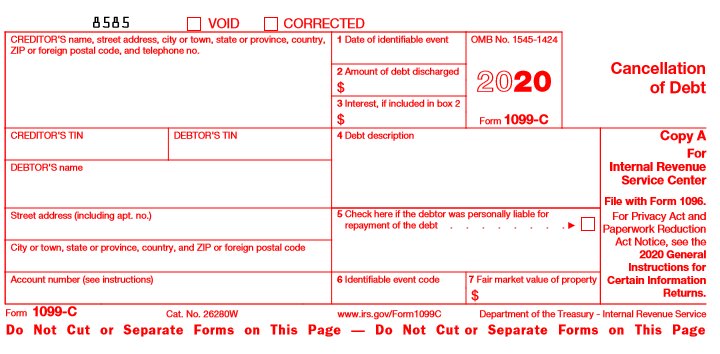

The IRS is clear: If you are forgiven a debt of more than $600, then it counts as income, which means it needs to be reported as such on your taxes. Conversely, if you’re a landlord and you willingly forgive rent that your tenant owes, you can issue a 1099-C form, which then compels them to claim it as income on their taxes.

An IRS 1099-C form can have legitimate uses for landlords, but using one to get back at tenants who owe you rent is probably not the best use of your energy.

Image Source: Internal Revenue Service

That’s the official reason why you’d use such a form. But landlords sometimes try to use a 1099 form as a way to “get back” at tenants who skipped out on paying rent.

Here’s a hypothetical scenario: A judgment is issued in your favor by the court, but your tenants are not able to make payments. You evict them, but they can’t make good on the judgment, so you still don’t get your missing rent.

Your official recourse is to let the judgment continue to accrue interest and, if the ex-tenants ever do come into some money, collect on the debt at that time.

Some landlords, however, are keen to try and take things into their own hands.

“Can I send a 1099 to last address known of a tenant who stuck me for rent?” begins one question on the Mr. Landlord forum. “I'm tired of using the courts to win worthless judgments. I'd rather send in a 1099 to IRS and let tenant be on the defensive end for once.” Some of the replies on the forum suggest the writer leave well enough alone. Others, however, chimed in with their own claims of sticking their former tenants with a big tax bill (how they’d know what their former tenants’ tax bills were is just one question that comes to mind in this scenario).

But the original poster on that forum isn’t alone. At MassLandlords, we’ve had people ask about issuing 1099 forms as revenge against former tenants, and the question comes up plenty all over the internet.

“The tenant moved out and owes me for last month and a half rent plus utilities,” writes Calvin of Georgia, in an old letter to BiggerPockets. “Instead of going after them in small claims court (they don't have any money) I would prefer to report it as income to the IRS for them and let the IRS have a chance of getting some taxes out of them.”

Check out the verbiage on that last letter in particular. “I would prefer to report it as income to the IRS for them,” as though the former landlord were doing this indigent tenant a favor. “[L]et the IRS have a chance of getting some taxes out of them,” as though anyone, ever, has felt so warm and fuzzy toward the IRS that they wanted to help them out!

In these instances, issuing a 1099-C form is nothing more than a petty form of revenge. The IRS certainly isn’t going to come find you and give you a check for your altruism. You can’t use it as a write off, either, since the missing rent wasn’t money you had to begin with.

Further, issuing such a form is your formal way of stating that you have forgiven your indebted tenants the money they owe you. Once you do that, you can never go back and recoup it. You are far better off going to court and getting a judgment in your favor that way, or, if you already have a judgment in your favor, letting it stand and continue to accrue interest. At least then you have a chance of being made whole. Consider a judgment in your favor like a winning lottery ticket that, for some reason, you can’t cash in yet. You may not be sure you’ll ever get the money, but that doesn’t mean you’d throw it in the garbage. Would you give it away to inconvenience someone else, knowing that meant you’d never be able to collect what you were due?

It would be disingenuous for us to imply that all landlords who are considering issuing a 1099 for missing rent are doing so just to be petty. There are plenty of cases in which landlords have been seriously put at a disadvantage by tenants who are looking to make things difficult for them. We have heard plenty of stories of angry tenants who have damaged the property before leaving for the last time. In these cases, ex-tenants tend to stop short of crimes they could be arrested for (think arson), but still leave plenty of disaster in their wake (leaving all the taps on and plugging the drains is just one anecdote that we’ve heard over the years). We are not about to say that injured landlords shouldn’t be upset by that. However, we can’t condone using the IRS to exact revenge with arguable impact on the past tenant and no benefit to the landlord.

Can you issue a 1099 form to a renter who has stiffed you on rent? Yes. Is it petty? It definitely can be. Will you actually receive any benefit from it besides knowing you potentially put someone in a bad situation in a worse one? No.

Will you be a better person for having done this?

That’s up to you to decide.

Yes you can do that… especially since the COVID pandemic has hit. 1-2 years on a 1099 in free rent assistance is also reportable income to unemployment assistance. If the tenant doesn’t report free rent as income ..a felony can be prosecuted because now the tenant is guilty of fraud and not report income.

Seems like the writer of this article has never been a landlord. It’s not being petty- it’s about being fair. I think having to deal with Consequences makes people grow.. so I see it as a very valuable lesson for the tenant, and some form of redress to the injured landlord.

Can someone tell me how to fill out the 1099-C without a TIN or EIN? Send one to ex-tenant and IRS?

Petty? Guessing Ms. Rau is a renter; certainly not a LL. People who intentionally don’t pay you the rent you’re owed are not going to pay you because you have a judgement from the courts. You’re not getting what’s owed to you anyway. Forgiving it means that they’re going to be far less likely to screw another LL. Harder to screw the IRS than a private party.

I am a landlord in this situation. Not only am I owed 20 months of back rent, but the damage done to the property, the utilities, property tax and home owner’s insurance that I had to pay.

The drain on my retirement funds …. this is NOT punitive. The fact that I was not able to evict, I had to commit to take the property OFF THE MARKET, to get them out. This is a loss of my rental business / retirement income. I am surely sending them a 1099-C. This was income to them. It allowed them to buy a new truck, an R.V. and take a vacation to Las Vegas.

Yes, I’m mad…. And Yes, I’m filing that 1099-C.

Haha hell yeah, get ‘em !!

Forget a 1099-C, it is time for a 1099-NEC. Tenant vacated owing 3 months rent. I went to small claims court and won the judgement for 3 months unpaid rent plus interest in Dec 2022. I now need to file a 1099-NEC for the amount of the judgement so the former tenant can pay tax on the compensation he took from me. I will continue to pursue the amount of the judgement by garnishment of wages and a lien on his BMW 640i.

I think Ms. Rau needs to understand that taxes must be paid on compensation. She also needs to understand there are “professional tenants” who use the courts to their advantage when it comes to avoiding rent.

One more note for other landlords about collection of judgements. About a year ago I sent a letter to the county clerk (Gwinnett County, GA) and asked them to tell me the percentage of financial judgements, given to the plaintiff, that were paid off. The clerk had no idea. When I was court in Dec 2022, and won the judgement, I asked the judge if he had any idea about the success rate on the collection of his judgements. He had no idea. This tells me the legislators have no idea how the horrible the laws are when it comes to protecting hard working landlords against deadbeat tenants. It is time to change all this. I was temped to tell the judge, if his pay was tied to the collection of his judgements, the laws would be changed that same day before he went home.

Perhapsf you’re lucky you can garnish his wages…

The writer of this article sounds like she has had a 1099-C sent on her behalf.

Hey Lance,

I am a landlord in the South Atlanta area and I’ve had a deadbeat tenant. The court doesn’t really look out for the landlords and the whole process is draining and should and could be done in a faster manner. How did this work out?

I understand exactly how all these landlords feel. I’ve been a landlord for 40 years and have never been able to collect on a judgment. Yes fill out a 1099 and send it in to the IRS. The government puts the burden on landlords. The tenants always get away without paying. I guarantee if the tables were turned the tenants wouldn’t be so understanding.

It is the law. There is no other answer.

I do t have a judgement but the eviction. I had to forgive two months of rent to just get her out. Can I still fill out a 1099 for her if not part of the eviction judgement?

Let the interest build up on the money judement and make it worthwhile for the IRS to chase them.

The tenant can,t escape thier ssn and thier address won,t help but the IRS can always find them