Should I Issue a 1099-C Form if My Ex-Tenant Owes Rent?

| . Posted in News - 14 Comments

By Kimberly Rau, MassLandlords writer

The IRS is clear: If you are forgiven a debt of more than $600, then it counts as income, which means it needs to be reported as such on your taxes. Conversely, if you’re a landlord and you willingly forgive rent that your tenant owes, you can issue a 1099-C form, which then compels them to claim it as income on their taxes.

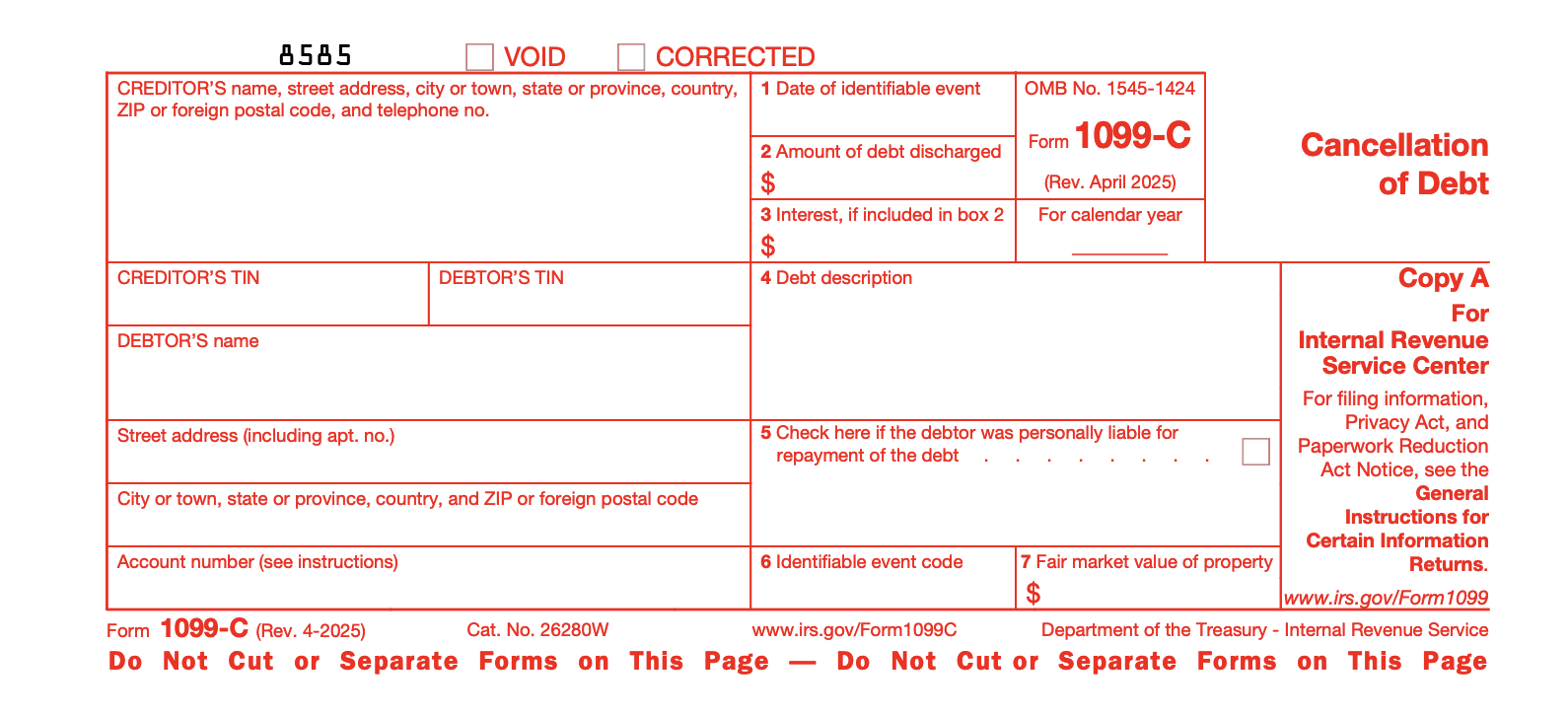

An IRS 1099-C form can have legitimate uses for landlords, but using one to get back at tenants who owe you rent is probably not the best use of your energy.

Image Source: Internal Revenue Service

That’s the official reason why you’d use such a form. But landlords sometimes try to use a 1099 form as a way to “get back” at tenants who skipped out on paying rent.

Here’s a hypothetical scenario: A judgment is issued in your favor by the court, but your tenants are not able to make payments. You evict them, but they can’t make good on the judgment, so you still don’t get your missing rent.

Your official recourse is to let the judgment continue to accrue interest and, if the ex-tenants ever do come into some money, collect on the debt at that time.

Some landlords, however, are keen to try and take things into their own hands.

“Can I send a 1099 to last address known of a tenant who stuck me for rent?” begins one question on the Mr. Landlord forum. “I'm tired of using the courts to win worthless judgments. I'd rather send in a 1099 to IRS and let tenant be on the defensive end for once.” Some of the replies on the forum suggest the writer leave well enough alone. Others, however, chimed in with their own claims of sticking their former tenants with a big tax bill (how they’d know what their former tenants’ tax bills were is just one question that comes to mind in this scenario).

But the original poster on that forum isn’t alone. At MassLandlords, we’ve had people ask about issuing 1099 forms as revenge against former tenants, and the question comes up plenty all over the internet.

“The tenant moved out and owes me for last month and a half rent plus utilities,” writes Calvin of Georgia, in an old letter to BiggerPockets. “Instead of going after them in small claims court (they don't have any money) I would prefer to report it as income to the IRS for them and let the IRS have a chance of getting some taxes out of them.”

Check out the verbiage on that last letter in particular. “I would prefer to report it as income to the IRS for them,” as though the former landlord were doing this indigent tenant a favor. “[L]et the IRS have a chance of getting some taxes out of them,” as though anyone, ever, has felt so warm and fuzzy toward the IRS that they wanted to help them out!

In these instances, issuing a 1099-C form is nothing more than a petty form of revenge. The IRS certainly isn’t going to come find you and give you a check for your altruism. You can’t use it as a write off, either, since the missing rent wasn’t money you had to begin with.

Further, issuing such a form is your formal way of stating that you have forgiven your indebted tenants the money they owe you. Once you do that, you can never go back and recoup it. You are far better off going to court and getting a judgment in your favor that way, or, if you already have a judgment in your favor, letting it stand and continue to accrue interest. At least then you have a chance of being made whole. Consider a judgment in your favor like a winning lottery ticket that, for some reason, you can’t cash in yet. You may not be sure you’ll ever get the money, but that doesn’t mean you’d throw it in the garbage. Would you give it away to inconvenience someone else, knowing that meant you’d never be able to collect what you were due?

It would be disingenuous for us to imply that all landlords who are considering issuing a 1099 for missing rent are doing so just to be petty. There are plenty of cases in which landlords have been seriously put at a disadvantage by tenants who are looking to make things difficult for them. We have heard plenty of stories of angry tenants who have damaged the property before leaving for the last time. In these cases, ex-tenants tend to stop short of crimes they could be arrested for (think arson), but still leave plenty of disaster in their wake (leaving all the taps on and plugging the drains is just one anecdote that we’ve heard over the years). We are not about to say that injured landlords shouldn’t be upset by that. However, we can’t condone using the IRS to exact revenge with arguable impact on the past tenant and no benefit to the landlord.

Can you issue a 1099 form to a renter who has stiffed you on rent? Yes. Is it petty? It definitely can be. Will you actually receive any benefit from it besides knowing you potentially put someone in a bad situation in a worse one? No.

Will you be a better person for having done this?

That’s up to you to decide.