An Act to Further Lead Remediation in Rental Housing by Increasing the Deleading Credit

Summary

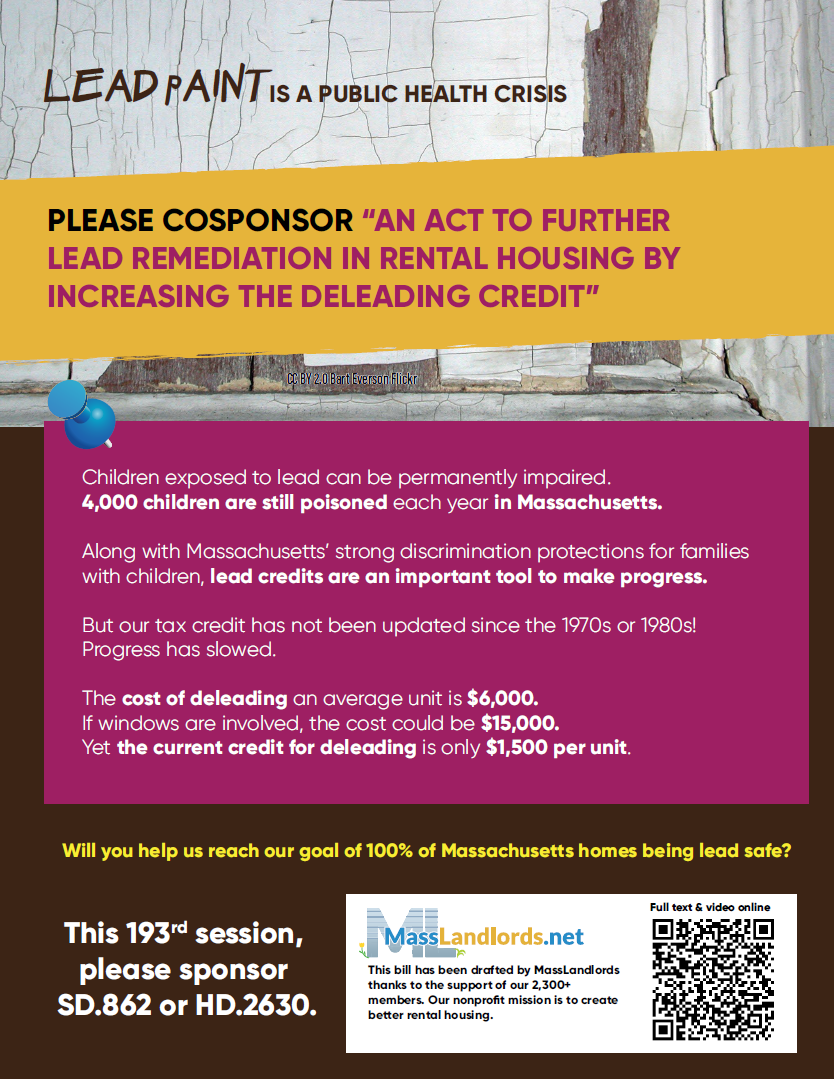

Lead remediation is an important part of creating safe rental housing, but it is also very expensive. This bill would increase the current deleading credit offered by the state from $1,500 to $15,000. This increased credit will contribute to increased lead remediation in rental housing in Massachusetts.

Update for August 2023

This bill was not included in the FY24 budget but can be taken up separately. We are working to see if the bill can be heard in its own right apart from the budget.

Update for March 2023

Gov. Healey's budget for the upcoming year proposed to double current tax deductions for deleading, to $3,000 for full and $1,500 for partial abatement. MassLandlords' bill to increase full abatement credit to $15,000 has 18 sponsors in the House and Senate and is listed among legislation that influenced the governor's deleading budget proposal.

Deleading Bill FAQ

Why $15,000?

This is the cost to remove lead paint covered windows, the most dangerous sources of lead, for a typical apartment.

The current amount authorized in the law is $1,500. This law was written in the 1970s. (The lead credit may not have been enacted until 1988; we're trying to find the history.)

If the deleading credit had been adjusted for inflation, it would now need to be approximately $6,000. This would be consistent with the average cost to delead a unit in 2022, about $6,000.

If windows are involved, deleading becomes very expensive. Historical properties are also very expensive. The cost to delead a property with windows are close to $1,000 per window. A typical three-decker apartment has 15 windows per unit. This bill would eliminate barriers to deleading in many more units, including units with lead painted windows.

How many properties are already deleaded?

To the best of our knowledge, only approximately 10% to 20% of addresses have deleading certificates on file.

How many units still need to be deleaded?

We estimate 450,000 housing units need to be deleaded.

The 2021 American Community Survey estimated 1,016,582 renter-occupied housing units in Massachusetts.

The Department of Public Health estimates approximately 10% of pre-1978 housing units are deleaded.

Ten percent deleaded of one million means that approximately 900,000 renter-occupied units still need to be inspected for lead.

Not all inspected properties have lead. Based on current inspection trends, half of all inspected units are already fully compliant without any deleading work. This means only 450,000 units are hazardous. (We won't know which ones until we inspect.)

Aren't landlords required to delead?

Yes, under Massachusetts law, landlords cannot refuse to rent to a family with children under the age of six. Also, children under the age of six may not live in an apartment with lead hazards, whether known or unknown. Landlords must delead.

Enforcement is lacking, however. Although discrimination cases are raised against owners who refuse to rent to children, it takes approximately three years for the Massachusetts Commission Against Discrimination (MCAD) to resolve a discrimination complaint. This is no help to someone who needs lead-free housing on the first. Also, even if a landlord is fined, they might still not have the capital to safely remove the lead hazards.

Increasing the lead credit would create a powerful market incentive to delead even absent adequate enforcement.

Who would vote against this?

We don't have good visibility into state budgeting, but presumably someone will have to look at our current tax revenue or shortfall and decide whether this bill can be sustained or if a lower amount is required. Given the historic budget surplus of 2022, and the fact that this credit has not been increased in 50 years, we feel increased public funding for deleading is long overdue.

How much would this cost?

This bill would cost only a fraction of state budget, and if we are effective at eliminating lead hazards forever, would repay itself in terms of reduced blood lead screening costs and much higher Bay Stater achievement scholastically, socially and economically.

At $15,000 credit per unit, assuming the 450,000 units calculated under "How many units still need to be deleaded?" the total cost would be approximately $7 billion. But this would not be paid all at once.

Based on present market conditions and industry capacity, the Department of Public Health receives notice of the successful deleading of approximately 3,000 units per year. At $15,000 per unit, this would equal only $45 million per year, less than 0.1% of state budget.

This credit will increase the number of companies operating as licensed lead inspectors and licensed deleading contractors. Over time, therefore, the annual cost to the commonwealth of the deleading credit would increase. But so too would the savings and public health benefits from reduced lead poisoning.

How is a tax credit different from deducting business expenses for deleading?

A landlord can generally deduct the cost of repairs and improvements from their taxable rental income. So if a landlord deleads (an improvement), they can probably find the IRS service life of that repair (27.5 years), divide the cost of the deleading by that service life, and deduct that amount from their taxable income each year.

A deduction is different from a tax credit. A deduction reduces your net taxable income. Then you calculate your tax. Then you apply credits. Credits directly undo tax obligations from all sources.

Imagine a deduction for a roof repair. You deduct the $1,000 repair and your tax obligation decreases by whatever your tax rate is, let's say 30%. You save $300. You still owe tax on your net rental income, if any.

Imagine a credit for deleading. If the credit is $1,000, then your final tax bill decreases by the full $1,000. If you don't use the credit, it carries over for a certain number of years onto future returns. A large deleading credit should be expected to take several years to apply.

Credits eliminate state tax obligations from all income sources up to the amount of the credit.

What if we do nothing?

At present deleading rates of approximately 7,000 units per year, Massachusetts will be lead free in the year 2170. An additional 600,000 children will be poisoned over this timeframe.

Bill Numbers

Find my legislator.

Full Text and Explanation of the Deleading Bill

|

An Act to Further Lead Remediation in Rental Housing by Increasing the Deleading Credit.

|

|

|

1.

|

|

|

Section 6(e) of Chapter 62 of the General Laws is hereby amended by replacing the words “one thousand five hundred dollars” with the amount “$15,000.”

|

This bill would amend Section 6(e) of MGL Chapter 62. It would replace the words "one thousand five hundred dollars" with "$15,000," increasing the deleading credit to roughly the cost of a three-decker apartment with leaded windows. That's it! |

|

|

MassLandlords Talking Points

- Massachusetts was a nationwide leader when we enacted our deleading law in the '70s.

- Unfortunately, we haven't increased the amount of public funding available for deleading in 50 years.

- The tax credit is currently $1,500 per unit, which reflects 1970s (or 1980s) deleading costs.

- By inflation alone, it should now be $6,000.

- If a unit has windows, windows have gotten expensive faster than inflation, that's a $15,000 deleading job easily.

- Massachusetts and the CDC have lowered the blood lead level that constitutes poisoning.

- It used to be 50 micrograms per deciliter.

- Now we know how dangerous lead is. The reference level of concern is now 3.5 micrograms per deciliter.

- We know deleading credits work. We've dramatically reduced the worst lead poisoning with deleading credits.

- The curve is flattening out, though. We're not seeing reductions in poisonings. Many units are still not deleaded.

- We don't know what Fiscal Year 2023 will bring, but Fiscal Year 2022 had a record surplus.

- It seems like we're long overdue for increased public funding of deleading.

See Also

- Deleading Credit Bill to be Filed (January 19, 2023)

- Rep and Senator Contact Response Form

Past Presentations

To view all of this presentation, you must be logged-in and a member in good standing.

Log in or join today and gain access all presentations and videos

Slides are available only for members in good standing who are logged in.