Issue IRS form 1099-NEC for Contractors by January 31 Each Year

| . Posted in advice - 0 Comments

Landlords, property managers and investors who pay non-employee contractors more than $600 in a tax year must report these payments on form 1099-NEC. Read the Internal Revenue Service instructions.

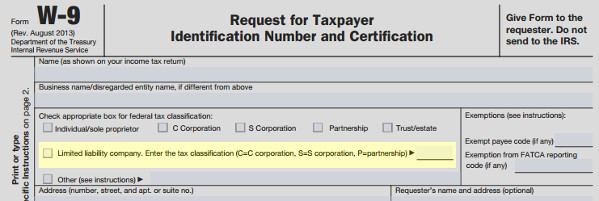

Caption: Since 2013 if not earlier, all LLCs have had the option to indicate the taxation status as shown here on this August 2013 revision. The latest revision has the same option. If the LLC is type “S” or “P,” you as payor must issue form 1099-NEC. Public domain.

A contractor is a 1099 contractor if you paid them at least $600 in services (including parts and materials), and they're not a corporation that pays its own taxes. This means you have to mail the contractor and the IRS a form 1099-NEC.

Note: LLCs are not necessarily corporations that pay their own taxes! For tax purposes, LLCs can be treated as either pass-through partnerships or pay-on-their-own corporations. You need to know which they are.

How Can You Tell if an LLC Is a 1099 Contractor?

Ask them to fill out form W-9. You'll see when you view it that there's a section where they must indicate their tax status.

Ideally, give this form to a contractor before you hire them. If they are unwilling to fill it out, this may indicate a general non-compliance with the rules.

What Happens if I Don't Issue Forms 1099-NEC?

This will dramatically increase the chances of an audit. If an audit finds you failed to report amounts on 1099-NEC, you will owe the tax the contractor should have paid, plus penalties and interest.

An audit may also substantially decrease your quality of life: It takes time to respond to auditor demands and the process can be unfriendly, depending on the auditor.

What If I Forgot? Can I Issue the Forms Late?

Yes, better late than never.

Where Do I Get Form 1099-NEC?

Small landlords can order information returns by U.S. mail. Make sure to visit the employer page, not the individual taxpayer page. Make sure to order both forms:

- Form 1099-NEC

- Form 1096 (the cover sheet to form 1099-NEC)

You can also order instructions.

Larger landlords may find your accounting software can file forms for you.