RAFT Kiss of Death: 22% Single Payment Success Rate, Study Shows, with Record High Debts, Low Housing Stability After Award

| . Posted in News - 0 Comments

After receiving a single payment of Residential Assistance for Families in Transition (RAFT), a subset of renters will be more likely to accrue a larger debt than at any time in their past and then leave, according to RentHelper data shared with MassLandlords.

Balance histories for 23 renter households receiving RAFT were graphed against payments received. Thirteen of these households went on to record high balances after receiving RAFT. Of these, five subsequently moved out owing their landlord money. An additional five households did not accrue record high balances but moved out owing their landlord money nonetheless. Of the 23 study households, only five were fully helped by a single RAFT award and went on thereafter either to remain stably housed as of May 1, 2024, or to move out owing no money. (Moving out owing nothing implies renter choice.)

The statistics paint a grim picture of a 22% success rate (5 out of 23 stabilized by a single RAFT award). Likely this is due to two factors: on the one hand, gross inadequacy for good renters unaided by short-term subsidy; and on the other hand, abuse of RAFT by renters with no further intention of paying.

This "kiss of death" shows loving gestures nonetheless may spell doom for a subset of renters and/or their landlords.

Rental assistance became available in Massachusetts in mid-2021. At its peak, RAFT was widely known to be paying 18 months of rent for arrears and going-forward stipend.

The study is a complete survey in the sense that 23 households studied are all the households for which a RAFT credit appears in their ledger. (Public records litigation that would have increased the sample size, among addressing other issues, did not produce results.)

Here are five household narratives representative of the variety in this survey.

Household Received 13 Months' Rent, Did not Stabilize

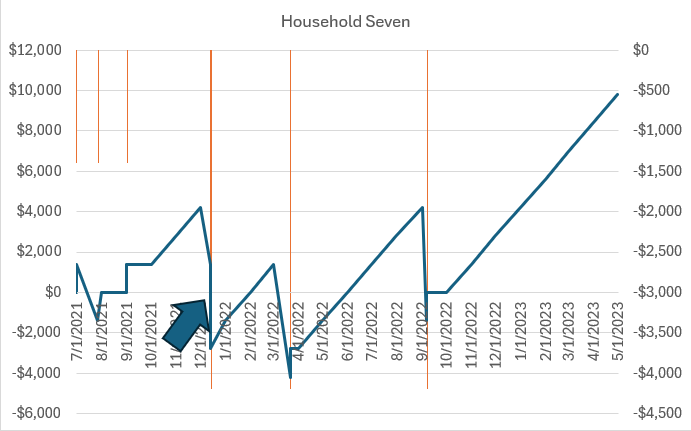

The solid line represents Household Seven's balance. Orange vertical bars represent payments. The dark arrow indicates the first time RAFT was received. CC BY-SA MassLandlords RentHelper.

Household Seven in the study was a market rate renter. They received five months' RAFT in December 2021. They never paid rent again. They would go on to receive RAFT twice more for a total RAFT benefit of $18,200. Meanwhile, the landlord worked through the housing court to evict the renter, which was allowed after 20 months of nonpayment, in May 2023. The final judgment showed $9,800 in owed rent after RAFT.

It is hard to know if this renter acted in bad faith or was in deep economic peril such that RAFT was inadequate. Possibly a combination of both factors was at play.

The moral hazard with RAFT is extreme. Paying rent yourself reduces your future RAFT award, so a rational actor expecting RAFT should withhold rent to maximize their eventual benefit.

Whatever the reason, eviction in this case took place before a fourth RAFT award.

Household Unstable Start to Finish

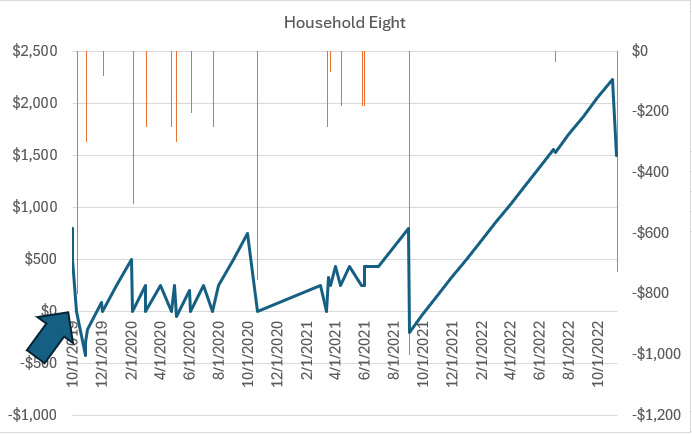

The solid line represents Household Eight's balance. Orange vertical bars represent payments. The dark arrow indicates the first time RAFT was received. CC BY-SA MassLandlords RentHelper.

Household Eight in the study was a Section 8 renter who received a RAFT payment to move into the apartment in late 2019. Their original share of rent was $150 after Section 8. They received RAFT twice over the next three years but never paid consistently. Each time after receiving RAFT, their balance climbed higher than before.

Their balance accrual rate increased following a Section 8 recertification that increased their share of the rent owed. This indicated that they had much higher income. Despite this new income, they continued not to pay. Eviction was allowed in late 2022. The renter was removed owing 10 months of their original share of rent, approximately $1,500 total.

This renter seems to have acted in bad faith, as evidenced by the Section 8 recertification showing they could pay.

Household Unstable Start to Finish, Better with Credit Report Threat

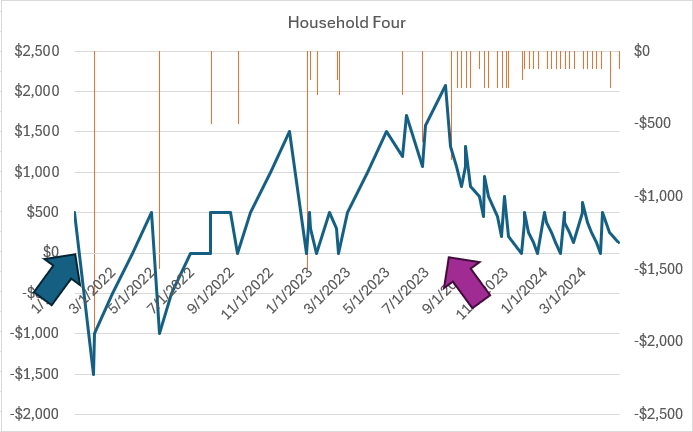

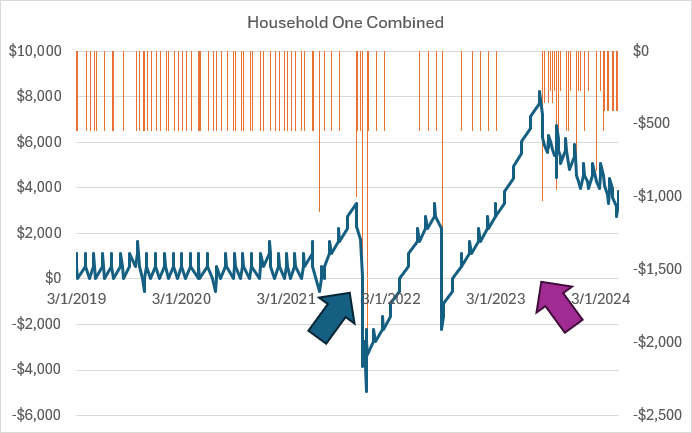

The solid line represents Household Four's balance. Orange vertical bars represent payments. The dark rightward arrow indicates the first time RAFT was received. The purple leftward arrow indicates pushback in the form of credit reporting. CC BY-SA MassLandlords RentHelper.

Household Four in the study was a market rate renter who received a RAFT credit to move into the apartment early 2022. They subsequently ghosted the landlord and stopped paying rent, as well. They received RAFT twice more. The total balance owed climbed through 2023, at which point credit reporting was threatened and a cosigner stepped in to make the renter a regular payer. Unfortunately, borrowing is not a long-term solution, and this renter left the apartment owing money.

This renter seemed to act in bad faith initially. The cosigner had not been aware of the nonpayment and stepped in following threat of credit reporting. For this reason, it seems likely the renter may have been in genuine need and unable to ask for help. Suffice it to say RAFT did not save them.

Household Received 9 Months' Rent, Did not Stabilize

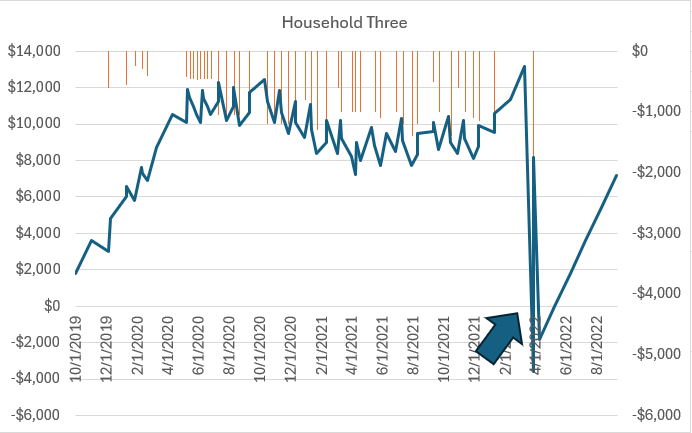

The solid line represents Household Three's balance. Orange vertical bars represent payments. The dark arrow indicates the first time RAFT was received. CC BY-SA MassLandlords RentHelper.

Household 3 in the study was a market rate renter. They made rare payments prior to the pandemic and then, in early 2020, started paying to keep their balance steady. They made progress reducing their balance until RAFT became available. They applied for RAFT, were awarded over 9 months' rent and stipend, and then never paid rent again.

After a long relocation settlement negotiation, the renter left owing four months' rent. It is unclear if the renter acted in bad faith or was in deep economic peril such that RAFT was inadequate.

Household Stable only after Court, Credit Report Threat

The solid line represents Household One's balance. Orange vertical bars represent payments. The dark arrow rightward indicates the first time RAFT was received. The purple leftward arrow indicates pushback in the form of threat of credit reporting and eviction. CC BY-SA MassLandlords RentHelper.

Household One is a household of two payers that remains stably housed as of May 1, 2024. They each made regular payments of $550 per month for years, including through the worst of the pandemic. For unknown reasons, one roommate stopped paying mid-2021. The second soon followed. A large balance accrued. RAFT was applied for and awarded to cover both arrears and provide a going-forward stipend, all of which appears on the RentHelper ledger as a single credit.

After receiving RAFT, from approximately mid-2021 until mid-2023, one roommate did not pay any rent at all. The second roommate made a number of payments, but with lower frequency than before. An even larger balance accrued. RAFT was awarded twice more.

A nonpayment eviction filed previously was brought to agreement for judgment in late 2023 and the landlord sought to enforce the payment plan with RentHelper. Additionally, the owner used RentHelper's credit reporting service to provide a second consequence to the renters for noncompliance.

This household seems to have avoided the "RAFT kiss of death" and have become regular payers again. Their balance is trending towards zero. They remain stably housed.

One of the two renters seems to have acted in bad faith, as evidenced by the sudden payments following threat of credit reporting.

Implications for Policy Makers

The promise of large cash awards has created moral hazards in which renters stopped paying rent even when they could afford it. This is demonstrated by the data showing court orders and credit reporting restored payments for these households. There can be no doubt. (The only uncertainty given our sample size of 23 histories is how widespread this may be.)

For renters acting in good faith, the temporary nature of RAFT was nevertheless inadequate to cure deep economic problems. This is why the Section 8 program was invented and remains the longest running housing safety net in our nation's history, now approaching 100 years. Section 8 avoids some moral hazards by requiring renters to make regular monthly payments, however small. And by being an open-ended commitment, renters in need are not needlessly evicted. If need increases, they just recertify to increase the housing assistance payment.

Implications for Landlords

Considering that 10 of the 23 renters who applied for RAFT in the sample subsequently left owing their landlords money, it is probably wise to navigate eviction and negative credit reporting in parallel to the long RAFT application process. If the renter can pay on their own, this will create the right incentives for that to happen. Absent court or credit reporting, RAFT may spell doom.

Contribute to this Research

Landlords with detailed account ledgers can email a spreadsheet to us at hello@masslandlords.net. We will use this information to contribute to future work.

The spreadsheet ledger should have columns for "date, debit or credit, and balance owed." For instance, if rent of $1,000 is due on the first, and on this date their balance goes to $2,000, we should see a row as follows: "5/1/2024,1000, 2000". If the renter pays on the second, we should see that as well: "5/2/2024, -500, 1500." Additional notes:

- Debits and credits on the same date may appear in any order in the table.

- Debits and credits may appear in two separate columns without a minus sign. For example, the header row could be "date, debit, credit, balance" and the rows could be "5/1/2024, 1000, , 2000" and "5/2/2024, , 500, 1500".

- Each ledger must be on a different worksheet.

- The property address must be visible in the worksheet title or elsewhere in the sheet for deduplication and verification purposes.

- If participating, do not cherry pick: Include one full payment ledger for each renter who ever received RAFT. Five renters received RAFT? We need all five ledgers.

- If you want a spreadsheet template to fill in, email us.

Our ability to conduct statistical analyses depends on sample size. The RentHelper dataset contains approximately 1,000 rental agreements of which 23 received RAFT. With an additional 40 full RAFT histories we could start to make statements with 95% confidence and also estimate frequency across the entire population of all ~100,000 RAFT awards.

We can incorporate your payment histories into our study