National Flood Insurance Program to Expire March 8 at Midnight

By Kimberly Rau, MassLandlords, Inc.

Congress has until midnight on March 8, 2024, to vote to extend the National Flood Insurance Program (NFIP). If it fails to reauthorize the program, the NFIP will lose authority to sell flood insurance, and will be unable to renew existing policies.

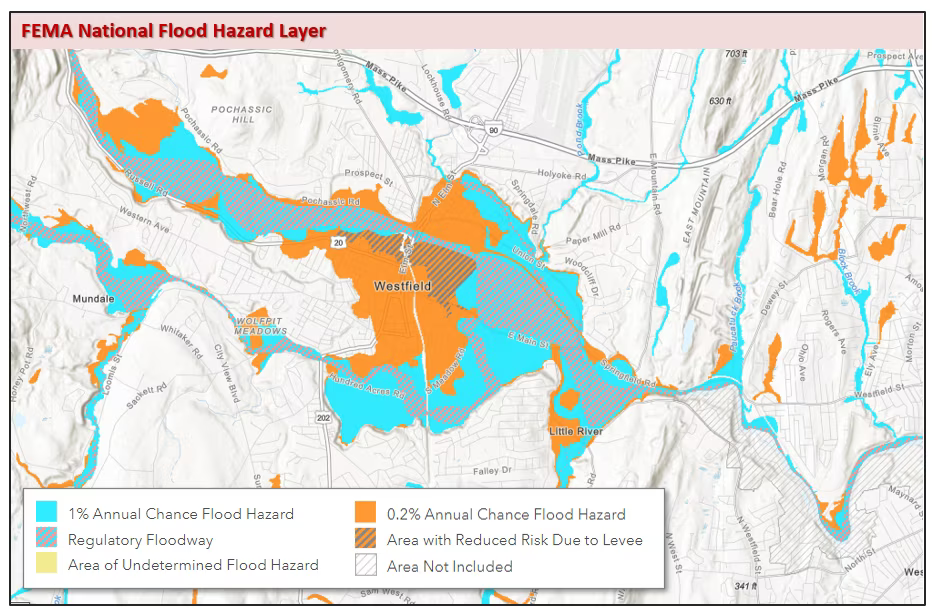

Areas located in high flood risk zones may go uninsured if the NFIP is not reauthorized by Congress. [Source: https://www.mass.gov/info-details/massgis-data-fema-national-flood-hazard-layer]

What is the National Flood Insurance Program?

Congress created the NFIP in 1968. Its purpose is to offer flood insurance coverage to property owners, renters and businesses. Insurance may cover buildings, contents or both. The program is administered by the Federal Emergency Management Agency (FEMA).

Flood insurance may be obtained through various participating insurance companies as well as directly through the NFIP.

Additionally, the NFIP works with communities that need floodplain management regulations to help reduce effects from flooding.

Occasionally, Congress must reauthorize the NFIP. The last multi-year reauthorization expired in 2017. Since then, there have been 27 short-term reauthorizations and several brief lapses in the program. One lapse went from Jan. 20 – 22 in 2018; this was followed by an 8-hour lapse on Feb. 9, 2018.

In April 2023, the Department of Homeland Security submitted 17 legislative proposals in a package that would reform the NFIP and create another multi-year extension. According to published talking points, the proposals address expanding the program and making it more accessible to low- and moderate-income policy holders. The proposals reportedly also promote working toward building climate resilience, reducing loss and creating a financial framework to ensure the long-term success of the NFIP.

As of this article’s initial publication, these proposals have not been adopted. Another bill was sponsored by Sen. John Kennedy (R-La.) that would have extended the program through 2024. That bill was blocked by the Senate in September 2023. On Jan. 19, 2024, President Joe Biden signed legislation to extend the NFIP’s authorization through midnight on March 8, 2024.

What Will Happen if the NFIP is Not Renewed?

If Congress does not renew the National Flood Insurance Plan, the program will lose the authority to sell any new flood insurance policies. Existing policies will remain in place through their renewal date, at which point, the NFIP will not be able to renew them.

The Flood Disaster Protection Act of 1973 states that lenders may not create or renew federally backed mortgages for properties in special flood hazard areas without flood insurance. This could block thousands of real estate purchases until the NFIP is reauthorized. One estimate from the National Association of Realtors suggests it could threaten 1,300 property sales per day.

Further, the NFIP can only process and pay claims for existing policies from its available funds. Once that money is gone, they will not be able to borrow additional funds from the U.S. Treasury to pay claims on existing policies.

Conclusion

It would be surprising if Congress did not authorize another extension (at least short-term) of the NFIP. However, it’s clear that these reauthorizations are stopgap measures that put millions of properties in jeopardy every time they are set to expire.

We hope that a solution leading to a long-term reauthorization will be approved. However, we urge you to consider your current and future real estate investments carefully. Even if the NFIP is reauthorized for another few decades, insurance costs are only going to keep rising, especially if we do not get a handle on climate change soon.

If you’re thinking of one day selling an asset located in a high flood risk area, remember that such properties often trade at a discount. It may make sense to speak to your financial advisor about the most prudent time to sell. If you are considering adding to your real estate portfolio, we urge you to investigate the projected effects of climate change for the properties you’re considering. If the housing you have your eye on isn’t in a flood zone yet, but has a high risk of flooding in the next 10 years, you may want to look elsewhere.