How the 1031 Exchange Can Turn Deferred Tax into a Real Estate Empire

| . Posted in advice, Did you know?, News - 7 Comments

An IRS regulation called “Section 1031” (formally, “26 U. S. Code Section 1031: Exchange of property held for productive use or investment”) allows owners to sell one property to buy another property tax-free. Technically, the taxes avoided are capital gains and recapture tax. This “1031 exchange” was passed into law in 1921 and remains one of the oldest regulations on the books.

That same sale replaced with a 1031 exchange.

History and Purpose of the 1031 Exchange

In 1921 it was clear to the 67th Congress that the tax code imposed unfair taxes on investors. If you sold one property and immediately put all the money into another property, you’d have to pay tax on the sale. Really, if you never saw the money yourself, buying the next property ought to be like a deductible business expense. There was no distribution.

So Congress created the “1031 exchange.” There were three purposes at that time. First, they wanted to avoid unfair taxes: if you never touched the money, you shouldn’t pay tax on it. Second, they wanted to encourage active investment and re-investment. Third, they wanted to provide a safe harbor for properties that were impossible to value fairly.

In 1924, Congress changed its mind on properties that were hard to value and said, “Too bad, come up with a value.” So they repealed the part about “no market value.” But the essence of the 1031 exchange remained in full effect.

In 1979, the section 1031 exchange was greatly expanded by a court ruling in Starker v United States.

Investor T. J. Starker and his family owned timberland that Crown Zellerbach Corporation wanted immediately. Starker signed a written agreement to deed that timberland over to Crown immediately, on the condition that Crown would purchase and deed over replacement properties chosen at Starker’s discretion some point in the future. The agreement was carried out on both sides.

Starker claimed exemption from tax on his return, on the basis that he had exchanged properties under Section 1031 by using a binding agreement to purchase. The IRS sued and lost. This set in motion a series of new regulations that established the so-called “Starker exchange,” which now comprises nearly all 1031 exchanges.

Under a modern 1031 exchange, an investor has a certain timeframe in which to close on their new properties and still claim exemption under Section 1031.

Example 1031 Exchange

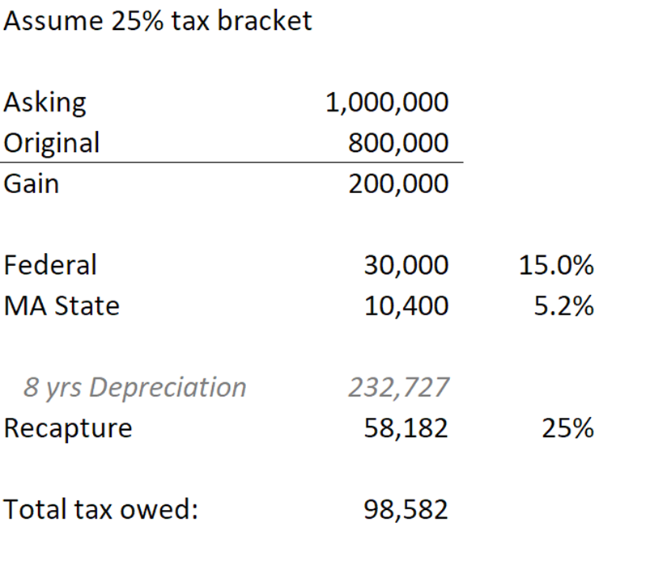

Imagine you invested in a three-decker in Cambridge for $800,000 (pricey neighborhood!) in 2010. You want to sell it today for $1 million. You would owe capital gains on $200,000. The federal rate is zero to 20%, depending on your tax bracket. Let’s call it 15%. The Massachusetts state rate is 5.2%. If you depreciated your property all these years, which you ought to have, you would also owe recapture tax equal to approximately $60,000. In total, you would owe $98,582 in tax on sale.

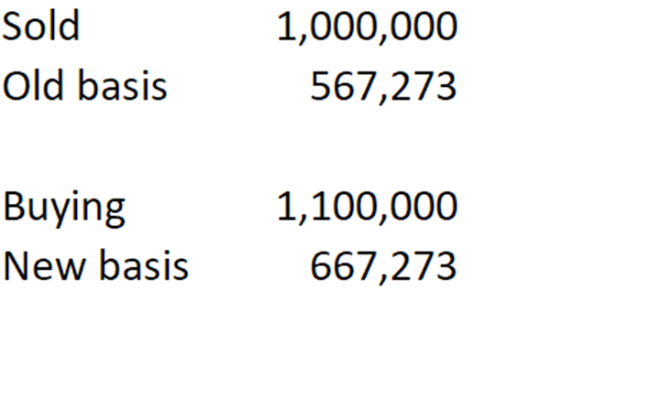

If on the other hand Section 1031 is used to transfer that investment into a new property of like kind, the old tax basis carries forward to the new property. The basis increases by the amount that the new property is more expensive than the old. The IRS will be made whole when you sell the new building, since your basis is lower than it ought to be and you will pay more tax then. But for now, all tax has been deferred.

This process can be repeated indefinitely, climbing up the ladder of property value to the sky, until either you or your company closes its doors for the last time.

1031 Requires “Like Kind”

If you sell “A”, you must buy “A”. Real property can be sold and exchange for more real property. Business vehicles can be exchanged for business vehicles. Cattle can be exchanged for cattle.

Under regulations as of 2017 December 16, cattle were exchangeable but not between sexes. For instance, a male cow (a “bull”) was considered not to be like kind with a female cow (a “cow”). Also, only business property is exchangeable. For instance, you cannot exchange your home or that portion of it occupied by you. And exchanges crossing the US national boundary are not considered “like kind.” You cannot sell a rental in the US for a rental in France.

Since all real estate is like kind with itself, many possibilities exist for an investor. You can exchange the rented portion of an owner-occupied three-decker for another three-decker. You can convert a primary residence or a second home into a rental for a period of years, and then exchange that into another rental. You can exchange a residential property for a commercial property. You can exchange a three-decker for ten units. You can exchange ten units for four three-deckers. You can exchange ten units for a vacant lot. You can even exchange 200 units across 70 properties for a passive replacement property, like a REIT.

Passive replacement property includes tenants-in-common, Delaware statutory trusts, and UPREIT’s. These require expert assistance. The key point is, you can “sell up” and “sell out” of being a day-to-day landlord and still defer your capital gains and recapture taxes indefinitely.

Example figures for a normal, taxable sale.

How to Complete a Section 1031 Exchange

The first step is preparation. Know which tax ID holds your property. Is it you personally? Is it your LLC?

Then decide whether you are going to trade up in equity and value, in which case you will pay no tax. Or choose to take cash out, in which case you will have to pay some recapture and capital gains tax.

Finally, decide whether you want to go forward, in reverse, or build-to-suit. You can sell your old building first, then buy the new one (a forward exchange). You can buy the new building first, then sell the old one (a reverse exchange). Or you can sell your old building in exchange for binding contracts to build an entirely new property (talk to an expert).

The Section 1031 Exchange Process

Let’s look at a typical “forward exchange, trade up” as an example.

First, you need to hire an enrolled agent, tax attorney, or certified public accountant to act as your Qualified Intermediary (QI). You will enter a written exchange agreement with the QI. Then you will sign an agreement to sell your property with a cooperation clause naming the QI as the recipient of the funds. The QI will attend the closing and take all your money from the sale.

You will then notify the QI of the intended new purchase. You cannot be vague. A precise address and legal description is required.

Once identified, you will purchase the replacement property with a cooperation clause. The QI will close on that property for you and pay for that purchase with funds from your sale and other funds you may provide.

Finally, you will file form 8824 showing that you never received a cent in this process.

There are very strict deadlines in the 1031 exchange process. For this forward exchange, “Day Zero” is when the deed is recorded on your sale. “Day 45” is then the last day to notify the QI of the new property. Day 180 is the last day to close the purchase of the new property.

If the deadline lands on a weekend or holiday, you must comply with requirements by the preceding weekday. It is not like tax returns, where you get until the following weekday. The only exception is if the president declares a disaster. If the exchange crosses a calendar year, you have until 180 days or your tax filing deadline, whichever is earlier.

Common 1031 Exchange Pitfalls

If you do not meet any deadline, you will owe all the tax on the sale, no appeal possible.

If you have inconsistent tax ID’s on the sale and purchase, for instance, you owned the old property but the LLC you wholly own is buying the new property, you will owe tax.

If you can’t find a suitable property in the timeframe allowed, there are no extensions. You will owe tax.

If you change your mind about making the exchange, you will owe tax.

The only leeway arises during what’s called an “involuntary exchange,” when your property is destroyed and you exchange the residual value for a property in good repair. Here all timelines are relaxed.

Note also that any cash received from any closing will be taxable. For instance, if you have utility escrows, closings costs, monies related to tenants, or excess borrowing/excess mortgage, you will have to pay tax. You should therefore always bring cash to the closing.

Flexibility around the 45 Day Rule

By Day 45 in a forward exchange, you must identify the new property. There is some wiggle room here. You must satisfy one of the following:

First, you could satisfy the three-property rule: name any three properties regardless of value, close on one or more of them. Second, you could satisfy the 200% rule: name as many properties as you like up to 200% of the fair market value of the sold property. Third, you could satisfy the 95% rule: name as many properties as you like -- as much total value as you like -- so long as you close on 95% of what you identified.

Section 1031 Exchange Summary

IRS rules give us permission to sell our property and not pay capital gains or recapture taxes. This is a great incentive for us to reinvest rather than sell out. You can trade up, trade down and take cash out, or trade sideways to move locations. To get the maximum tax savings, you must trade up. Using a qualified intermediary creates a safe harbor and allows you to perform a Section 1031 exchange with the least risk of messing it up. For more information, read the Wikipedia page.

This article has endeavored to provide accurate information but cannot provide advice particular to your situation. Always contact a qualified intermediary, CPA, or tax attorney before making any investment decisions.