Seniors: How to Spot a Covid-19 Scam

| . Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

With a global pandemic forcing everyone indoors and essentially eliminating in-person social contact, senior citizens are in need of connection and information more than ever. Unfortunately, scammers are well aware of this, and are taking advantage of these vulnerabilities to try and cash in.

Don’t be caught off guard by scammers cashing in on the coronavirus.

The FTC has published a page that highlights some of the biggest scams going around right now. These include undelivered goods, fake charities and phony emails or texts. Phone scammers have started focusing on coronavirus-related schemes and social media is rife with misinformation and rumors. This can spell trouble for those of us who may be technologically challenged or overwhelmed by the state of the world right now.

First and foremost, a couple of points that will help you see through any scam:

- If it sounds too good to be true, it probably is, and

- Anyone who is asking you to pay by wire transfer or gift card is almost certainly scamming you. If they won’t take a secure method of payment (credit card), move on.

Here are some of the biggest scams going around right now, and how to avoid getting taken in. Most of them are variations on the social security or gift card scams that have been going around for years, and some are specific to the pandemic itself.

Undelivered Goods

Supply chain disruptions, combined with fear, have made certain products hard to find on supermarket shelves or online. Finding toilet paper in stock is something of a game at this point, and good luck locating the masks the CDC is now suggesting everyone wear. It can be hard to even find fabric to make your own.

Enter the scammers, who create fake websites and use them to offer in-demand products. Even two months ago, ordering from an unknown company might have been unthinkable, but now, people are getting desperate. Any site that offers hot commodities is a godsend. The customer places an order. Unfortunately, the site isn’t real and the products aren’t actually available. The scammers take off with the money, and the product never ships. If the customer paid by wire transfer or gift card, their money is as good as gone. Even if they used a site like PayPal or a credit card, there’s still the potential to lose big. With many products on backorder and long shipping times becoming increasingly frequent, by the time it becomes clear the product is never coming, consumers may be past the window to file a claim with their banking institution.

Purchasing online can be safe if you know which sites and payment methods are reputable. Consumers should play it smart by researching non-familiar companies before ordering. The FTC suggests searching for the company name along with the terms “scam” or “fraud” and seeing if anything comes up. If the site is legitimate but the pricing seems unfair, contact your state Attorney General. For Massachusetts, you can find that information here. As always, pay via credit card, not cash apps, wire transfers, or gift card.

Fake Charities

In times of crisis, people often feel compelled to help those who have the least. There are lots of great ways to do that. However, con artists are also setting up fake charities or fund raisers where the only person benefiting is scammer. Not only do people stand to lose money, but those who need help don’t get it. And money spent on fake charities means fewer donations going to legitimate groups.

The solution here is, again, to do your research. The FTC has a page outlining how to do that. If a group checks out, consumers should use a credit card to donate, which may offer some degree of fraud protection. Donations should never be made by wire transfer or by purchasing gift cards. Run any donations by a trusted family member or friend before donating. Remember: There’s no deadline to give. A legitimate charity will still be there tomorrow, and will be happy to receive a donation.

Email, Text and Phone Scams

There are lots of ways scammers can hurt innocent people through email, texts or phone calls. They may send you an official-looking email with a link to download coronavirus safety tips. This may install a virus or other malware on your computer, or allow scammers to steal personal information by accessing your computer. Do not click on any unfamiliar links. Hover over the “from” email address to see what the actual email address is (scammers can disguise their email name in order to appear more official, but actually hovering over it will reveal the actual address).

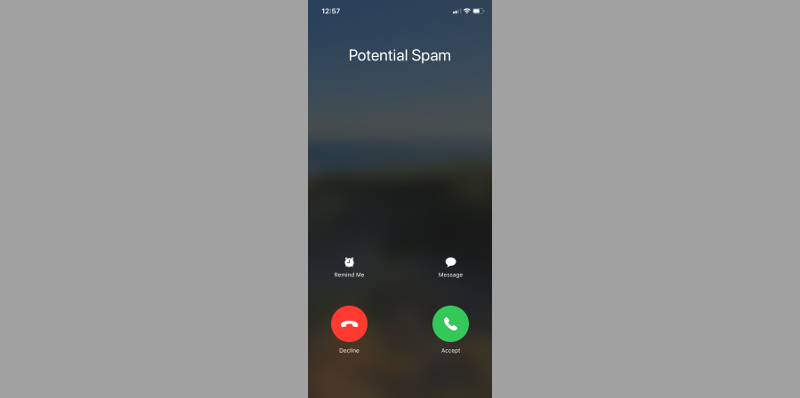

If you get a phone call that sounds strange (especially if it’s a robocall), the FTC recommends you just hang up. Do not press any numbers or engage with any people who may pick up. Doing so tells scammers they have a live line and will continue harassing you. As a reminder, the IRS will never phone you out of the blue, and banks will never ask you for your social security or debit card numbers over the phone. Anyone who has a legitimate need to speak to you can call you directly or reach out by some other means.

Another best practice is to check your banking institution’s web site, where you may be able to find updates on common scams and tips to avoid them. Bank of America recommends looking for the red flags (many mentioned in this article), not trusting caller ID (scammers can use technology to make it look like they are calling from anywhere) and never cashing checks from strangers or sending back money for “overpayment.” That’s a common scam where a person says they want to buy something, then sends a check for too much money. They commonly ask the seller to send back some of the overpayment, and keep a little extra “for their trouble.” The seller does so, the check bounces, and the seller is on the hook with the bank for the money.

If the caller is asking you for personal information to “confirm” something (such as where to send stimulus payments), do not provide the information. If you have any doubt as to whether this may be a legitimate call, check this site first. Any information you may need on stimulus checks, donating to charity or coronavirus prevention can be found there. The IRS does not need to call you to send you a stimulus check, and will not ask you for personal information over the phone.

Need more resources? The AARP has assembled a page listing common scams and fraud as well. You can check it out here.