Qualified Opportunity Zones offer Tax-Free Gains

The Tax Cut and Jobs Act of 2017 (aka “Trump Taxes”) allowed states to designate up to 25% of low-income census tracks as “opportunity zones.” Investments made in these zones and held for ten years are excluded from capital gains taxes. Investments sold to invest in these zones will have deferred or forgiven capital gains taxes. There is no minimum investment or business size required to qualify.

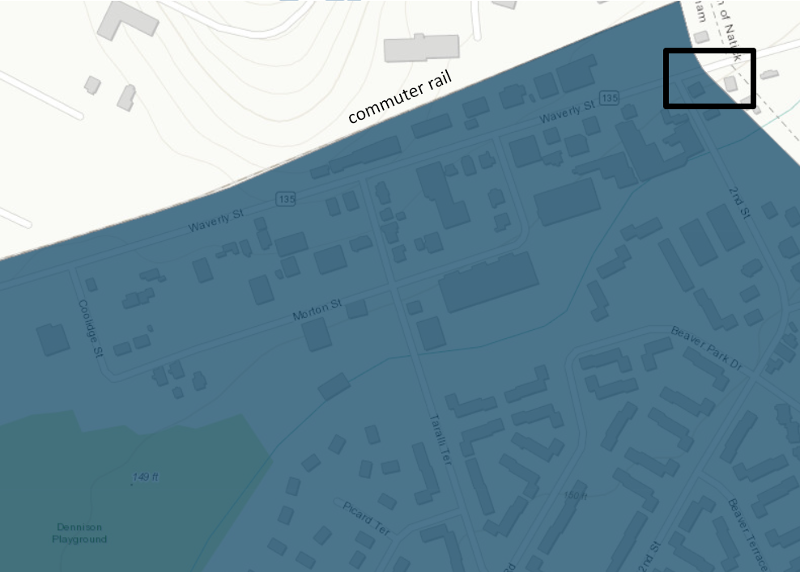

The Natick-Framingham town line (inset of map) illustrates the arbitrary nature of the zones. Between two adjoining lots, only one is eligible for preferred tax treatment.

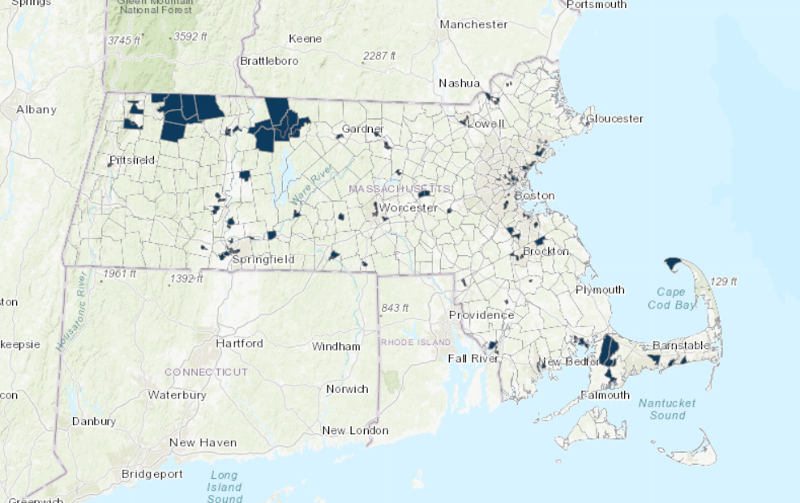

In Massachusetts, all regions include designated opportunity zones, with the exception of Berkshire south county, Greater Milford into Whitinsville, South Shore/Plymouth, and the islands. Large tracts of Berkshire North County and Franklin County are designated as opportunity zones, as well as some surprising areas like Provincetown and a variety of neighborhoods inside the 128 beltway.

Opportunity zones are demarcated by streets, railroads, town lines, and zip codes. A lot on one side of a town line may be a qualified opportunity zone, but the adjacent lot on the other side of the town line might not. It is important to use the map to know precisely which lots are opportunity zones.

Qualified Opportunity Zones are defined down to the road, rail, town line, and zip code. Inset is of Natick-Framingham town line. This graphic comes from a networking and training presentation.

Step One: Create the Opportunity Fund

Opportunity zones are developed via an opportunity fund, which anyone can create (landlords included). To create the fund, you need to allocate cash or sell an investment (and realize any capital gain).

Within 180 days of selling the investment, if applicable, you will create a new legal entity specifically designated as your opportunity fund. It can be a real estate investment trust (REIT), partnership, corporation, LLC, S-corporation, estate, or other trust.

Opportunity Seed vs the Opportunity Fund

We will introduce two terms that are not used in the Tax Cut and Jobs Act, but which are helpful to explain how it works. The “seed” is the amount of money you are collecting to create the fund. The “fund” is the thing you are investing in or building.

For instance, if you sell an old building to create an opportunity fund and invest in a new building, the old building will be the “seed” and the new building will be the “fund.”

Under Section 1400Z-2(a)(1)(A) of the Tax Cut and Jobs Act, sale of the seed makes you eligible for deferred or forgiven capital gains on that investment. Provided you comply with the terms of the Act, capital gains on the seed will be deferred until 2026 or until the fund assets are sold. For instance, if your old building was purchased in 2009 for $100,000, and at time of sale it is worth $200,000, your $100,000 capital gain will not appear on your tax return until 2026, or whenever your new investment is eventually sold.

In addition to the deferred capital gain treatment, if you invest the seed by the end of 2019, and hold your fund investment for at least seven years, 15% of your capital gains will be forgiven entirely. If you invest the seed by the end of 2021, and hold your fund investment for at least five years, 10% of capital gains will be forgiven. The intent is to encourage rapid investment and economic growth.

Defining the Opportunity Zone Fund

Once you create the fund entity (see above), you have thirty (30) months to invest the seed money. You must either double the non-land taxable basis of a piece of real estate, or double the business assets employed within an opportunity zone.

For example, imagine you buy a piece of rural real estate worth $150,000, on which is a $50,000 building. Over the next two years you invest $50,000 in renovations or new structures. You will have doubled the non-land basis within the time required, and that property will now qualify. Hold the real estate for ten years and you won’t pay any capital gains on it. Your seed will also receive the deferred or forgiven treatment described above.

Or to consider a business example, imagine you invest in a startup headquartered in and operating out of an opportunity zone. The business may have a $1,000 laptop when you invest. You buy it a second laptop, which doubles the business assets in use. However large that business later becomes, your investment in it will have qualified, and you will not pay capital gains on it when you sell your stock.

In addition to saving on the capital gains, you will also save from the time value of money on the seed, for which your capital gains were deferred.

Qualified Opportunity Zones in MA cover most regions, with a few exceptions.

Qualified Opportunity Zone Caveats and Deadlines

You will need to talk to an accountant or tax attorney familiar with opportunity zones to be sure that your seed and entity are properly designated for the opportunity fund.

For the seed, you must invest before 2019 to have 15% of seed gains forgiven. You must invest before 2021 to have 10% of seed gains forgiven.

For the fund, you must invest within ten years after the zones are defined to have 100% of fund gains forgiven. In the case of Massachusetts, this means you have until March 2028 to invest.

You have to hold your investment for ten years from the date of investment. If you don’t invest until February 2028, you will need to hold until February 2038.

You have to double the taxable basis of the property or business you purchase (excluding the value of the land). In some zones, it will be difficult to double the non-land basis of a property, given zoning constraints and the high value of Massachusetts real estate. Invest carefully having run your numbers and checked your zoning in advance.

Qualified Opportunity Zone Conclusion

Qualified opportunity zones are a major opportunity, especially for rural landlords, turnaround experts, developers, and startup investors. Remember to explore this option during your next search for investment or before your next acquisition.

The public are invited to participate in our networking and training events to make connections