Forcing Tenants to Pay Brokers’ Fees is Already Illegal, No New Legislation Needed

| . Posted in News - 0 Comments

By Eric Weld, MassLandlords, Inc.

The so-called “broker fee ban” passed into law July 4, 2025.

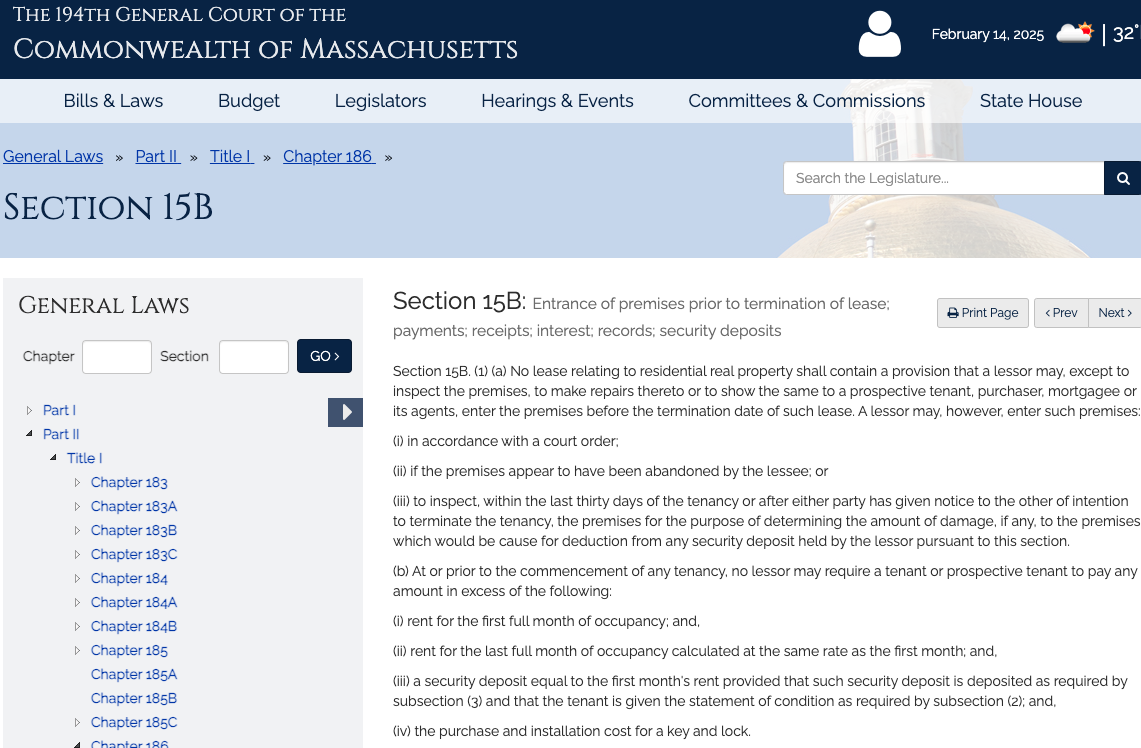

It is illegal in Massachusetts for a landlord to require a new tenant to pay a real estate broker’s fee as a condition of moving in, according to MGL Ch. 186 s. 15B. The law states it clearly: No amount may be collected pre-tenancy beyond first and last month’s rent, security deposit and money to change locks.

MGL Ch. 186 s. 15B(1)(b) clearly enumerates the four fees allowed to be collected prior to tenancy, none of which includes a broker’s fee. Recent court cases have further defined the illegality of landlords requiring new tenants to pay the fee for a broker that the landlord hired. Image: Mass.gov.

Still, the topic of real estate brokers’ fees and who should pay them has picked up a lot of steam in recent months. The governor, legislators and city councilors have all publicly discussed introducing or supporting new legislation that would require the person who hires a broker to pay the fee. A series of media content has swirled around the topic. Making matters worse, Gov. Maura Healey has said she would like to see brokers’ fees abolished. Other legislators have suggested shifting brokers’ fees from tenants to landlords when they hire their services.

Real estate brokers provide valuable services for landlords and tenants, and deserve to be paid for that, the same as plumbers, builders, housing providers and other contractors who exchange service for payment. Brokers’ right to charge for their services is codified in state law.

What has politicians eyeing new laws is the illegal practice of landlords hiring brokers, then requiring their tenants to pay for the service.

But new legislation is totally unnecessary. It’s also a waste of resources and legislative bandwidth.

Here's the exact wording of Ch. 186 s. 15B(1)(b):

(b) At or prior to the commencement of any tenancy, no lessor may require a tenant or prospective tenant to pay any amount in excess of the following:

(i) rent for the first full month of occupancy; and,

(ii) rent for the last full month of occupancy calculated at the same rate as the first month; and,

(iii) a security deposit equal to the first month's rent provided that such security deposit is deposited as required by subsection (3) and that the tenant is given the statement of condition as required by subsection (2); and,

(iv) the purchase and installation cost for a key and lock.

Real Estate Brokers Must Contract with Tenants

Further framing the law is 254 CMR 7.00, the regulation governing real estate brokers’ business with tenants.

The regulation mandates that brokers contract with their tenant customers through several steps: 1) brokers must disclose written notice up front to prospective tenants if they will charge a fee, how much the fee will be, and the manner and time in which the fee will be paid; 2) this notice must be given to the prospective tenant at the first meeting between broker and tenant, and signed and dated by both parties; and 3) brokers may not charge any fee to a prospective tenant unless a tenancy is created (or if a prospective tenant agreed to pay a fee even if a tenancy was not created).

The question that repeatedly ends up in court and media, and has legislators considering unnecessary new laws, is whether a landlord can collect a fee on behalf of brokers for their services. Ch. 186 s. 15B says no, landlords cannot legally do so. And 254 CMR 7.00 requires a signed contract between brokers and tenants.

Nowhere within these two laws is there a loophole that makes it legal for a landlord to hire a real estate broker, and then charge their new tenant for the service.

Real estate brokers provide valuable services, such as finding well-matched apartments for tenants, screening applicants for landlords, processing applications and fees, and advising on move-in processes. Brokers deserve to be paid for their service, but according to existing statute, must be paid by the party that hires them. Cc by-sa Malcolm Lawson, Flickr

Not Legal, But Tolerated

Over time the practice of landlords forcing new tenants to pay brokers’ fees – even if the landlord hired the broker – has become commonplace, especially in Boston. The fee often equals one month’s rent, but the amount seems arbitrary and decided by landlords and brokers. There seems to be scant regulation on how and how much a landlord can charge a tenant for brokers’ services and how it should be paid. Is it a profit scheme, or does the amount paid by tenants fully cover the broker’s tab?

This situation is the result of two circumstances: 1) the rental housing market has become so tight, with so few vacancies, that many rental owners feel empowered to force conditions on their tenants, such as illegally requiring payment to a broker that the landlord hired; and 2) this practice has grown slowly over several decades, and while not legal, has become accepted and has not been properly enforced.

Somehow, certain media coverage has come to a consensus that this practice is a legal workaround of the law: It may go against the “spirit” of Ch. 186 s.15B if not the “letter” of the law, the narrative goes.

This is incorrect. Requiring a new tenant to pay a broker’s fee as a condition of moving in is a violation of the letter of the law.

Some recent media accounts also use the phrase “eliminating renter-paid brokers’ fees,” another inaccuracy. What is being proposed and supported by the governor is legislation that requires whoever hires a broker to pay the fee. Renters sometimes hire brokers, too, to help them find rental housing. No one is arguing that a landlord should pay a broker when a renter hires them. Brokers should be paid for their services, including finding and screening tenants, or finding ideal rentals for people seeking housing.

We agree with the premise: If a landlord hires a broker, the landlord should pay the broker’s fee. Same with a renter. This doesn’t require a new law, only enforcement of existing laws.

No Strict Precedent

Part of the confusion around this section of Ch. 186 may be the lack of strong legal court precedents that specify the illegality of requiring new tenants to pay a broker’s fee.

However, there are three cases that together underscore the illegality of requiring move-in fees in excess of the four stated in the law.

Hermida v. Archstone

A 2011 case in U.S. District Court, D. Mass., Hermida v. Archstone established that an amenity fee required to be paid by the plaintiffs as a condition of moving into a rental owned by Archstone Reading violated Ch. 186 s. 15B.

The plaintiffs, the Hermidas, sued their landlords on the grounds that they were unlawfully charged a $475 “amenity use fee” as a lease condition for use of the property’s swimming pool, gym and outdoor grill.

District Judge William G. Young concluded that the language of “section 15B is unambiguous,” and prohibits a landlord from requiring a tenant at the beginning of tenancy to “pay any amount in excess of” the four fees outlined. Judgment for the plaintiffs.

Perry V. Equity Residential Management LLC

More pertinently, the 2014 case Perry v. Equity Residential Management LLC (ERM) invalidated the defendants’ practice of charging any fees beyond those listed in Ch. 186 s. 15B – in this case, application fees, amenity fees, community fees and pet fees – as move-in conditions.

“The statute is a list,” noted District Judge Rya Zobel in the Perry v. ERM decision. “If a fee is on the list then it is a permissible up-front charge; if it is not on the list, then it is impermissible.”

The defendants, ERM, argued that the language in Ch. 186 s. 15B is ambiguous, and therefore does not specifically disallow requiring nonrefundable fees as a move-in condition.

Zobel refuted this contention. “I am not the first to consider this matter,” she wrote. “Two of my colleagues have held that the language of section 15B(1)(b) is unambiguous,” referring to two cases, Hermida v. Archstone and Gardner v. Simpson Fin. Ltd. Partnership.

Woo v. Valentin

More recently and specifically, in a 2022 case in housing court’s western division, Woo v. Valentin, presiding Justice Jonathan Kane determined that Woo, a landlord and plaintiff in the case, violated Ch. 186 s.15B when they required Valentin, a new tenant, to pay an $850 “rental agency fee” (aka broker’s fee) as a condition to rent property.

Further defining the argument, Kane notes that real estate brokers are certainly allowed to charge fees to tenants for housing search and other services. That right is detailed in 254 CMR 7.00.

The law “does not prohibit a real estate broker from charging tenants a fee for services rendered,” writes Kane in his decision, “however, the regulations clearly imply that the prospective tenants will work directly with the broker and be presented with certain disclosures to sign…Instead, the lease executed by the parties [in this case] explicitly requires Defendants to pay a broker’s fee as part of the consideration for rental of the Property. Based on these facts, the Court concludes that the mandatory broker’s fee charged by the landlord is a violation of G.L. c.186, s. 15B(1)(b).”

Because all these cases were tried in lower courts (i.e., not superior court), they do not establish legal precedents, and only stand as persuasive decisions, or suggested rulings for future justices to follow, or not.

The matter of landlords charging brokers’ fee payments may still be ripe for further litigation. If a penalty, such as treble damages plus court costs and attorney fees, were applied to violators of Ch. 186 s.15B when they lose in court, it would likely motivate some landlords to stop doing so. This penalty is available to judges under existing statute.

New Law Not Needed

Much of the recent hoopla in Massachusetts to write new laws regarding brokers’ fees may have been triggered by the New York City Council’s December 2024 passage of the FARE Act. The Fairness in Apartment Rental Expenses (FARE) Act mainly prohibits landlords from charging prospective or new tenants fees to pay brokers that the landlord hired. The law generated a lot of media attention.

Included in the attention – accurate or not – are several dubious claims that Boston, out of 336 U.S. cities with at least 100,000 people, is now the only remaining major city still allowing landlords to require tenants to pay brokers’ fees.

Gov. Healey has since announced that her FY 2026 budget will include a section eliminating “renter-paid broker fees” (except, we presume, when renters hire brokers to find them an apartment).

Without enforcement like applying court penalties, a new law or budget provision that only reinforces existing laws will be ineffectual. To the extent that new legislation is effective, some landlords will absorb brokers’ fees, but adjust rent upward to compensate for the payment. If the intent of the law would be to lower rental prices, as is claimed with New York City’s FARE Act, it will fail.

Creating a new, superfluous law mandating landlords to pay their own brokers’ fees won’t lower housing prices, and could cause them to increase. Worse, it could deter property owners from creating new rental housing, constricting stock and pushing prices up further. If the worst-case scenario happens and broker fees are banned outright, then brokerages would be banned and many renters, especially international students and low-income renters, will be left without help.

As ever, the pathways to bring housing and rent prices down remain a product of supply and demand. When housing supply meets demand, prices will come down as the market balances. Toward that end, new laws should incentivize new rental housing, not discourage it.