BlueHub Legislation Fails; Lawsuit Against Nonprofit Moves Forward

| . Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

Read the most recent article here.

As a lawsuit heats up against Roxbury nonprofit BlueHub Capital, a bill that could have protected such groups from litigation seems to have failed at the end of the most recent legislative session. Was BlueHub helping the community, or preying on homeowners during a time of need?

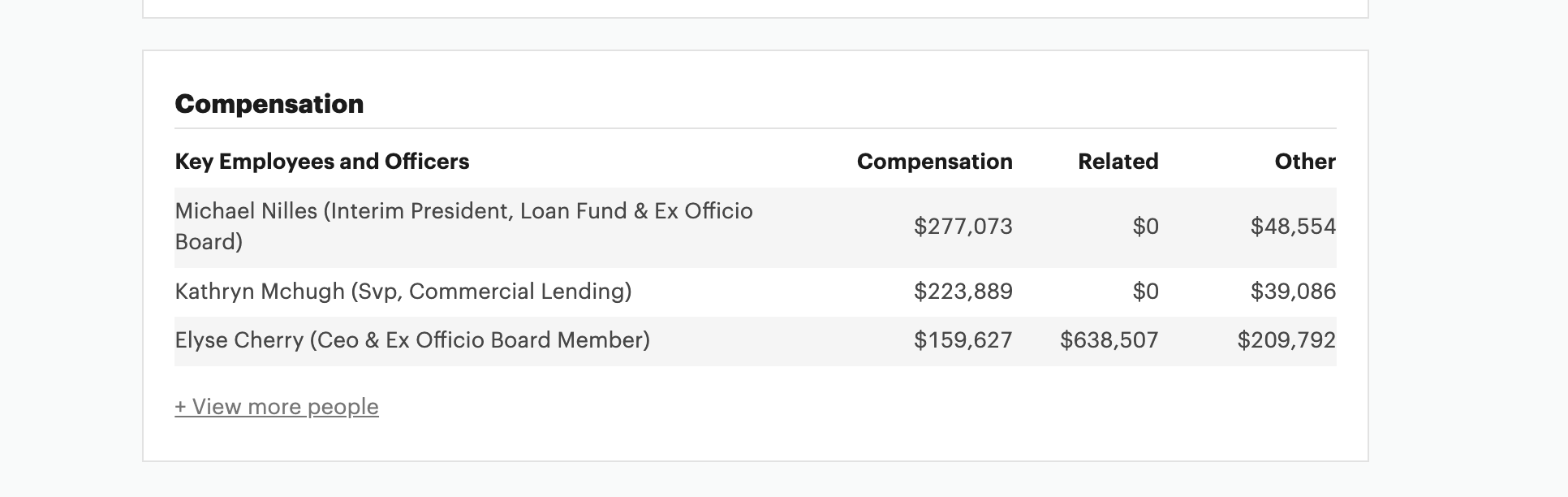

BlueHub Capital is a nonprofit whose CEO, Elyse Cherry, received nearly $800,000 in compensation and “related” earnings in 2022. That’s not including the “Other” category. (Image: ProPublica)

BlueHub: A Nonprofit That Makes Bank

BlueHub Capital, formerly Boston Community Capital, is a nonprofit that offers to help people on the brink of foreclosure save their homes by buying the at-risk properties and then selling them back to the homeowners with new mortgages that are more affordable. The mortgage lending portion of the company is called BlueHub SUN.

With that new mortgage comes a “shared appreciation mortgage” (SAM) that entitles the company to a portion of the accrued equity when the homeowner sells their home or refinances with another lender. This equity, the company states, allows the nonprofit to continue to invest in the community by helping other homeowners.

It’s a lucrative business. BlueHub began offering SAMs in 2010, after the 2008 housing market crash. As the housing market recovered, home values rose, and some recipients of BlueHub SUN mortgages found themselves owing tens of thousands of dollars or more in equity to the lender before they could sell or refinance.

The 2022 reported revenue for BlueHub Capital was more than $22 million. That year, CEO Elyse Cherry earned a salary of nearly $800,000.

Lawsuit Alleges Homeowners Not Informed of Shared Appreciation Mortgage

In 2020, a group of BlueHub borrowers filed a class action lawsuit against the lender. Plaintiffs allege that the ramifications of a SAM were not explained to them when they entered into a new mortgage with BlueHub, and that the lender engaged in predatory lending practices that have made individuals unable to build generational wealth.

The SAM must be paid off before the home can be refinanced with another lender or sold, often requiring the homeowners to lose a large chunk of their equity. It also blocks borrowers from accessing home equity lines of credit. In some cases, the SAM can take more than 40% of the borrower’s equity, depending on how long the mortgage remains with BlueHub and how much the property has appreciated in value.

Attorneys for the plaintiffs allege BlueHub’s disclosure practices are opaque and that the company is not clear at closing about how much money the homeowners will owe through the SAM. They also claim that because BlueHub promises no “balloon payments” on mortgages and no negative amortization on the loan, they are misrepresenting their product.

Sara Jane Shanahan, an attorney for BlueHub, stated to GBH News that she is “confident that the program has been very beneficial to people and that all the disclosures were made in accordance with the law.”

When asked whether closing documents BlueHub borrowers sign show the percentage of their equity that must be shared with BlueHub, Shanahan said they do not. She said that’s because there are a number of hypothetical situations that could change how much is ultimately owed. She stated that borrowers are given formulas to calculate potential appreciation and sharing scenarios.

BlueHub alleges that without their help, the homeowners, many of whom likely would not have qualified for refinancing from other lenders, would have lost their houses entirely.

“SUN offers clients a second chance to regain their financial footing and save their homes for good,” the BlueHub website states. “But that second chance isn’t free.”

BlueHub has requested a summary judgment against the plaintiffs, but if that is not granted, the case will move to a jury trial.

BlueHub Website Disclosures Not Historically Clear

Today, the phrase “shared appreciation mortgage” appears twice on BlueHub’s Foreclosure Relief Page, with a brief explanation of what a SAM is. But a search through archives of the pages reveals that in 2019, the phrase “shared appreciation mortgage” does not appear at all. Verbiage instead reads “resell the home, typically at current fair market value on the very same day, to its existing occupants with a new, fixed-rate 30-year mortgage and a shared appreciation arrangement with BlueHub SUN.” There is no link to a page that defines what this “arrangement” might be, and there does not appear to be an internet archive for the explainer button that shows up on the page.

In March 2020, the verbiage is the same on BlueHub’s page, and it remained the same through March 2021. This means that BlueHub did not become as transparent about SAMs as it is now until after the lawsuit was filed.

How did BlueHub manage to get special legislation put into the Senate’s economic development bill? Opaque legislation processes means we may never know. [Image: 123rf]

Economic Development Bill Includes Legislation to Protect BlueHub

During the 2023-2024 legislative session, verbiage was included in the Senate’s version of an economic development bill (S.2869) that would have protected nonprofit mortgage lenders who make initial disclosures about shared appreciation mortgages from certain types of litigation after the fact.

This did not sit well with plaintiffs in the lawsuit, who wrote in to oppose the language in the bill and testified against it at the State House in 2023.

“They are criminals,” Derrick Harper, a BlueHub client, stated at the hearing.

“In plain language, what this means is that mortgage lender BlueHub Capital…will be exempt from every consumer protection law in Massachusetts,” Nardella Thomas, a plaintiff in the aforementioned lawsuit, wrote. “This legislation is a get out of jail free pass for one mortgage lender.”

This verbiage did not appear in the House’s version of the economic development bill. The Senate forced the House to amend its bill. When H.4804 was put before a conference committee, it did not pass before the end of the two-year session on July 31, 2024. This means the bill is likely finished, as any bills left unpassed at the formal end of the session must have unanimous approval. This is typically not attempted for controversial bills such as this one.

When the new legislative session begins in January 2025, all unpassed bills are considered ended. Though the same verbiage could be re-introduced in the next session, for now, it is presumed to have failed.

Though BlueHub did not appear by name in the Senate’s version of the economic development bill, it is the only nonprofit we could find in the state that utilized shared appreciation mortgages.

We wonder who managed to convince Senate representatives to include such controversial protections in the economic development bill, and how. We checked the state’s lobbyist website and can find no record of BlueHub registering itself, or any of its employees, as a lobbyist. Surely the Senate did not include verbiage to protect the company out of the blue. This could point to lobbying violations, but we are unlikely to ever know for sure. The legislature is exempt from public records law.

Conclusion

A decade ago, BlueHub was being praised in the press for helping homeowners. Then-Attorney General Martha Coakley reportedly upheld it as a way to help revitalize the neighborhoods hit hardest by the foreclosure crisis. Now it’s the subject of a class action lawsuit with people decrying their practices as predatory. Are they villains, or heroes? That’s in the judge’s hands now.