Average Insurance Premium Up 9%

| . Posted in News - 0 Comments

"Catastrophic" Winter Leads Insurers to Seek DOI Increases

We first saw the trouble on our message boards in early May, where landlords (especially in Worcester) were commenting on sharply higher premiums this year. Then in early July WCVB reported on it. And then we went to the Division of Insurance to see for ourselves.

According to WCVB, the average premium increase for the state's largest insurer, Mapfre USA Corp, will be 8.9%. The trouble with averages is that some folks will experience much, much greater increases. If you were one of the unlucky few to file a claim in the last year, you might see an increase as high as 44%. That is tantamount to cancellation.

The worst part of this is the callous indifference with which some insurers are notifying long-term customers of their premium increases. Usually their customer service representatives are not at liberty to disclose how much of the increase is due to the general Division of Insurance rate increases, and how much is due to their claim history.

The best advice is to shop around for insurance. You may be stuck paying more, but perhaps you can get better coverage with another insurer. We know of one landlord who couldn't avoid paying higher premiums, but by shopping around they did get disproportionately higher coverage limits in places. That amounted to a better deal than staying put.

A Visit to the DOI

Any member of the public can call the Division of Insurance and request access to public records and insurance filings. This theoretically allows us to see which companies will be increasing which premiums.

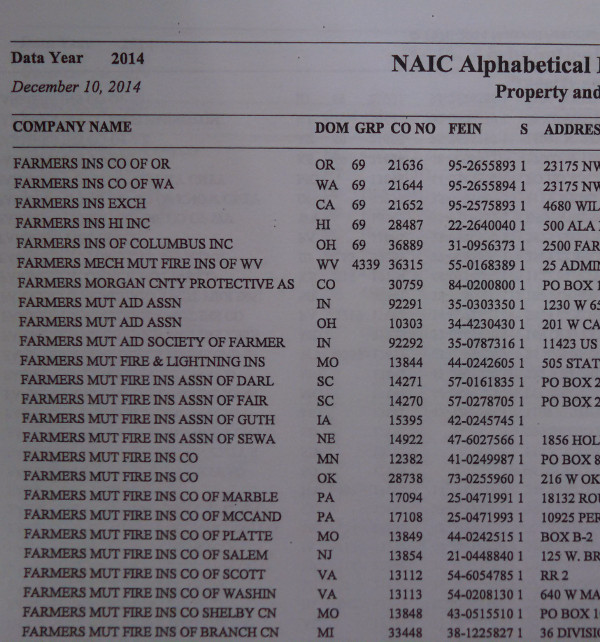

But a trip to the DOI is not for the faint of heart. Once you get your visitor badge at the security desk, you must travel to an upper floor where there's a public computer room. A friendly staff person will seat you at a terminal and show you how to find your company. There are literally thousands of insurance companies registered to do business in regulated Massachusetts, many of them with substantially identical names. Picking the wrong company means getting no data, or worse, wrong data that looks right.

One page of hundreds listing all kinds of Farmers insurance companies. Which one is yours? Read the fine print on your policy.

Once you find your company name, get the NAIC Company Number alongside the name and type that into the system. Are you ready? Click search, and brace yourself for a tidal wave of 40-page filings, computer-generated jargon, and numbers stretching back to the beginning of time. It is very difficult for a lay person to know what they're looking at.

If you are lucky, you will find a form with "Filing Type" containing the word "Rate". You can then view it to see its "SERFF Status" and whether it was approved or rejected. The "rate" forms that are "approved" are little nuggets of insight, for they can tell the future.

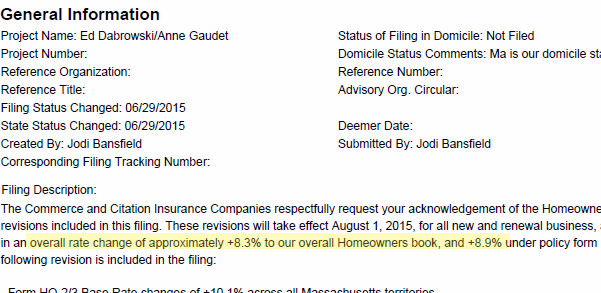

In the case of Commerce/Mapfre, cited by WCVB, you can read the "Filing Description" for the closest thing to a plain English statement of intent.

This is the easiest way to see rate changes. You need to understand which category of insurance you're looking at (e.g., HO-3 is owner-occupied).

By this point in the process, your friendly DOI staff person has walked away, never to return. You can stay for as long as you want, lost in the jungle of PDF files. Indeed, another person we met that afternoon had been there since the morning, and was still there when we left. Perhaps someone should call search-and-rescue.

Practical Implications

The landlord facing the 44% premium increase was insured with Homesite through GEICO (technically, Homesite Insurance Company of the Midwest). GEICO had told the landlord that this premium increase was probably due mostly to general DOI increases.

When we went to the DOI, we were able to find the appropriate Homesite company, review their latest filings, and see that the category relevant to this landlord (HO-3) would see a 7.6% increase. Unless we have misinterpreted the filing, the balance of the increase (36.4%) would therefore be attributable to the landlord's first-ever claim, filed in early spring for wind damage.

The claim paid out $300, after the deductible, and the landlord's premium increase would be $800 annually. That's a raw deal. This landlord should not have filed the claim.

The moral of the story is to use your insurance for big stuff, or to find a company that will give you better guidance on whether to file a claim in the first place.

And for everyone else, well, it looks like a 10% premium increase is on the horizon.