A Landlord’s Guide to the Supplemental Nutrition Assistance Program

| . Posted in News - 5 Comments

By Kimberly Rau, MassLandlords writer

On the surface, it may not seem like the Supplemental Nutrition Assistance Program (SNAP) would be terribly relevant to landlords. After all, it’s not like tenants can pay their rent with food stamps or a SNAP debit card. But did you know that SNAP benefits can count as income when you are vetting a potential tenant’s ability to pay the rent? And that more people than you probably think get some form of food-related assistance?

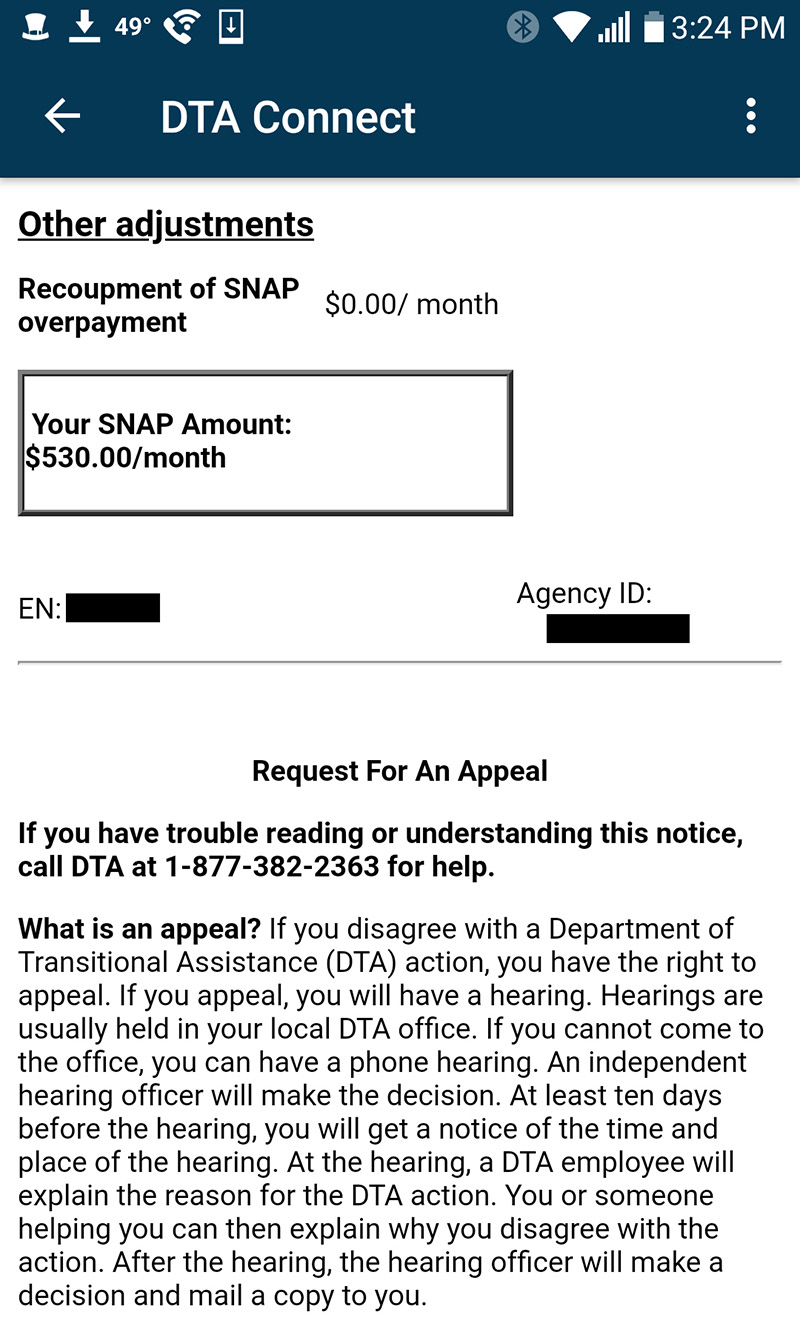

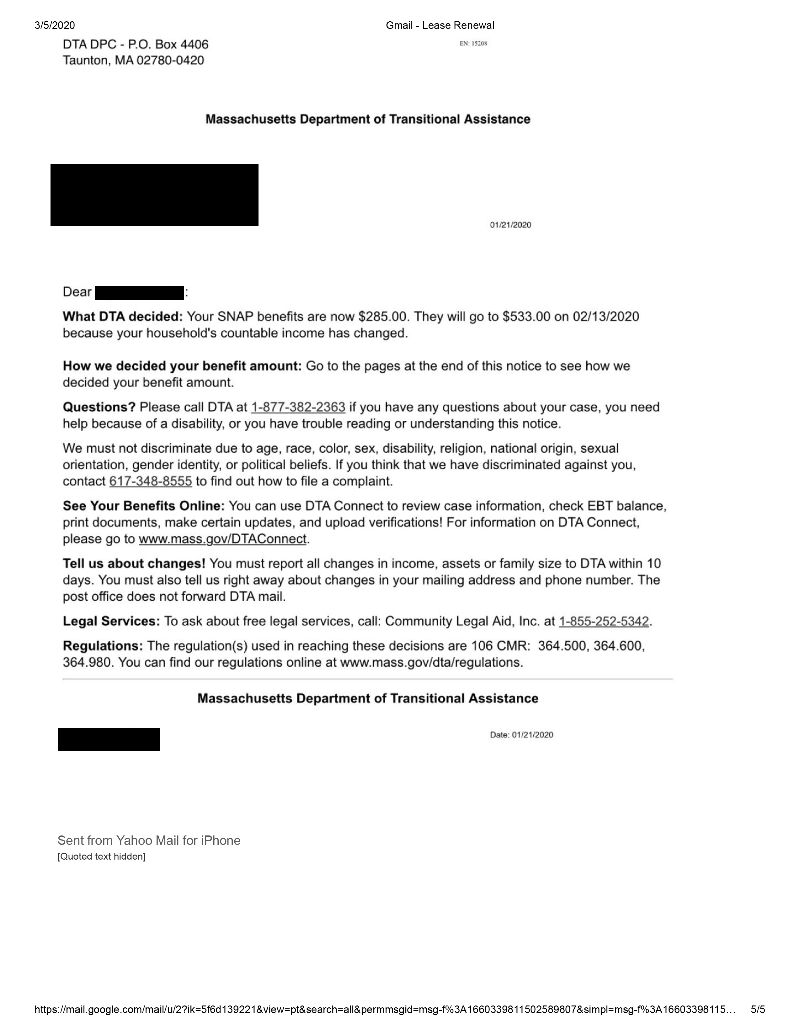

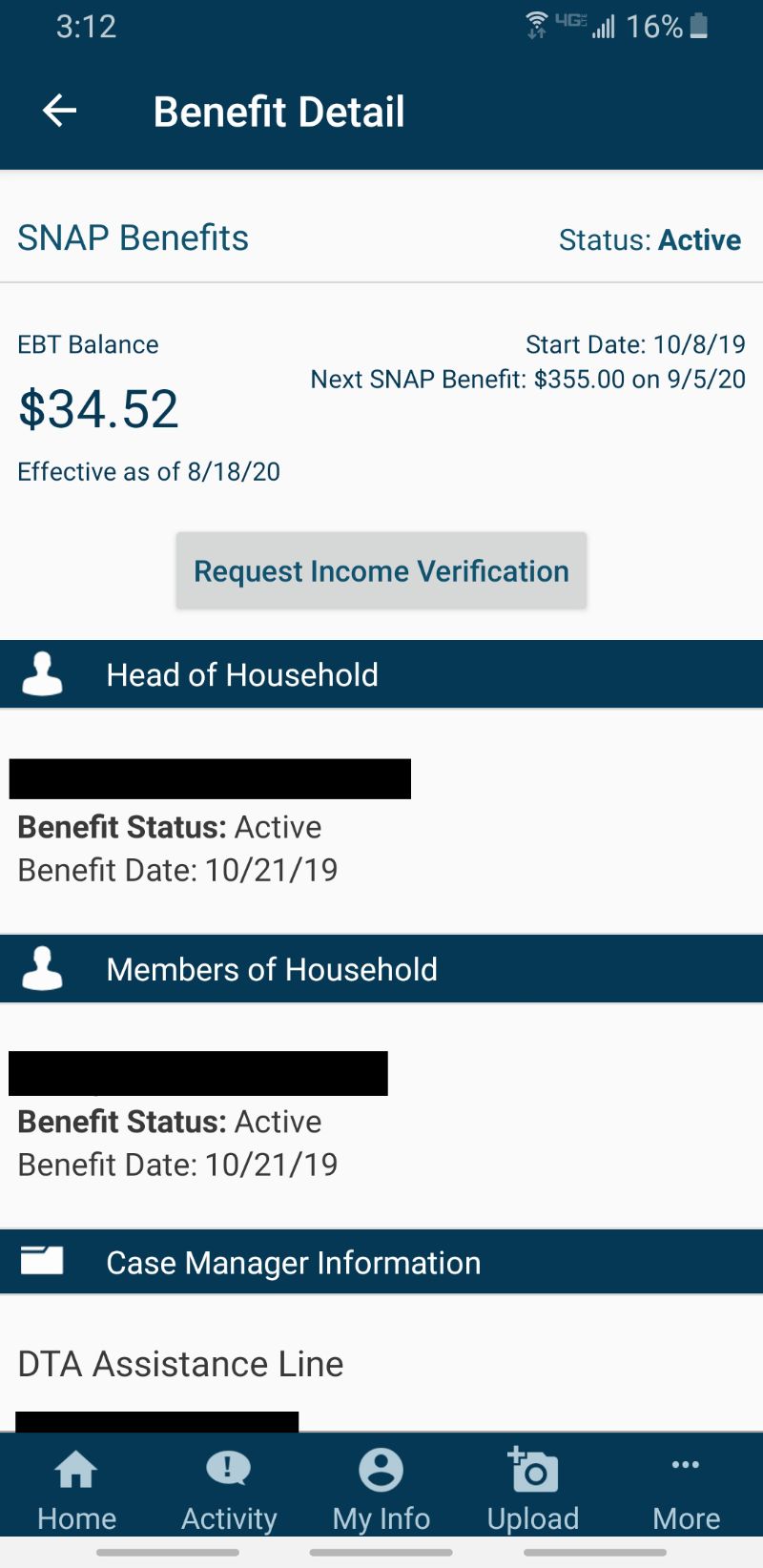

Though SNAP benefits are considered confidential, a potential tenant wanting to count them as income can provide you proof of their benefits. Here are three examples that you may see (personal information redacted).

Images credit: CC BY-SA 4.0 MassLandlords Gwendolyn Property Management

In this guide, you’ll get a background on SNAP and learn why it’s important to consider it with regard to rental housing.

What is SNAP, and how is it different from food stamps?

The Supplemental Nutrition Assistance Program is typically called SNAP, and is the same thing as the former “food stamp” program. Created in 1964, it provides a monthly benefit to low-income U.S. citizens and certain legal noncitizens that allows them to purchase nutritious food.

Prior to 1990, recipients of food assistance received actual stamps that could be redeemed at participating grocery stores for food items. Then, in 1990, the benefits system began converting over to Electronic Benefits Transfer (EBT) cards. Paper food stamps were totally eliminated in 2008, and on October 1 of that year, the name officially changed to SNAP.

Who pays for SNAP benefits? How is the program funded?

The United States federal government pays for 100 percent of SNAP benefits. States split the cost of administering the program with the federal government, with the federal government covering close to half of the costs.

Of course, federal programs are funded by federal tax dollars, which means that anyone who pays taxes helps pay for SNAP. However, the amount you pay may be less than you think: In Fiscal Year 2019, just eight percent of the federal budget, amounting to $361 billion, went to “safety net programs,” including Supplemental Security Income for the elderly and disabled, and SNAP, among many other initiatives. If that number sounds big, compare it to the country’s defense budget, which was $697 billion, or 16 percent of the budget, in the same year.

Who is eligible for SNAP, and how much can someone get in benefits?

Like many government assistance programs, qualifying – and how much in benefits someone is eligible for – is based on income and household size. For the SNAP program, a “household member” is considered anyone with whom you buy food and make two-thirds or more of your meals with, as well as your spouse (even if you don’t share food with them) and any child under 22 who lives with you. As far as income goes, SNAP considers your paycheck income, of course, as well as any child support payments.

Here is a general list of income guidelines. Under these guidelines, assistance maximums range from $194 a month, for a one-person household, to $1,018 a month, for a household with seven members. However, COVID has changed several aspects of the SNAP program, including income and benefits guidelines. Here is a list of income guidelines under the Disaster SNAP program. And through at least June 2021, recipients saw a 15 percent boost to their snap benefits. Further, due to COVID, rules requiring recipients to be looking for work or logging volunteer hours were temporarily suspended.

While grocery costs can vary wildly depending on the local cost of living, the USDA prepares suggested food budget reports based on family size and income (budget levels are divided up between “thrifty,” “low-cost,” “moderate-cost” and “liberal), as well as average food costs. The reports assume all snacks and meals are prepared at home. A suggested “low cost” monthly budget for a family of four is $748.50 as of December 2020. By comparison, the maximum in benefits a family of four could hope to receive on SNAP is $646 before COVID increases are factored in.

What can SNAP benefits be used for?

Recipients of SNAP benefits can use their EBT cards to purchase most foods, as well as seeds or plants for growing food (for instance, tomato plants or beans). SNAP benefits cannot be applied toward hot or prepared foods, alcoholic beverages, supplements, live animals or pet food. It cannot be used on non-food items such as diapers or feminine sanitary products. If that seems like an oversight to you, you aren’t alone. However, it may be explained in part by the dearth of women in Congress at the time that SNAP was created. In 1964, the 88th Congress was in place. A total of 14 women (two in the Senate, 12 in the House) out of the 535 members (100 senators and 435 representatives) were part of that Congress. That’s less than 3 percent representation for approximately half the population.

A more complete breakdown of eligible items can be found here.

How common is it for someone to receive SNAP benefits?

The most recent official information on SNAP benefits is from Fiscal Year 2019. In short, 760,000 Bay State residents received SNAP benefits in FY19. This represents 11 percent of the state population, or one in nine. More than 53 percent of those receiving SNAP benefits were in families with children; almost 51 percent are in families with members who are disabled or elderly; and more than 32 percent are in working families.

Nationally, 12 percent of the population received SNAP benefits in FY19.

Why is knowing about SNAP benefits important for landlords?

First and foremost, as a landlord, your tenants may come to you if they are having trouble paying the rent. SNAP benefits can help a family access nutritious food, but if money is tight it can also help them redirect dollars that would be spent on groceries to other expenses, such as rent. You may be the resource that can point them in the right direction (more about that later).

In that same vein, SNAP benefits count as income. As we said, benefits that help recipients save money at the supermarket allow them to re-allocate that money to other needs. An applicant with an annual wage that looks too low to allow them to afford a rental unit you’re offering may actually have enough to cover the rent when SNAP benefits are factored into the equation.

So, should I encourage applicants to list SNAP benefits as income if they have them?

Absolutely. Your goal should be to get a tenant who can afford to pay the rent, and SNAP may help them do that.

What happens if I don’t want to count an applicant’s SNAP benefits as income?

You could be opening yourself up to charges of discrimination. You cannot decide not to rent to someone because they receive government assistance. If an applicant can afford the place, then, barring other disqualifying reasons (19 large dogs, for example, or an open admission that they plan to sell drugs out of the place), you should consider renting to them. If you’re not sure how to properly screen your potential tenants, take some time to read over our applicant qualifier form. It’s a points-based system that allows you to objectively screen your applicants.

So if a tenant lists SNAP benefits as income, how do I verify that?

You can’t make a phone call to verify SNAP benefits. The United States Supreme Court has ruled that SNAP benefits are confidential. However, a tenant who volunteers that they receive SNAP benefits because they are hoping it will help them secure a rental unit should have no problem providing you with the proof you’re looking for. It’s not illegal for them to give you the information, you just can’t call the SNAP offices yourself and ask for proof.

If one of my tenants needs food assistance, how quickly can they get SNAP? How do they get started?

Depending on their circumstances, someone who has fallen on hard times can get emergency SNAP benefits in as little as seven days. These are called emergency SNAP benefits, and to be considered eligible, applicants must answer yes to one or more of the following questions:

- Does your income and money in the bank add up to less than your monthly housing expenses?

- Is your monthly income less than $150 and is your money in the bank $100 or less?

- Are you a migrant worker and is your money in the bank less than $100?

Your tenant should start by applying for SNAP, at which point a case worker will screen them for emergency eligibility. Applicants who get emergency benefits will also get instructions on how to get ongoing benefits.

Your tenants should also know that state Department of Transitional Assistance (DTA) employees must keep application information private, including immigration status. SNAP benefits are not cash, so they do not create a “public charge” problem with immigration officials.

If your tenant does not meet the requirements for emergency benefits, all is not lost: They may still be able to get monthly benefits if they meet income requirements for their household size. Non-emergency SNAP cases are typically decided within 30 days.