Questions and Answers for March 2016

| . Posted in advice, groups - 0 Comments

Adapted from our Message Boards.

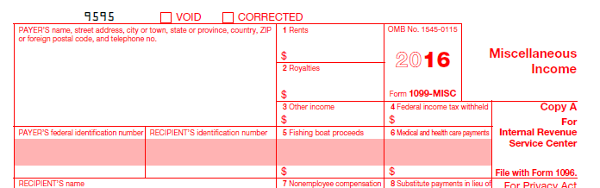

Q: I got a 1099-MISC for a security deposit. Is that right?

Technically your copy will be black and white, and for tax year 2015, will say "2015" instead of "2016".

The IRS requires a 1099 to be sent for security deposits paid for by state or federal funds. This is rare. Remember that the most widespread program, Section 8, doesn't pay for security deposits.

The rationale behind the 1099 is the IRS will never know if the security deposit was returned to the tenant or applied to their last month’s rent.

As a landlord they want you to claim the income now. If later on you apply it to the tenant’s rent, you don’t have to claim any further income and you won’t get another 1099 for it.

If you return the deposit to the tenant, you can claim an expense.

Of course this treatment is in direct violation with Massachusetts law, which requires that the security deposit be treated as the original copy of the Mona Lisa and carried on a velvet pillow from the tenant's hand into an escrow account. Nevermind. Uncle Sam demands his taxes now, even though the money is truly not ours.

The best advice we read was to refuse to accept security deposits from state or federal governments. Require tenants to provide these on their own, or take first and last (no security). This way you aren't giving the government an interest free loan (in the form of your tax payment) for the life of the tenancy.

Q: I have a long-term tenant who is late again. Usually they catch up, but I'm worried because they are months behind and they have said they need their tax return to pay the rent. What should I do?

Long-term tenants usually get some extra leeway, but this is how landlords end up in trouble. Relying on their tax return to get caught up on bills is unsustainable. It would normally take 30 minutes to find, fill out, and send in a new form W-4 to adjust their withholding. This would be far better than yo-yo-ing from bankruptcy to riches every tax season.

Should you issue a notice to quit and then a letter offering to work with them? Sure, if that helps you preserve the relationship. Issue the letter the moment you issue the notice. The notice gives you access to your right to file in court, and the letter lets them know that you are open to payment plans.

Remember that tenants given notice to quit for non-payment have the right to cure their first notice. So if you have never given notice for a previous yo-yo, they might cure and you'll be back in business together. On the other hand, a 30-day notice (or one full rental period) comes with no right to cure. This applies only to tenancies-at-will but is less reversible than a 14-day. A good attorney can fill you in on other drawbacks to 30-day notices.

The best advice we read was to work with a lawyer for this eviction, to assume that the back rent would never be paid, and to move steadily towards getting a new tenant in the building.

If you want to try the W-4 trick to adjust withholding, that's worth a shot, too, because that's a long-term strategy and these are long-term tenants. They might thank you for meddling with their affairs.