EOHLC to Cut Housing Benefits; 23,000 Federal Vouchers Affected in Mass.

. Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

Citing concerns about future federal funding and the Section 8 rental assistance program, the Executive Office of Housing and Livable Communities (EOHLC) announced in March that it would be doing away with supplemental benefits offered through a federal pilot program, including utility and security deposit assistance for some Section 8 renters.

Cuts to Section 8 benefits mean some families could end up unhoused. (Image: CC by SA 4.0 JRau MassLandlords Inc.)

This change will not affect individuals who receive state-funded housing assistance through the Massachusetts Rental Voucher Program (MRVP), or Section 8 participants whose vouchers are managed directly through public housing authorities. Still, approximately 23,000 voucher-holding households will be affected by EOHLC’s announcement. For some, it could mean the difference between staying housed or getting evicted. For landlords with Section 8 renters, it will mean less money for repairs and necessary work, including decarbonization.

Moving to Work: A Section 8 Pilot Program

The Section 8 housing voucher program is administered by the U.S. Department of Housing and Urban Development (HUD). HUD distributes housing vouchers to states, which are then disbursed by either regional administering agencies (RAAs), such as RCAP Solutions in Worcester and Metro Housing Boston, or local public housing authorities (PHAs) such as the Hampden Housing Authority in Springfield. EOHLC only administers vouchers through RAAs.

HUD offered certain Section 8 voucher administrators the chance to participate in the Moving to Work (MTW) program, a pilot that gave participating agencies some flexibility in how vouchers were administered.

“The MTW demonstration program encourages MTW agencies to tailor their programs to the needs of their local communities,” states HUD Exchange, an informational website for community partners. “It allows MTW agencies to design and test innovative, locally-designed housing and self-sufficiency strategies for low-income families by using assistance received under Section 8…of the Housing Act of 1937 more flexibly.”

Until recently, EOHLC was a participant in the MTW program, which meant that approximately 23,000 Section 8 vouchers administered by RAAs across the state received certain benefits not available to Section 8 voucher holders who received housing assistance through PHAs. Benefits included funds to cover a security deposit at move-in, an allowance for utilities such as hot water, and deducting the first $5,000 of earned income when calculating the recipient’s income-based rent.

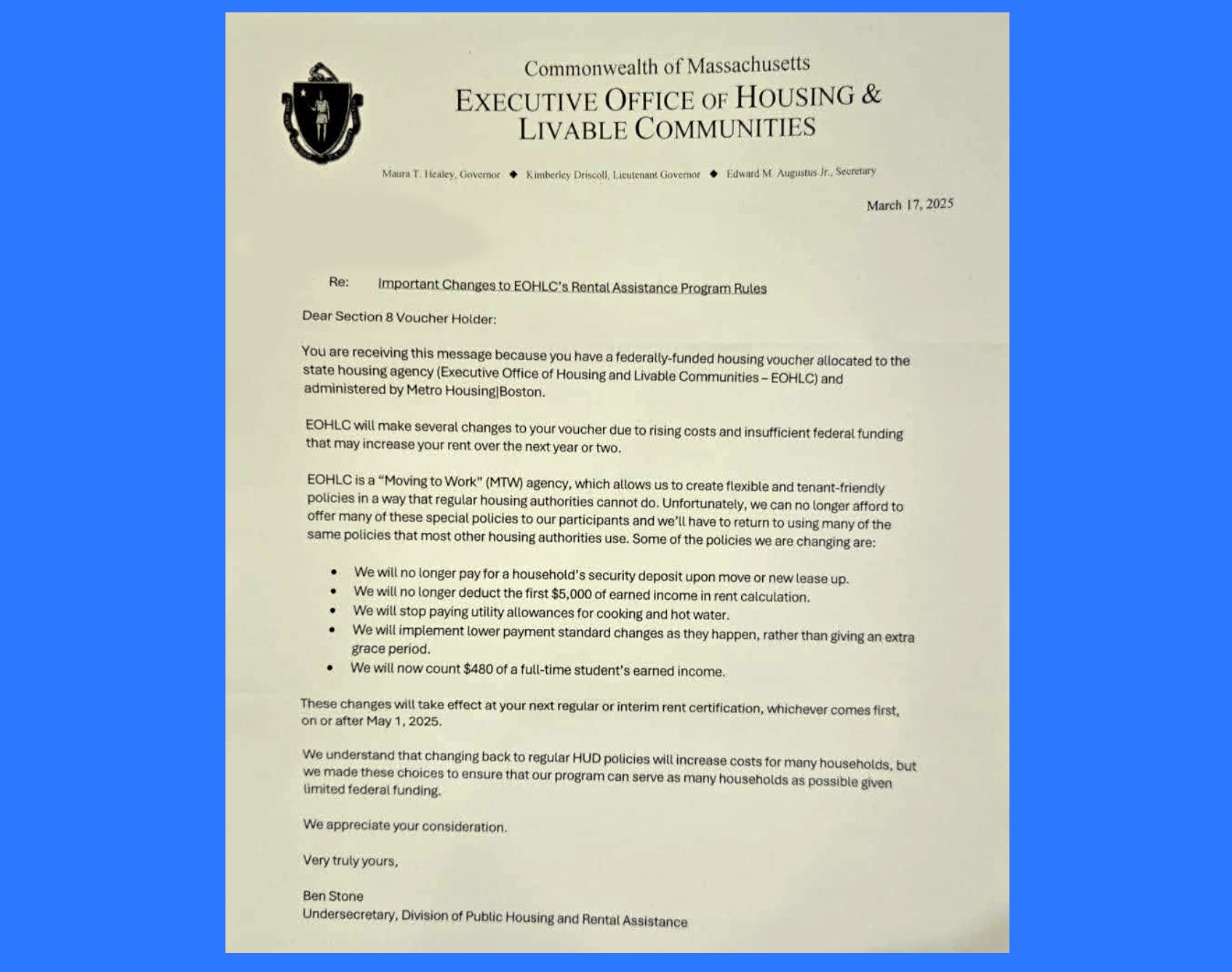

The enhanced utilities allowance and $5,000 income deduction were pilot programs, and not all Section 8 recipients, even those whose vouchers were administered by EOHLC, took advantage of those benefits. However, on March 17, 2025, EOHLC announced it would be ending the supplemental pilot programs at the recipient’s next regular or interim rent certification on or after May 1, 2025.

This gave around 23,000 families and their housing providers less than two months’ notice that their rent and utilities were potentially going up. For landlords, it meant short notice that the public portion of their payments could be decreasing. Voucher holders looking to move must now come up with a full security deposit if their new lease requires it, a big ask for people on fixed or limited incomes.

The letter some Section 8 recipients received in early March. For some families, this will mean around two months’ notice that their rent may be increasing. (Image: CC by SA 4.0 MassLandlords Inc.)

EOHLC Cites Budget Concerns; Federal Section 8 Funding Remains Same for FY26

Though the federal government has removed all mentions of the MTW program from the HUD website, we don’t believe the program has been defunded, or staff fired. State websites still provide details on the program, and other states are still participating in it, with no mention of an end date. Rather, EOHLC opted to discontinue many of the benefits available through the pilot program out of concern that future funding or staffing may decrease.

“EOHLC will make several changes to your voucher due to rising costs and insufficient federal funding that may increase your rent over the next year or two,” the letter to Section 8 voucher holders read. “Unfortunately, we can no longer afford to offer many of these special [MTW] policies to our participants and we’ll have to return to using many of the same policies that most other housing authorities use.”

“We understand that...will increase costs for many households, but we made these choices to ensure that our program can serve as many households as possible given limited federal funding,” the letter from EOHLC continued.

Around the same time EOHLC sent their letter to voucher holders, the U.S. House of Representatives voted in favor of a funding plan that does not cut Section 8 money for next year. The federal government allocated $32 billion for Fiscal Year 2025; this recent spending plan maintains that amount for FY26. That $32 billion reflects a $4 billion increase over the FY24 budget. There is no formal budget for FY25 yet, despite the fact that it is nearly over, and no formal budget for FY26 exists.

While maintaining current funding levels is certainly better than a drastic cut, inflation, including rising rents, means that $32 billion won’t go as far in FY26 as it did the year before. That said, without hope of a formal budget anytime soon, there is a chance that continuing resolutions from Congress may more than level fund Section 8. There’s no way to know for sure at this point. EOHLC has stated that the cuts to the MTW pilot program are to ensure those on the program can remain on it.

It’s unlawful to reject applicants because they receive Section 8 assistance, but changes to the program with little notice don’t make the program attractive to landlords. [Image: CC BY-SA JRau MassLandlords Inc.]

Cuts to MTW Program May Leave Voucher Recipients Unable to Afford Rent

Though only some Section 8 recipients in Massachusetts will be affected by the cut to their benefits, it puts those individuals in a tough spot.

For instance, renters used to a certain amount of funding to put toward utilities could see their water and other utility bills increase. For those on a tight budget, there may not be additional money to spare. And if a voucher holder must move (for instance, if the landlord now needs the rental unit for a family member or is selling the property and is not renewing the lease), they will need to come up with a security deposit if the new lease asks for it. Not doing so could cost them the rental.

This means that some people may not move out when their lease is up, because they will have nowhere to go. Some may struggle to pay their utilities, leading to additional issues. Still others may be unable to pay their new portion of the rent. If the landlord needs the unit but the tenant can’t leave, or the tenant cannot pay their rent, eviction may follow. This is unpleasant and costly for everyone involved.

One of the budget cuts is a 6% decrease to Section 8 MTW landlords.

One of the biggest cuts to the MTW program means some voucher holders could see their monthly rent increase if they participated in the pilot that deducted the first $5,000 of earned income before the tenant portion of the rent was calculated. An extra $5,000 of annual income affects the ratio of how much the federal voucher will cover vs. how much the renter is responsible for.

Math example: An extra $5,000 of income could lead to less rent for the landlord.

For example, a household earning 60% of the state median income earns $63,900 a year. Renting a $2,500 apartment in Dorchester puts them rent burdened at 47% of income to rent. That’s too high. Section 8 ensures an income to rent ratio of 3:1. Under typical Section 8 guidelines, that means the family would pay $1,775 and the program pays $725. But under MTW guidelines, the first $5,000 of income was exempted, and the family’s rent would have been calculated based on an annual income of $58,900. Their rent would have been $1,636. This one change alone creates a gap of $139 a month (2.6% of gross income). This reflects a 6% rent reduction if the tenant cannot make up the difference. And that’s for a family earning more than the average Section 8 voucher recipient, which we discuss in the next section.

With so many Americans living paycheck to paycheck, and Section 8 specifically designed to help low-income renters, the extra expense could be a difficult burden to bear. Landlords too will have to contend with these issues. Do you forgive the portion of the rent the voucher holder cannot pay? Do you start a lengthy eviction process?

Voucher Recipients Likely Can’t Afford a Rent Increase

HUD reported in 2023 that while 26% of voucher holders nationwide receive the majority of their income from wages or salaries, they don’t make much money: 95% of households receiving subsidized housing assistance are “very low income,” and 79% are “extremely low income.” In fact, the average household in subsidized housing earned $21,725 in annual income.

More math: Lower income families will be hit hardest by the loss of benefits.

Let’s go back to that $2,500 Dorchester apartment and re-calculate the numbers using that average income of $21,725.

Under the MTW program, the first $5,000 of that income would be exempt, and the household’s share of the rent would be $465, with the program paying the rest. Without MTW, that rent share bumps up $138 – the same increase our family earning around $64,000 a year sees. But in this case, that $138 reflects 7% of the family’s gross monthly income. It’s a lot less likely the landlord will see this rent, because the family simply doesn’t have it to spare. EOHLC has pulled the rug out from under the renters, and the housing providers who rent to them.

Many Mass. Section 8 recipients are older people, single-parent households or children.

Other statistics from 2023 show that 46% of Section 8 households in Massachusetts are headed by someone age 62 or older, the youngest age someone can start receiving Social Security benefits. Twenty-eight percent of Massachusetts households on Section 8 have someone with a disability, 28% have one or more children under age 18, and of those households with children, 89% are headed by single parents. These are not people with piles of discretionary income.

And that’s just the families who are voucher recipients. A 2022 report from The Boston Foundation stated that more than 585,000 families in Massachusetts meet the state’s criteria to receive rental assistance, but not everyone gets it. Of those families, approximately 250,000 actually receive help from state or federal housing subsidies.

That leaves 335,000 families without rental assistance, and the waiting list is years long. EOHLC has closed its waiting list for Section 8 mobile vouchers entirely (the waiting lists project-based vouchers and vouchers administered by local housing authorities appear to still be open). With the governor effectively slashing RAFT benefits in half, even more renters are going to struggle to pay the rent over the next year. That’s bad news for them, and for the landlords who provide their housing.

Conclusion

On paper, EOHLC is taking proactive steps to ensure that they can continue funding existing Section 8 vouchers. There is much uncertainty about funding for federal programs with the current administration. However, we aren’t confident in how EOHLC responds to crises.

At the height of the Covid-19 pandemic, Massachusetts had an eviction moratorium in place. Technically, renters were still obligated to pay their rent, but landlords could not evict them if they didn’t. Many people were out of work, and not everyone was eligible to receive the extended unemployment benefits offered by the government.

In response, the state increased benefits for the RAFT rental assistance program, but many applicants found themselves denied without reason, or “timed out” of the process with little to no communication. When we asked for what should have been public records surrounding that process, we were informed they were not readily available. Our lawsuit to receive this information against EOHLC (then the Department of Housing and Community Development, or DHCD) was ultimately dismissed, but our complaint still stands. The disorganization that led to 47,000 missing applications and $800 million spent without record makes us question this decision by EOHLC as well.

It's never a good idea to reduce assistance in the face of a recession, especially when those receiving assistance are already in a tight financial position. It feels like an unforced error. Was this truly the only way to maintain the Section 8 program? Only time will tell.