Can You Collect on a Massachusetts Monetary Judgment? Not Easily.

| . Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

When your tenant stops paying rent, you lose that monthly income for your rental property. Getting it back may be impossible.

You’ve made it through the eviction process and have a monetary judgment in your favor for owed rent. But collecting on that judgment may be harder than you think. (Image: CC by SA 4.0 MassLandlords, Inc.)

When you win an eviction case for nonpayment of rent, the judge will order your former tenant to vacate the property and pay you the owed rent. A judge may also order them to pay your attorney fees.

Getting a monetary judgment in your favor is a victory, but whether you actually see the money is another story. It’s up to the renter to pay you. If they don’t, it’s up to you to pursue what you’re owed. In Massachusetts, that’s often easier said than done. If your tenant is judgment-proof, you may never see those funds. Even if your former tenant isn’t judgment-proof, you may be in for an uphill battle. But it may be worth it to try.

Supplemental Processes Allow You to Garnish Income

When you receive a monetary judgment in your favor following an eviction, the other party is supposed to pay that owed money to you. But this isn’t automatic (the courts aren’t going to force them to write you a check that day), and a quick glance around any landlord forum will tell you that many tenants don’t seem willing, or perhaps able, to make their former landlords whole. If they don’t pay what they owe, you can return to court and try to get an order to have their wages garnished.

In Massachusetts this is called a wage attachment, and the process to obtain one is called a “supplemental process.” However, not all types of income can be garnished for all purposes.

What it Means to be Judgment Proof

Massachusetts recognizes two kinds of income: protected and unprotected. Certain types of income are automatically protected, including any type of public assistance. This includes income from Social Security, workers’ compensation, disability payments, various veterans’ benefits, unemployment and payouts from state-funded pensions and retirement funds. These sources of income are shielded from attachment from all but the most high-priority debts, such as criminal fines, owed taxes, or court-ordered child support or alimony.

You may remember Robert A. Kennedy, the ex-cop from Stoneham who repeatedly did not pay his rent to multiple landlords. He retired after the federal government charged him with fraud, and pled guilty to avoid jail time.

Because Kennedy stepped down, and was not fired, from the Stoneham police department, he was, at the time of publication, still eligible to receive his taxpayer-funded pension of approximately $5,000 per month, or $60,000 a year. The Stoneham retirement board voted to move forward with pension forfeiture proceedings in March 2024. At the time of writing, the hearing that determined whether Kennedy could retain his pension had not yet been held.

For the sake of illustration, if Kennedy keeps his pension, the only landlords who could garnish anything from that income would be the ones named in the criminal case brought against Kennedy. The judge ordered him to pay those landlords approximately $14,000 as part of the plea deal, and restitution from criminal cases is considered a priority. The other landlords who evicted Kennedy and received judgments in their favor would not be able to garnish Kennedy’s pension to recoup their money.

If Kennedy got a job for an additional source of income on top of his pension, then his former landlords might be able to get a wage attachment for that money. Conversely, if Kennedy lost his pension, he would likely have to seek full-time employment, which his creditors could access for repayment.

But even if Kennedy does have a source of non-protected income, it may be impossible to collect on the judgments awarded in each eviction.

Protections for Income in Massachusetts Exceed Federal Guidelines

The United States and Massachusetts both recognize the importance of consumer protection laws when it comes to creditors. As a result, no creditor can take the entirety of your income even with a wage attachment.

The federal government protects $217.50 of disposable income per week from deduction (30 times the federal hourly minimum wage). “Disposable income” refers to post-deduction wages, commonly known as take-home pay.

If your disposable income exceeds 40 times the federal minimum wage ($290/week), then the federal government says that 75% of that income is protected from creditors.

But states are welcome to create laws that protect more income than that, and Massachusetts is one of the states to have done so. The state protects 85% of an individual’s gross (pre-deduction) income, or 50 times the state minimum hourly wage for disposable (post-deduction) income, whichever is greater. Right now, that works out to $750 per week.

Lawmakers have introduced a bill that would raise those limits to protect 90% of a person’s gross income, or 65 times the state minimum wage in disposable income, whichever is greater. That would equal $975 per week.

Right now, in Massachusetts, if your gross income is $1,000 a week, you can protect $850 of each paycheck from garnishment. Robert Kennedy was making up to $187,000 a year as a police officer, or $3,600 a week before taxes. If he were still earning that salary, the state would protect nearly $160,000 a year from garnishment, or just over $3,000 a week.

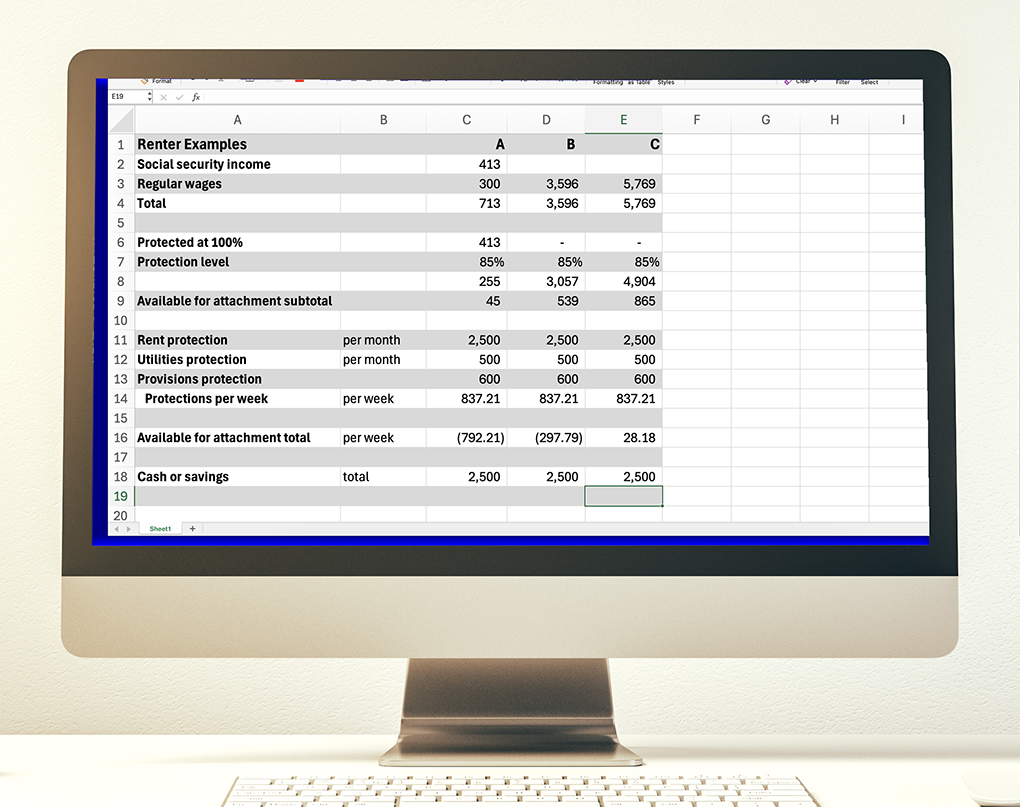

But wait, there’s more. Once you’ve calculated your protected income (at least $750 per week), Massachusetts allows you to protect a certain amount of your remaining income from creditors as well.

You can protect $500 a month for utilities, up to $600 a month for provisions such as groceries and $2,500 a month for rent. You can also protect up to $2,500 in cash or savings, with anything over that available for attachment.

This significantly reduces what is available for creditors to collect against.

The math doesn’t lie: Whether someone makes $700 a week or nearly $6,000 a week, after all of the income Massachusetts allows an individual to protect from creditors, little to nothing is available for wage attachment. (Image: Derived 123rf)

Even With a Judgment in Your Favor, You May Have Trouble Collecting Owed Rent

Let’s say you have a tenant who has not paid their rent. Mediation attempts fail to result in an agreement, and you end up in court. You win your eviction case and are awarded your owed rent, plus legal fees. Your former tenant does not pay, and you seek a garnishment to collect against the judgment. They don’t receive any public assistance, so you assume you will have no problems collecting. You decide to take them to court for a supplemental process hearing. Your former tenant shows up, and they bring documentation.

Let’s say this individual earns $60,000 a year. This works out to $1,153 a week before taxes, of which roughly $980 a week is protected from creditors, leaving just $173 to collect against. Great, you think, collecting $173 a week is better than nothing!

But there are those other protections to consider as well. To figure out what each of those monthly allowances are by week, divide by 4.3 (52 weeks in a year divided by 12 months gives you approximately 4.3 weeks in every month).

Even if your former tenant now pays a very low rent of $1,000 per month, they can protect an additional $232 per week (the monthly rent divided by 4.3) if they bring documentation to court. Now there’s nothing left for you, nor for any non-priority creditor. And that’s not even considering grocery bills and utilities.

But what if your former renter is earning a much higher income, like Kennedy was?

Imagine a scenario where Kennedy does not receive his pension, and has to get another job. Let’s say his new job pays $120,000 a year. That’s just over $2,300 a week before taxes. (It might sound like a lot, but remember, he was making up to $187,000 a year, or just under $3,600 a week before taxes, as a police officer.)

Massachusetts would protect $1,955 (85% of that pre-tax income) from creditors, which leaves $345 a week for you to collect against.

But out of that $345, Kennedy can protect up to $580 per week for his rent (the monthly $2,500 allowance, divided by 4.3). Remembering the previously mentioned protections, Kennedy could also protect up to $140 a week for provisions such as groceries, and $116 for utilities. His creditors are out of luck.

In fact, even at his top reported income, it would be difficult to garnish Kennedy’s paycheck. If he earns $187,000 a year (nearly $3,600 a week before taxes), just $540 is available after protecting 85% of that, and that’s quickly eaten up if Kennedy brings a utility bill or rent statement to court.

Is There Any Point to Getting a Judgment Against a Tenant if I May Not Ever Collect?

At MassLandlords, we encourage you to avoid stepping foot in court if you can avoid it. Eviction takes a long time, it’s incredibly expensive, and, as we’ve just shown, if your tenant doesn’t willingly pay, your odds of getting to collect against any judgments are low.

But if you do end up in court and you win, there are still some benefits to having a judgment in your favor.

Attorney Jordana Roubicek Greenman spoke with MassLandlords for this story. She noted that “the amount of legal fees one could spend garnishing wages is certainly prohibitive,” and attorneys may shy away from taking such a case. But there are other avenues besides wage garnishment that may help landlords eventually see their lost money.

A judgment is good for 20 years, so at some point you may be able to collect against that. For instance, though it seems impossible that you could ever garnish someone’s wages to collect on a debt, there is a relatively low cap – just $2,500 – on cash/savings in Massachusetts. If your former renter ever comes into some money, you may be able to collect at that point.

Roubicek Greenman remembered a particularly protracted eviction case that started before the Covid-19 pandemic and dragged out through the eviction moratorium and beyond. Her client was finally able to get the non-paying tenant out, though the tenant did not pay the money owed. Roubicek Greenman checked back on the former tenant and realized that after the eviction, the individual purchased a house.

“I recorded the execution,” she told MassLandlords. In this instance, recording an execution means placing a levy on the property. “They will never be able to refinance or sell without paying off my client.”

If you go this route, your attorney will need to be prepared to extend that levy every five years, but it may mean that you eventually get paid what you’re owed.

Supplemental process may not be easy, but if you start each new tenancy off on a credit reporting platform, then, if something goes wrong, you can structure a post-tenancy payment plan with your former renters. (Image: CC by SA 4.0 MassLandlords, Inc.)

Supplemental Process Isn't What it Used to Be

The way we describe renters being judgment proof is very different today than it was 15 years ago.

“I remember attending a WPOA meeting back in the day,” said MassLandlords Executive Director Doug Quattrochi. “Sandra Katz was speaking to the room describing a long, hard-fought eviction against a terrible tenant. ‘But we got his car!’ she beamed. I remember her describing how she got a repo order on the tenant's expensive new vehicle, which he purchased by saving all the rent money he should have paid. Nowadays, that's unheard of. I haven't had a landlord tell me about a big payoff since then.”

Best practice is to start each tenancy on a credit reporting platform and, if the tenancy fails, structure a post-tenancy payment plan for less than one days' wages a month.

Members Tell Us How They’ve Successfully Collected Owed Rent

Housing forums are full of landlords advising other housing providers to consider their money gone and not waste time going after it. But we wanted to hear from our own members.

We asked MassLandlords members on our Facebook group how they had successfully collected on owed rent and got a handful of positive responses. Two landlords said they had seen some success going through collections agencies. One of those landlords, Peter Houser, said he had been successful in a “small percentage” of cases by doing so.

“It’s worth a shot,” Houser said. “It is pretty easy to set up with the collection agent.”

Landlord Jennifer Marquez seemed to agree with his assessment. “It took a few years but well worth it in my opinion,” Marquez told MassLandlords. “Not for the money received but for the time and hassle that the former tenant had to deal with because the collection agency took her back to court.” Marquez said she hoped the inconvenience of having to return to court would dissuade the former tenant from stiffing another landlord.

Landlord Stacey Roller-Devendorf recalled setting up a payment plan with a former tenant who paid $20 to their former landlord and then dropped off the face of the earth, never to pay again. Landlord Sherri Korman Way said that she wrote her former non-paying renter a letter stating she would report him to the credit bureaus if he didn’t pay.

“I got a check from his mom and a letter saying don't contact us again,” she told MassLandlords. “I got my money though!”

It seems there are some small successes if you’re willing to do the legwork and chase down your money. Whether it’s worth the effort is up to you.

Conclusion

Evicting a non-paying tenant takes time, money and a whole lot of patience. Actually seeing the money you’re owed takes even more. It’s why we advise you to stay out of court if possible. If you can’t avoid it, then there are some benefits to getting a judgment in your favor.

You may get lucky and have a tenant who doesn’t want the mark on their credit report, so they pay what they’re owed. Or, they may have a good job they don’t want to lose, and you may be able to get a wage attachment. Maybe you keep tabs on them and have your judgment recorded when they buy property of their own. Perhaps you don’t mind setting up something with a collections agency and waiting it out.

But more often than not, it seems, in Massachusetts, that money is probably gone.