Natural Disasters Cause Spike in Homeowner’s Insurance Premiums

. Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

Homeowner’s insurance premiums are on the rise across the country due to natural disasters. Massachusetts is no exception. One analysis of policyholder data found that home insurance premiums rose 15% in the bay state between May 2022 and May 2023.

Wildfires in California have caused billions of dollars in property damage, causing some insurance companies to stop writing policies in the state. (License: Ross Stone for Unsplash)

Just how much Massachusetts residents are paying for home insurance is unclear. NerdWallet reports that the average rate for policies in 2024 is $1,320. That’s significantly less than the national reported average of $1,820. However, Massachusetts-based insurer Plymouth Rock Assurance suggests rates are higher, at least in certain areas. For example, Bristol County has an average annual home insurance cost of $2,165. Middlesex County comes in at $1,987. Data for multifamily homes is harder to pinpoint, so we consider these numbers a “per unit” cost.

There are a lot of variables when it comes to how much homeowner’s insurance will cost individual property owners. No matter what your costs are, however, you’re almost certainly paying more than you were last year. Next year’s premiums will likely be higher, even if you submit no claims.

Regardless of whether a homeowner has made a claim, insurance rates must increase just to keep up with inflation. But big jumps in premiums are another story. The biggest reason for a much higher bill is often due to natural disasters, such as wildfires and flooding.

How Natural Disasters Are Testing the Insurance Industry

Different regions of the United States face a variety of natural disasters that can cause devastating property damage. California faces catastrophic wildfires. Florida and Texas have serious hurricanes and flooding. Here in Massachusetts, blizzards, coastal storms and flooding are the most common natural disasters.

These weather events can cause billions of dollars in damage. When a small number of insured homeowners make a claim for damage, insurance companies can handle the loss. When thousands of properties are destroyed, and billions of dollars in damage accrues, the few insurance companies that share those clients must pay out those astronomical sums all at once.

The Associated Press reported that the homeowner’s insurance industry in the United States has had multiple consecutive years of underwriting losses. Losses in the first half of 2023 were $24.5 billion, a number that is close to the total amount of loss reported for all of 2022. A PBS Terra Nova video that discusses how wildfires are impacting the insurance industry noted that there have been 267 wildfire disasters with at least $1 billion in damage since 2020. According to the video, the 2017–18 wildfire season wiped out double the amount of profit seen in the prior 26 years combined.

As a result, some major insurance companies refuse to insure properties in high-risk areas. PBS reported that some providers have stopped writing new policies in California altogether, including industry giants Allstate, State Farm and Farmers.

What does this mean for homeowners? As of 2022, approximately 63% of U.S. homes have mortgages, and almost all of those mortgages will have some sort of insurance requirement. If you cannot get insurance, your home value will drop, and you may not be able to sell your home or get a mortgage if you need one. Homes become overvalued at that point.

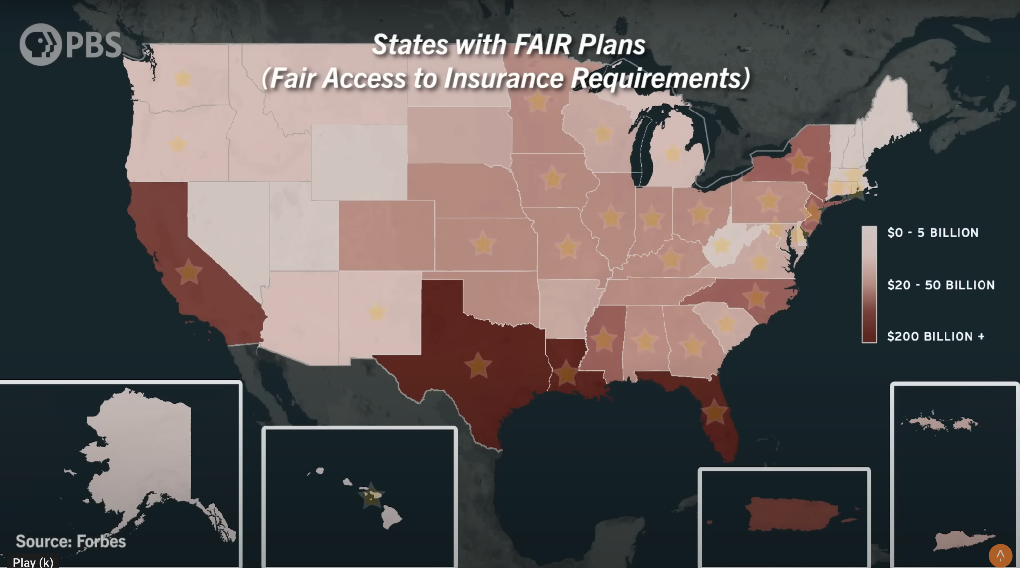

As natural disasters continue putting properties at risk, more and more states have adopted insurance requirements under the FAIR plan, as shown by this PBS Terra map. These last-resort insurance plans are expensive and offer less coverage than traditional plans. But because many insurers operate nationally, FAIR plan losses in California, Texas, Louisiana, and Florida impact premiums here in Massachusetts. (Fair use, PBS Terra)

High-Risk Properties Are Expensive or Impossible to Conventionally Insure

If you have too many car accidents, your auto insurance provider may drop you as a client. Similarly, if you have multiple homeowner’s insurance claims, you may find yourself insurance shopping. But sometimes, insurance companies opt to not renew policies because the area your home is located in has become too high-risk. Then, conventional insurance policies may be entirely off limits.

What happens when homeowner’s insurance is unavailable, or too expensive?

To address the problem, many states have Fair Access to Insurance Requirements (FAIR) plans, a safety net for the most at-risk properties. In Massachusetts, this is handled by the Massachusetts Property Insurance Underwriting Association. These plans provide insurance to homeowners who have not been able to get policies through the voluntary (conventional) market. You may be familiar with FAIR plans if your rental properties have knob-and-tube wiring. But such plans are not without risk, or expense.

High-risk insurance pools provide expensive coverage and may cause insurance companies to leave the state.

FAIR plans provide insurance of last resort to homeowners who can’t get insurance through conventional means. They are policy groupings, or insurance pools. Such plans tend to be more expensive than traditional insurance policies. They also frequently offer less coverage compared to conventional plans.

However, as natural disasters increase, more and more homeowners may find themselves turning to these “last resort” plans.

The National Flood Insurance Program seems constantly in jeopardy.

Most home insurance policies don’t automatically cover flood damage. Owners with properties not in designated flood zones may be able to add additional coverage to their policies. For these homes, such additional coverage is not as expensive as the main policy.

For residences in flood zones, however, the cost of getting home insurance at all, never mind insuring a property against flood damage, can be very expensive. The federal government tries to mitigate some of the cost through the National Flood Insurance Program (NFIP). Federal funding backs the plan, which subsidizes some of the cost.

However, funding for this program seems to be perpetually at risk. Congress must re-authorize the program every few years. Between 2023 and 2024, the program saw multiple short-term reauthorizations, but it is at risk of expiring if something more permanent is not decided soon (as of publication, Congress has until midnight on March 8, 2024, to reauthorize the NFIP). If the NFIP is not re-authorized, participating insurance providers will not be able to create or renew flood insurance policies.

In other words, homeowners with high-risk properties are left with policies that are often very expensive and less comprehensive. In some cases, homeowners may be left uncertain if their policy will even be renewed. If prices keep increasing, and natural disasters continue to imperil more properties in at-risk zones, what should homeowners do?

The clearest answer is to stop building and investing in areas that are high risk for natural disasters. It’s too risky, too expensive, and your properties are almost guaranteed to trade at a discount when you’re ready to sell. Additionally, the more we encroach on these areas, the less sustainable life becomes for everyone.

Heavy rainfall can overwhelm streets and lead to flooding, which is often not covered by standard home insurance policies. Cambridge rain like this now routinely turns puddles into yard flooding. (License: Yassine Khalfalli for Unsplash)

Climate Change is Not Going Away

Hurricanes can cause extensive property damage, through high winds, heavy rainfall and flooding. While sophisticated equipment has made it easier to predict hurricanes and tropical storms, giving people time to prepare against them, global warming has impacted how strong these hurricanes are. Rising sea levels and warmer ocean temperatures are a perfect recipe to make things more intense.

Tom Knutson, a leading climate change scientist for the National Oceanic and Atmospheric Administration (NOAA), notes that even if a hurricane’s intensity remains the same, the fallout from the storm can be more damaging.

“Even if hurricanes themselves don’t change [due to climate change], the flooding from storm surge events will be made worse by sea level rise,” he told NASA.

Though most people think of Florida when they think of hurricanes, Massachusetts is not without its share of storm-related problems. Throughout the winter of 2024, heavy snow forecasts had coastal towns preparing for flooding and storm surge. And it doesn’t end with storms.

For a clear example of how human encroachment is affecting the environment over time, we only have to look to one of the Northeast’s most popular vacation destinations.

Cape Cod is a popular place to vacation and build a second home, especially when you’re pretty much guaranteed weekly rentals at a premium throughout the summer.

But what is this doing to the cape? Despite long-term efforts to preserve the natural beauty of Cape Cod, erosion is fast wearing away the shoreline. And so many homes built on such fragile land has also negatively affected water quality. Estimates show that 90% of the coastal bays on the cape, as well as more than a third of its ponds, are polluted by nitrogen and phosphorous, primarily due to untreated wastewater leaching from the many septic systems on the peninsula.

The various towns on Cape Cod will have to invest billions in sewer treatment infrastructure to combat the problem. Some are arguing for compost toilets to reduce the strain on the environment. It may sound surprising, but the real answer may be that it’s time to stop building on the Cape.

Coastal erosion isn’t the only environmental issue Cape Cod is having. Studies have shown the septic systems on the cape are negatively impacting the water in coastal bays and ponds as well. (License: Unsplash)

Climate Change Is a Problem Our Leaders Are Slow to Fix.

It’s all well and good to tell people not to build or buy in high-risk zones. We can offer tips on how to lower your expenses if you already have a high-risk property (see next section). But that doesn’t stop the actual problem, which is that without serious efforts to combat climate change, we’re in big trouble.

We can tell every consumer out there not to buy property along the shore, but that isn’t going to stop sea levels from rising. We can tell you how to reduce greenhouse gas emissions in your rentals, but that only accounts for around 20% of all such emissions.

Mom-and-pop landlords can’t single-handedly reverse global warming. Nor is it feasible to expect insurance agencies to keep covering the costs of natural disasters. Eventually, the premiums are going to be so high that no one will be able to afford them. We are already seeing companies pulling out of certain areas to reduce their costs, leaving homeowners with fewer and fewer options.

We can’t solve this with good intentions. Industries love to put responsibility on the individual, but it’s simply not enough. Take recycling. We can hand out paper straws and recycle our water bottles until the cows come home, but individuals aren’t the ones responsible for the mismanagement that has led the Great Pacific Garbage Patch. Similarly, we cannot out-insure increasingly severe hurricanes. We need global solutions from our leaders and corporate accountability to see meaningful change.

At MassLandlords, we are working hard to find ways to protect everyone’s future in Massachusetts. In 2023, we proposed a climate resilient capital task force, and will continue to introduce bills that aim to protect the land we live on. But that’s not enough if the bills don’t go anywhere.

Got a High-Risk Property? Take Steps to Reduce Expense.

If your property is in a high-risk flood zone, there are steps you can take to lower your insurance premiums. The National Flood Insurance Program has many suggestions for homeowners looking to lower their cost for flood insurance. They include elevating utilities above water levels, filling in basements and elevating your property. There’s also a detailed guide from 2014 about retrofitting properties in flood zones.

After all that, however, one cost-saving suggestion from the NFIP is “relocating your home or business.” In other words, if you can, choose to build or buy elsewhere. That won’t guarantee you’ll never see flood damage. But it will reduce your risk compared to knowingly building in a flood zone.

Conclusion

Climate change is here to stay, and fighting its effects will be a longstanding battle. Our advice is to talk to your financial advisor about the best time to sell off any assets in high-risk areas, and avoid investing in any new properties in such places. We also highly suggest you speak to your representatives about backing climate-friendly legislation before there are even fewer places left to safely live.