Issue IRS form 1099-NEC for Contractors by January 31 Each Year

| . Posted in advice - 0 Comments

Landlords, property managers and investors who pay non-employee contractors more than $600 in a tax year must report these payments on form 1099-NEC. Read the Internal Revenue Service instructions. A contractor is a 1099 contractor if you paid them at least $600 in services (including parts and materials), and they're not a corporation that pays its own taxes. This means you have to mail the contractor and the IRS a form 1099-NEC.

Note: LLCs are not necessarily corporations that pay their own taxes! For tax purposes, LLCs can be treated as either pass-through partnerships or pay-on-their-own corporations. You need to know which they are.

How Can You Tell if an LLC Is a 1099 Contractor?

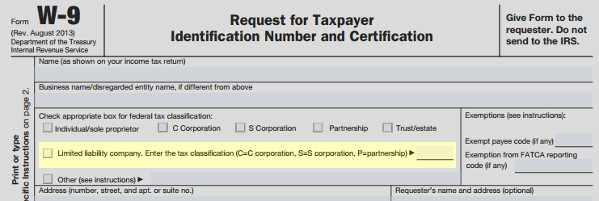

Ask them to fill out form W-9. You'll see when you view it that there's a section where they must indicate their tax status:

Ideally, give this form to a contractor before you hire them. If they are unwilling to fill it out, this may indicate a general non-compliance with the rules.

What Happens if I Don't Issue Forms 1099-NEC?

This will dramatically increase the chances of an audit. If an audit finds you failed to report amounts on 1099-NEC, you will owe the tax the contractor should have paid, plus penalties and interest. An audit may also substantially decrease your quality of life: It takes time to respond to auditor demands and the process can be unfriendly, depending on the auditor.

What If I Forgot, Can I Issue the Forms Late?

Yes, better late than never.

Where Do I Get Form 1099-NEC?

Small landlords can order information returns by U.S. mail. Make sure to visit the employer page, not the individual taxpayer page. Make sure to order both forms:

- Form 1099-NEC

- Form 1096 is the cover sheet to form 1099-NEC

You can also order instructions.

Larger landlords may find your accounting software can file forms for you.