Short-term Rentals

By Peter Vickery, Esq, Legislative Affairs Counsel

In Massachusetts, using your property for short-term rentals may be banned, or may require registration, special permitting, or paying taxes like a hotel starting July 1, 2019.

Short Term Rental Tax Double Whammy

A new statewide law takes effect July 1, 2019, hitting owners of short-term rentals (e.g. Airbnb operators) with a double whammy. In expanding the room-occupancy excise tax to cover short-term rentals the Legislature imposed not only the state tax of 5.7% but also gave municipalities the right to charge an additional 6%.

Municipalities can charge 9% instead of 6% if the owner rents out two or more units, a differential that lawmakers call a “community impact fee.” Most of the local excise tax money goes into the municipality’s general fund, with the exception of the community impact fee funds, of which the town or city must earmark at least 35% for affordable housing or local infrastructure projects. Communities that are in the Cape Cod & Islands Water Protection Fund are able to charge a further 2.75% for projects to address water pollution.

For an overview of the law’s scope and exemptions and for the Department of Revenue’s more detailed explanation, read the Mass DOR FAQ and Technical Information Release 19-3.

Another helpful Q&A was written by Attorney Richard D. Vetstein, author of the Massachusetts Real Estate Law Blog.

Note that there is no-statewide registry, in the sense of identifying properties, but all short-term rental businesses do need to register for the short-term rental tax on MassTaxConnect. Note also that there may be local municipal registries that do identify specific properties separately for each town or city. Do not operate after July 1, 2019 until you have registered on MassTaxConnect and complied with all local registration requirements.

Municipal Ordinances/Bylaws

As well as paying the state and local excise taxes, property owners also have to comply with municipal ordinances and bylaws that apply specifically to short-term rentals.

The following municipalities have adopted bylaws/ordinances that affect the ability of property owners to engage in short-term rentals. We may update the list as more communities follow suit, however note that it seems likely all communities will eventually pass some restrictions.

Boston

The Boston ban for investors was first passed by City Council on June 13, 2018, Docket #0764. The Boston ordinance sharply curtails who can rent out units, and has been challenged in federal court by Airbnb. Certain provisions are in force while others remain unenforced pending the litigation. We wrote about Boston’s Airbnb ban extensively.

Cambridge

The Cambridge ban predates the Boston ban by a year, and is largely the same as what the Boston article describes. Cambridge Ordinance 1397 should be read by operators.

Lynnfield

Short-term rentals are banned without a permit. No permits have been known to be granted.

Richmond

Owner-occupied single-family dwellings temporarily vacated for 30 days or less do not fall within the Town’s definition of “Short Term Room Rental Business.” But absentee owners do come within the definition, which means that if the owner does not reside in the property a special permit is necessary.

Salem

Short-term rentals are permitted subject to payment of the transient occupancy tax, licensing, and (depending on the zoning district) granting of a conditional use permit. Non-resident owners must name a local representative. For accessory short-term rentals, the owner must live in the unit for at least 270 days of the year.

Saugus

Short-term rentals are banned except in specially designated zones.

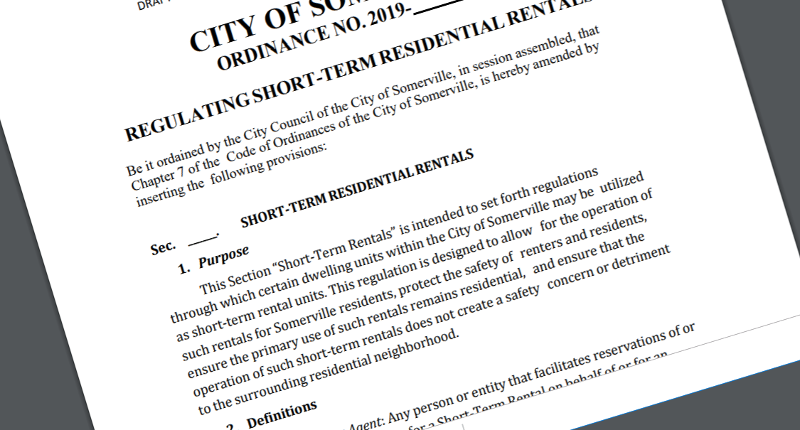

Somerville

Effective May 23, 2019, Somerville’s ordinance permits short-term rentals under two programs (Tourist Home Accessory Use and Historic Bed & Breakfast) but prohibits short-term rental of an entire unit.

West Newbury

Short-term rentals are permitted in owner-occupied premises subject to the owner obtaining an annual license.

Williamsburg

Short-term rentals of up to four rooms are permitted in single-family dwellings that the owner or leaseholder occupies for at least 183 days of the year, subject to registration and licensing.

Always consult with your local town or city government for additional information concerning inspections and other requirements not identified here.