Landlords Raising Rent in Anticipation of Possible Rent Control Deadline; Nonprofit Loophole

. Posted in News - 0 Comments

In a clear demonstration of the unintended consequences of rent control, landlords in several office hours and on MassLandlords message boards have shared their difficult decisions to raise rents on long-term renters currently paying below-market rents. The November 2026 ballot initiative set a deadline of Jan. 31, 2026, from which all future controlled increases would be calculated. MassLandlords does not endorse these preemptive rent increases.

![The Facebook banner image shows a protest outside the state house. Masked supporters hold signs. One sign reads in Spanish, “tener un techo es un derecho.” Another reads, “housing is a human right.”]](https://masslandlords.net/app/uploads/landlords-raised-rent-homes-for-all.png)

A screenshot of the Homes for All Mass Facebook page showing 413 followers as of November 18. Even small things can have outsized impact on the world. (Image: Fair Use)

The ballot initiative text was defended by Massachusetts Law Reform Institute and Heisler, Feldman, & Ordorica, P.C., before the Attorney General as part of ballot certification. There was no recognition in their brief or comments that landlords might preemptively respond to the ballot text by raising rents in advance. The renters most harmed by the proposal are those currently most in need of stabilization.

If the ballot initiative as written were to pass into law, rents would be able to increase by either 5% or one of the Consumer Price Indices, whichever is lower. (The text does not specify which index.) The text states that the rent on Jan. 31, 2026, would be the rent from which all future increases must be calculated. There is no provision for vacancy decontrol. This means that if a renter leaves, the new renter pays the old rent until the next annual increase. Then any increase is controlled to 5% or CPI, whichever is lower. Below-market rents would remain so forever.

Anonymized Example: Long-Term Renter, Senior Harmed

Consider the following scenario, representative of the kind reported to MassLandlords:

A long-term renter had been a good and contributing member of their community. They had been very flexible with repair scheduling, as well, which was important to the landlord because the apartment is old. (It meets code, but repairs are frequent.) In recognition of the age of the unit and the ready cooperation of the renter in all matters, the landlord had not raised the rent for the last 10 years. The apartment rent should be $3,000 per month. The rent charged prior to the ballot initiative was $1,500 per month.

The landlord read the ballot initiative, and calculated that this unit would be forever tied to its rent on Jan. 31, 2026. But they knew this renter would not live in the unit forever. In fact, they expected this renter may not live in the unit for even a few more years on account of their plan to downsize.

The ballot text gives the landlord few exemptions of any kind. If the rent is only $1,500 on Jan. 31, then it will be more or less that rent forever. Were they to remain forever under market because they provided what amounts to private charity to this senior? Are they to be punished for keeping the rents low, doing exactly what renter advocates want a landlord to do?

The landlord’s response in this case was swift and callous. The lease was long expired. The tenancy was at will. The landlord terminated and offered a new tenancy at $3,000 per month. We don’t know whether that senior is able to afford the new rent, but presumably not. This rent increase will likely accelerate their plan to downsize. A year before it passed, rent control has already destabilized this household. And as we stated above, this is not an isolated incident the last few months.

Think Carefully Before Deciding To Raise Rent

At MassLandlords we’re all prohibited (including members) from discussing what we should do with rent prices. There are federal antitrust regulations preventing this, as we were reminded recently with the litigation around RealPage. We cannot advise what to do.

Widespread best practice seems to be to make modest increases in proportion to actual changes in expenses, market conditions, inflation or by factoring in all three. Failing to raise the rent at all can result in the dynamic described above, where suddenly large changes are needed, to disastrous impact.

MassLandlords’ mission is to create better rental housing. “Better” is a powerfully broad term. It includes “more affordable.” Raising the rent quickly on seniors is not better, in the broadest possible sense of the word. Instead, it is exactly the kind of bad behavior that would galvanize support for rent control. Even if rent control were to pass, raising rents unsustainably quickly could lead to picketing by proponent organizations, as they have picketed landlords in the past. This is true regardless of how well justified an increase may be.

There is a significant loophole in the ballot text to keep in mind.

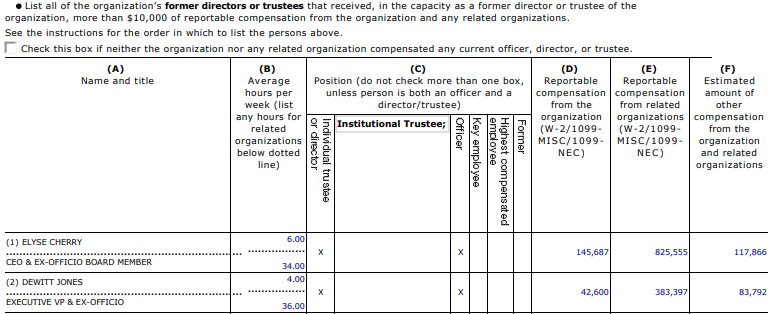

The 2023 form 990 from nonprofit BlueHub Capital shows that nonprofit compensation can be complex and lavish. Here CEO Elyse Cherry cleared over $1 million annually from a network of related organizations working a normal 40-hour work week. (Image: Fair Use)

Ballot Text Loophole: Nonprofits Exempt

The ballot text exempts nonprofits. (Most renter-sponsored initiatives exempt housing owned by nonprofits.) You can own rental housing as a nonprofit. Lots of organizations do, including the community development corporations. But who else is a nonprofit? MassLandlords, for one. And you can be, too.

If rent control in the future were to become a burden to you, you could potentially form a nonprofit. Nonprofit doesn’t mean non-salary. In fact, housing nonprofits can even have outsized compensation schemes. The CEO of nonprofit BlueHub Capital, Elyse Cherry, whose organization has been sued over unfair and deceptive practices, reported $1,089,000 in income on the 2023 BlueHub tax return. Even without notoriety, the top 10 executives at the Southern Middlesex Opportunity Coalition (SMOC) are all reported to make six figures, with the chief executive earning more than $300,000 a year. Nonprofit salaries are subject to board approval, true, but boards are typically made up of executives from like organizations. This creates a large, self-gratifying circle. (The same is true of for-profit companies with separate boards.)

To move your existing property into a nonprofit, you will have to form the nonprofit. This requires a public purpose. For many of us, it would be straightforward: Our purpose is to provide housing to people who cannot afford their own home. Easy enough. Many of us rent to such renters already anyway.

It is not necessary to establish a separate board for each LLC. A process called “fiscal sponsorship” can provide oversight for multiple efforts.

When your buildings are owned by the nonprofit, you can potentially apply for exemption from local real estate tax. Nonprofits do not pay real estate tax. This money saved can go to paying taxes on the income you will make. A typical landlord takes income via Schedule E, which passes through to our personal return offset by depreciation. Instead, we’d have to be W-2 for the nonprofit. When we did the math for a typical three-decker, we found that the real estate tax saved and the employer and employee taxes paid were roughly offsetting. You may earn a little more as a nonprofit, or a little less.

The hard part is financing. Your bank may not want the property deeded to a nonprofit without clearing their mortgage and issuing a new one. Or you may need to find a new lender.

This is all hypothetical, with details to be sorted through if and when it happens. Suffice it to say we at MassLandlords have created two nonprofits before. You likely can, too.

All of this is to say the rent control ballot initiative may be worked around.

And keep in mind, we plan to litigate. It would be better to continue supporting our local towns and cities by paying real estate tax, than to switch all rental housing to nonprofit hands. After all, real estate tax pays for the roads, the bike lanes, the schools, the trash service and much else that makes our investments work out.

We will keep you updated.