Judge Decides in Favor of Homeowners in BlueHub Lawsuit, Nonprofit To Appeal

| . Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

A nearly five-year legal battle got some resolution this September when Superior Court Chief Justice Michael Ricciuti ruled that BlueHub had violated consumer protection laws when it provided home loans with shared appreciation mortgages to its participants.

10 Malcolm X Blvd. in Roxbury, the address BlueHub Capital calls home. (Image: Google Earth)

The partial summary judgment, filed on Sept. 5, 2025, addressed the main questions surrounding the case, but did not address relief or damages. Those will be determined at a later trial, along with any outstanding issues not addressed by the court’s decision.

This article will discuss the main points made in the court decision, but you can read the full decision as well.

BlueHub CEO Elyse Cherry discussing fraud before the legislature at a hearing in 2023. (Image: Public Domain)

BlueHub SUN Background

BlueHub Capital is a Roxbury-based nonprofit that offers to help homeowners retain possession of their properties when they are on the brink of foreclosure or have been foreclosed upon. The company negotiates with the original lenders who hold the title, and buy the property at a discounted price. BlueHub then sells the property back to the homeowners with a new, lower mortgage.

BlueHub testimonials praise the fact that this practice has helped many people remain in their homes. But the help is not without cost. Homeowners who closed on a mortgage with BlueHub may have reasonably expected higher interest rates. But many claim they were surprised when they went to sell or refinance their home and learned they had a second loan on the property.

This second loan, called a shared appreciation mortgage (SAM), required BlueHub homeowners to pay the nonprofit a percentage of their accrued equity – sometimes more than half of it – before they could sell, refinance, or otherwise access their home equity. Some BlueHub clients claimed they were not told about the shared appreciation mortgage, or were not told how much equity the lenders would be asking for.

This alleged lack of proper disclosure was the basis behind the lawsuit against BlueHub, which started in 2020. BlueHub has defended itself, stating all terms were disclosed.

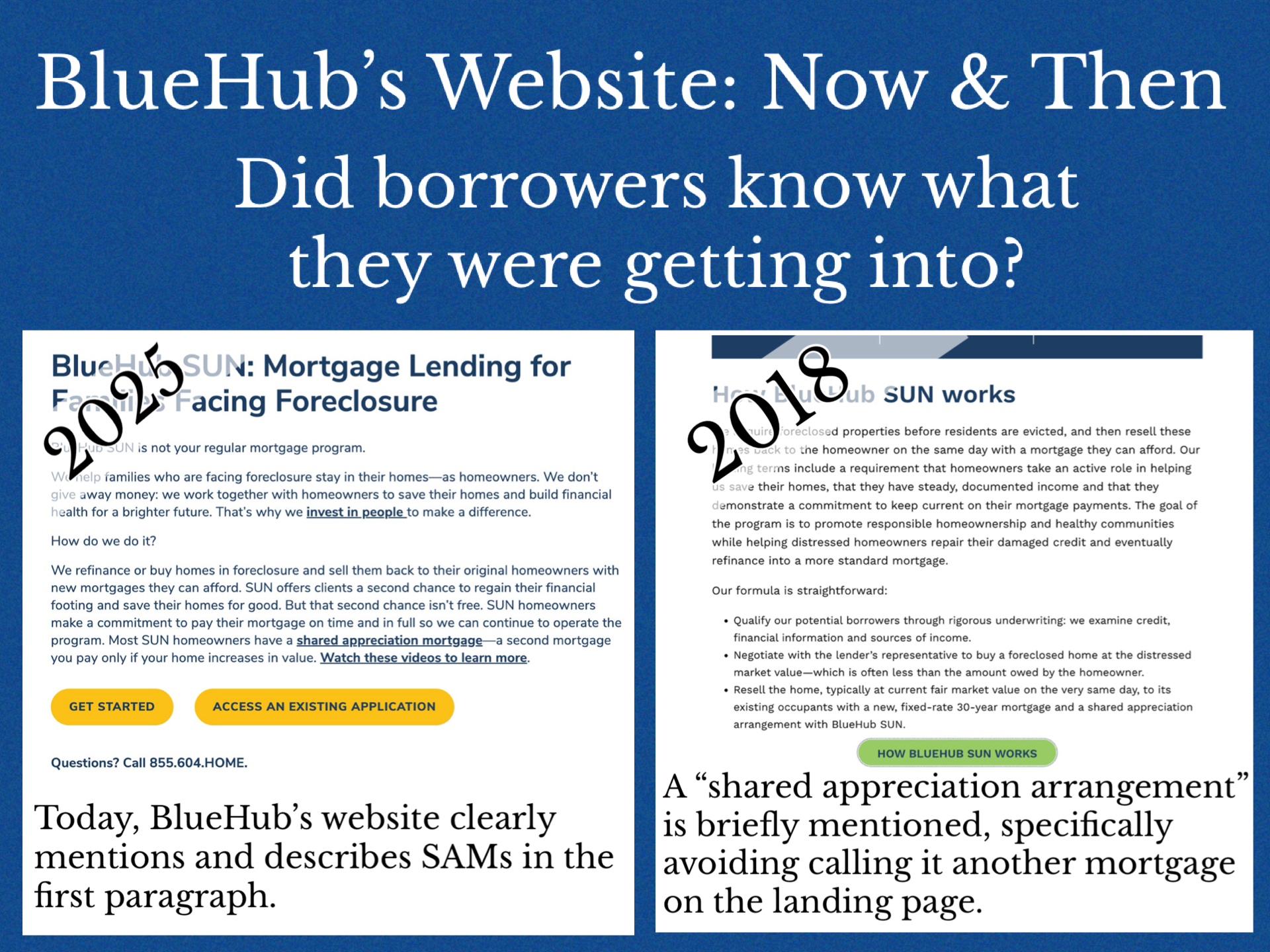

Today, the “Foreclosure Relief” section of BlueHub’s website clearly outlines what a SAM is. But in 2018, the equivalent of that section mentions only a “shared appreciation arrangement” much lower on the page, with nothing calling it a second mortgage. (The “learn more” link was not archived; we do not know what it said if you clicked on it.) [Image: cc BY-SA 4.0 MassLandlords Inc.]

Court Determines BlueHub Practiced Loan Splitting; Did Not Properly Disclose About SAM.

Two key points the court decision addressed surrounded how BlueHub set up mortgages and disclosed information about shared appreciation mortgages.

The court determined that BlueHub engaged in “loan splitting.” It said the primary mortgage and shared appreciation mortgage should have been a single transaction from BlueHub. BlueHub has a separate division that handles the actual mortgage lending, but the court found they largely operate and are perceived as one entity. Loan splitting can violate the federal Truth in Lending Act if consumers are expecting to undertake one loan, but documents are prepared as if there are two loans in play.

“Taken together, several facts in the record demonstrate that Defendants and Plaintiffs participated in a single transaction involving the SAM and Aura mortgage and that therefore Defendants have engaged in loan splitting,” the court decision reads.

On federal Truth in Lending forms, when asked if there was a balloon payment associated with their mortgages, BlueHub never checked “yes.” Nor did they inform borrowers about a balloon payment. A balloon payment is a large amount that would be due when a customer attempted to refinance, sell, or otherwise access their home equity. The court determined the SAM did in fact constitute a balloon payment.

Related to this, and possibly most important to the plaintiffs, the court determined that BlueHub had not properly disclosed the full terms of the SAMs to its borrowers.

2024 Law Is Not Retroactive To Current Case

The ruling also stated that the 2024 legislation introduced by Governor Maura Healey could not be retroactively applied to the lawsuit. The law gives immunity to companies that offer shared appreciation mortgages as long as the terms of the agreement are properly disclosed. The immunity law left it up to the attorney general to create regulations governing disclosures.

And though BlueHub is not specifically mentioned in that legislation, the nonprofit was then, and remains, the only company offering shared appreciation mortgages in Massachusetts.

Plaintiffs in the case were concerned that because the case did not have a ruling at the time Healey’s legislation was signed into law, it could be applied to their complaint. This is partially due to the fact that shortly after the legislation became law, BlueHub filed a notice of supplemental authority with the court.

Attorney General Andrea Campbell was quick to file an amicus brief with the court suggesting the law should not be applied retroactively. This decision confirms that.

Healey’s legislation is subject to regulation by the attorney general’s office. Campbell introduced prospective regulations that would require more transparency with borrowers, including the maximum amount that could be due from the shared appreciation mortgage, as well as disclosures about any balloon payments.

Ruling Did Not Find Evidence of Deceptive Practices

The court did not find entirely in the plaintiffs’ favor with their ruling. It dismissed claims that BlueHub forced borrowers to sign unfair contracts, as well as sweeping claims that BlueHub acted dishonestly.

Court documents show that several of the plaintiffs admitted that they had not read all of the documents presented to them prior to signing off on their mortgage with BlueHub.

“Plaintiffs cannot show procedural unconscionability because the record reflects that they had ample time to read the SA note and SAM prior to closing,” the judge determined.

Still, the courts did find BlueHub was at fault on several counts, including loan splitting and improper disclosure, findings the nonprofit strongly disagreed with.

BlueHub Responds, Plans To Appeal Decision

After the judge’s decision was published, BlueHub CEO Elyse Cherry told the media she strongly disagreed with the ruling and stated the nonprofit would be appealing.

In her Sept. 1 interview with CommonWealth Beacon reporter Jennifer Smith, Cherry painted an altruistic picture of the origins of BlueHub’s SUN program during the 2008 financial crisis (also known as the Great Recession) – and placed the blame of the shared appreciation mortgage requirement on the original housing lenders.

“We had people all over the country being tossed out of their homes, being put on the street. …For good reason or bad, they couldn’t pay the money back,” Cherry told Smith. She said BlueHub began approaching housing lenders, proposing to buy the mortgages at a discount to avoid foreclosure.

“They said ‘if we allow people to stay in their homes and not pay their full mortgage, why would anybody pay a mortgage?’” Cherry recalled, adding that the banks eventually accepted her proposals, on the condition that the borrowers gave up some of their home’s eventual appreciation, or equity.

Cherry said the judge misinterpreted what BlueHub is about when it ruled against them. She provided the hypothetical example of a homeowner who owes $500,000 on their mortgage, which they are unable to pay. BlueHub, she said, goes in and negotiates with the lenders, buying the house and selling it back to the original borrower at a markup, but at an amount still lower than the original loan, perhaps $300,000.

“Not only are they in their home… but they have such a lower mortgage, they’ve been released from the initial $200,000, and they’re way ahead on appreciation by the time they get to where they would have been had they just paid their mortgage,” Cherry said.

Unstated went the fact that this much larger appreciation over the original mortgage also benefits BlueHub. People who use the program may owe 40% or more of their equity when they sell, refinance or pay off the home. Cherry claims that money is re-invested into the community and that BlueHub is “not a business line at which you make lots of money.” (When reporters from Boston Public radio reminded Cherry in another interview that her salary and other benefits hover around $1 million annually, she responded that the board sets her salary.)

BlueHub Customers Spoke Out Against Nonprofit

Though BlueHub’s website has testimonials singing the company’s praises, other customers were not happy with what they viewed as deceptive practices. This includes Jonandria Jones-Booker, who turned to BlueHub in an effort to save her home. She spoke with MassLandlords in 2024, around the time Gov. Healey signed the legislation exempting BlueHub from the state’s consumer protection laws.

Jones-Booker said that throughout the closing process with BlueHub, she and her husband were not told about the shared appreciation mortgage they would later learn was attached to their property. They learned about the SAM when they attempted to refinance their home, at which point they were told they owed BlueHub over $95,000 in equity before they could refinance.

“We were devastated,” Jones-Booker said.

Other plaintiffs in the lawsuit also showed up at a hearing to testify about what was then pending legislation, telling their stories in hours of testimony.

“They are criminals,” Derrick Harper, a BlueHub client, stated at the hearing.

Conclusion

There’s a lot to unpack with BlueHub’s practices. On one hand, the company has kept people in their homes when the owners otherwise would have lost them due to inability to pay. On the other, just because a practice is lawful doesn’t mean it can’t be predatory.

We still think it’s questionable that Healey introduced and signed legislation that offers special protection to one specific group that happens to be led by a friend and strong political supporter. (Cherry has stated that she extends support to many candidates.) We applaud the attorney general for writing restrictions that will make for more thorough disclosures, while raising an eyebrow at the referrals the attorney general’s office made to BlueHub over the years. The BlueHub website is very clear about shared appreciation mortgages now, but that wasn’t always the case.

We need more transparency overall. Will Campbell’s regulations go through and provide that for those who may seek relief from BlueHub in the future? We can hope. In the meantime, we will continue to follow the BlueHub trial as it proceeds.