It’s a Great Time to Refinance, Especially Cash Out

| . Posted in News - 2 Comments

MassLandlords recently spoke with a commercial lender about the Greater Boston rental real estate market. The lender requested not to be named because their bank needs to review public statements, which would take so long as to render this article untimely. We have tried to convey the essential information here. Any errors or omissions are our own. Check with your preferred bank for alternative viewpoints.

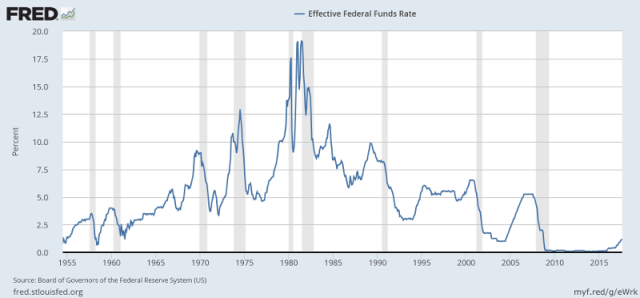

Historically low interest rates are at an end. Prices remain high.

Rents Peaking

From 2012 to 2015, we saw what may in hindsight be considered “peak growth” in rent rates, 6%/yr. Now in late 2018 we’re seeing 2 to 3% per year, and in some cases rents are stagnating. In Greater Boston, there’s a lot of Class A real estate with amenities, a doorman, etc. Concessions are needed to make these higher rents compare well in the market.

Boston is certainly unique: there’s a big supply on the market but there’s a lot of pent-up demand, so there’s great absorption at the moment. It’s like a renaissance of development and new housing. Rents overall are still very strong. As of yet there’s no sign of slackening.

Inside the “128 Beltway” is considered a safer lending area because rents remain strong through cycles.

Hot areas in Greater Boston are Quincy (a phenomenal area, great value recently), Chelsea (so close to downtown), Revere, and Everett, especially pending the new casino. Chelsea is the next East Boston.

Purchase Prices High Despite Rising Rates

On the acquisition front, we’re at an impasse. Rates have been so low for so long that values have skyrocketed in real estate compared to other asset classes. Interest rates should be driving prices down from 2015, but overall the higher interest rates are also driving higher expected cap rates. Despite rates having gone up 300 basis points in the last three years, sellers are not coming down any in price.

Acquisitions have therefore really stalled. This will be obvious if you have been in the market comparing rent levels to asking prices. It’s hard to find properties that will cash flow or meet desired returns.

Refinance Now?

The 2006 and 2007 pre-collapse mortgages all came to maturity in 2016 and 2017. Many commercial borrowers refinanced early in 2014 and 2015. This “wall of maturities” in 2015 was probably the peak of the refinance cycle. The last three years may have been an unnoticed correction from a banker’s point of view.

No one knows where rates will go long-term. We can and do set expectations for the next 12 to 18 months. In that timeframe, it’s all but certain that rates will rise. So if your mortgage is coming due in the next 1 to 2 years, think about refinancing now.

Note that banks are in a lot better position now than they were in 2007. They can no longer do risky loans. For risky loans, there are other lending sources besides traditional banks. The banks themselves are sitting on strong portfolios. There are not many great deals out there, so a well-prepared commercial borrower can get a lot of attention.

There have been eight rate increases since normalization began in 2015, after 8 years of no rate increases. There’s another increase expected in the December timeframe. In 2019 another three increases are expected.

If your rents have increased, your property value may have increased appreciably in a lender’s eyes. Even with tighter lending standards, you may be well positioned to lock in a low rate and take cash out for renovation or acquisition.

The advice is to look at your portfolios, your rates, and which mortgages are coming due. Remember that in 2007, rates were 6%. Plan ahead and refinance earlier if it makes sense.