How to Get a Property Tax Abatement for a Rental Income Property in Massachusetts

By Kimberly Rau, MassLandlords, Inc.

There are few things in life as certain as taxes, and it’s a safe bet that most people don’t like paying them. However, if owners feel the amount they’re being asked to pay is unfair, often due to an inaccurate property tax assessment, they may be able to ask their city or town for a property tax abatement, even on rental income property. This essentially offers property owners a refund on the taxes they’ve paid for that year. While getting one is not a guarantee, if granted, a property tax abatement could save you quite a bit of money.

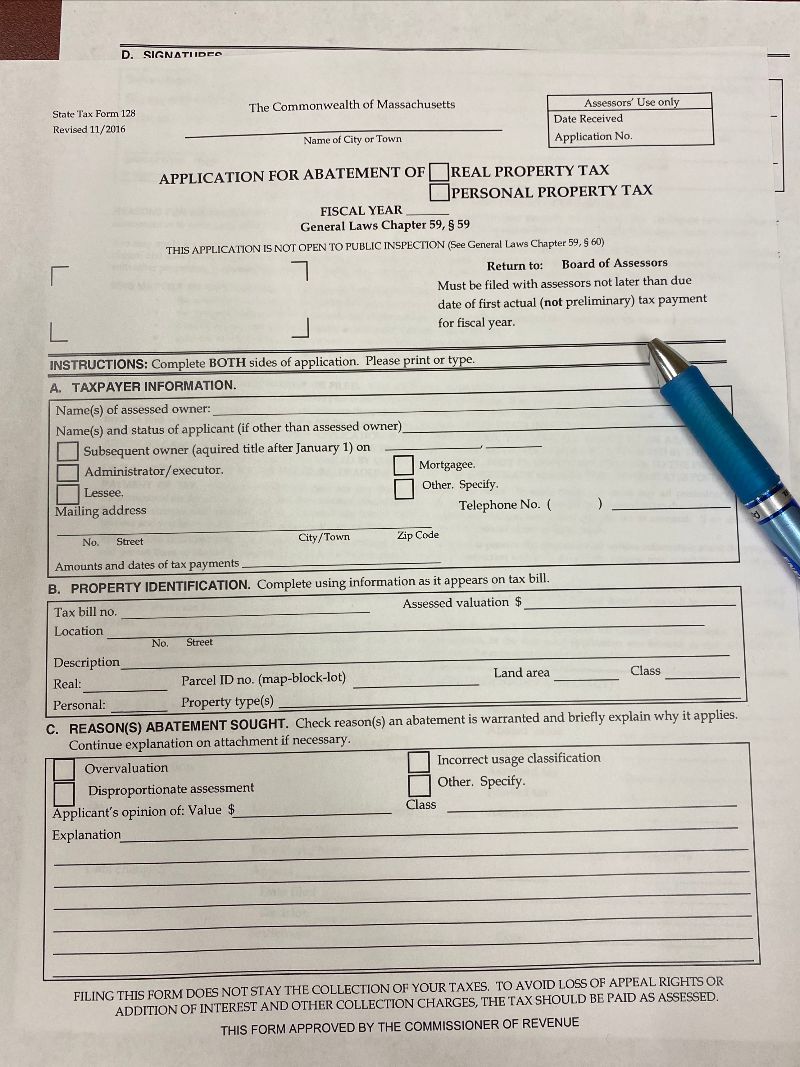

Seeking a property tax abatement for your rental income property? It starts with this form.

A Quick Overview of Property Taxes

Mass.gov sums up property taxes in a straightforward manner. “For many cities and towns, property taxes are the largest funding source for teachers, police, firefighters, and public works... and many other local resources and services.” Property taxes fund municipal responsibilities (that is, they do not go towards direct aid programs such as food stamps). Whether that’s new police cruisers or keeping a high school sports program funded for another year, property taxes are vital to the community.

That statement is especially true in municipalities where there is not a lot of tax income from commercial or industrial zones. In these areas, property taxes can fund up to 87 percent of a town or city’s budget. The Boston Chamber of Commerce put together an infographic that allows you to see what percent of Fiscal Year 2019 revenue came from property taxes in every town or city in Massachusetts. Boston, Worcester and Springfield got approximately 27, 24 and 17 percent of their 2019 revenue from property taxes, respectively. On the other hand, Carlisle and Sherborn each came in at more than 80 percent.

In 1982, after a ballot measure that was voted on in 1980, Proposition 2 1/2 (“two and a half”) was enacted. This put a cap on how much cities and towns could increase property taxes in a given year. Municipalities are not allowed to collect property tax revenue that is more than 2.5 percent of the assessed value of all of their taxable property. They are also not allowed to annually increase property taxes by more than 2.5 percent. These measures can be overridden by a citizen vote within an individual municipality if more revenue is needed for a specific project.

A drawback to the Prop. 2.5 cap is that when the rate of inflation exceeds 2.5 percent, as it often has since 1982, municipalities will see a decline in local tax revenue. This effectively decreases a city or town’s spending power, potentially hurting schools or other locally funded programs.

Of course, understanding why property taxes are important isn’t much comfort if you feel your taxes are still too high. In the next section, we’ll look at the differences between a property tax exemption and a property tax abatement.

Property Tax Exemption vs. Property Tax Abatement

Though the terms “exemption” and “abatement” are often used interchangeably in casual conversation, there is a difference between the two. You want to make sure you’re asking for the right thing when you visit your local tax office.

A property tax exemption is granted by a city or town and allows a qualifying person to be excused from paying all or part of their property tax for that year. However, these exemptions are not based on a property’s value. Instead, they are often circumstantial. For instance, elderly people with low or fixed incomes, religious organizations, or disabled individuals may qualify for exemptions. Rental income properties are typically not granted property tax exemptions.

A property tax abatement, on the other hand, is a reduction in the property taxes you have to pay based on your home’s value. The city of Westfield has a good breakdown of the reasons why someone may seek an abatement, including the tax office having incorrect information about the home (number of bathrooms, out-buildings that no longer are on the property, wrong square footage) or overvaluation. Overvaluation is when the assessed value of the property does not correspond to its true value.

In most circumstances, to file for a property tax abatement, you must be the current or assessed owner of the property, or an authorized agent. Check with your specific city or town if you are unsure about who should be filing for your property.

It’s important to note that you can have your tax office amend errors in factual data at any time (they say your property is 3,000 square feet, you know it’s closer to 2,500). However, if you do not go through the abatement process, any change in valuation will only be applied to the next year’s tax bill.

It’s also vital you remember that you must be current on your taxes while seeking an abatement. Pay your taxes on schedule as you normally would to avoid interest charges. If you get an abatement, it will act as a refund to you.

Where do I get a property tax abatement form?

So, now that you know a property tax abatement is what you’re after for your rental income property, it’s time to start the process of requesting one. Though certain parts of the property tax abatement process are regulated by the state, your first step will always be through your local city or town hall. That’s where abatement application forms are issued. Before you take a trip downtown, though, check your city or town’s website. Some municipalities make the form available for download, either year-round or when the window for filing is open. When and how you get your abatement request form is up to your local tax office.

There are strict timelines for when you can file your property tax abatement request, and cities and towns are not allowed to grant extensions. This is regulated by the state, and in most cases, your application must be filed before February 1. If you are paying your property taxes quarterly on a fiscal year basis, this is right before the third quarter’s payment is due. And while you may have missed the deadline this year, with such an involved process, it’s never too early to start thinking ahead.

How Do I Find Comps and Assessed Values to Get a Property Tax Abatement in Massachusetts?

In Massachusetts, there are three ways to determine property value: Cost, sales and income. For private homes, most owners seeking an abatement will go with the sales option, comparing the value of their home to recent comparable sales in the area.

If you are requesting a property tax abatement based on the assessed values of similar properties in your municipality, you will need to provide this information to your city or town. Called “comps,” these examples are of similar properties (this means things like lot size, square footage, condition, outbuildings, etc.) that are assessed at a value closer to what you think yours should be. Most Massachusetts municipalities want at least three comps as proof that your property is assessed too high, and multiple cities suggest that if you are using sales comps, they should be from 2018 or later. Tewksbury spells out that it wants those three comps, a full interior and exterior inspection (discussed in the next section), and information on when and how you purchased your property.

How do you find comps? Places like Zillow aren’t necessarily accurate, because market value does not equate to assessed value. If you are going with a sales approach (that is, looking at similar properties that have sold recently), start online or at our tax office.

For deeds, land sales and transactions, you can check MassLandRecords. The city of Boston also offers a tax parcel viewer, and lets you see your own property tax assessment here. In Springfield, the main site for the tax assessor’s office includes links to spreadsheets for comparable sales and street listings. Worcester’s property tax information is also available online, though you may need the owner’s name and other information to access certain property listings. The more information you can provide to back up your claim, the stronger your case will be, so again, due diligence is important here.

The Cost and Income Valuation Approaches

There are two other ways besides sales comparison to determine your property’s value: cost and income. Rental property owners may prefer these options to sales. If there is not enough sales data on similar buildings, for instance, if there are not a lot of multi-family units in your area and that’s what you have, looking at the building’s income may be more informative.

The income approach looks at market rent to determine property value. Essentially, the value is determined by looking at the expected cash flow you will get from renting it out, occupancy rates, and operating costs. The city of Boston states that this is especially useful for multi-unit residential income properties, where multiple sales comps may not be available to you.

The cost approach is a bit trickier. Property metrics says the cost approach is “based on the economic belief that informed buyers will not pay any more for a product than they would for the cost of producing a similar product that has the same level of utility.” In other words, the value is determined by looking at the value of the land the building is sitting on, and then subtracting any depreciation from what it would cost to build a new, identical building. This is best utilized for new or almost-new properties, or special use properties where finding sales comps would be difficult. The cost approach is complicated and typically reserved for specialized property, like churches. It should not be considered a loophole in the valuation process. For more information, the real estate exam prep page of For Dummies has a good breakdown.

Do I Need a Property Assessment to Get a Tax Abatement on My Rental Property?

Every year, property assessors are visiting homes in their municipalities to obtain tax information. Revaluations on properties are done every three years. According to Tom Walsh, who works with the City of Worcester, assessors are required to have knocked on every door in a given city every 9 years. As a property lister, Walsh works with the city’s tax office to ensure that property information for tax purposes is accurate. “The assessors try to get it as close as they can,” Walsh said. “They’re trying to make the assessment as accurate as possible. That’s their goal.”

He noted that tax bills in Worcester have “skyrocketed” after the most recent assessment (FY 2020) and that rents have gone up accordingly. What’s driving it is hard to pinpoint, but he was clear on this: If you are seeking an abatement, you must have an assessor look at your property.

Walsh said that people are sometimes reluctant to let assessors in. However, Walsh said that actually laying eyes on a property and noting any improvements (or lack thereof) is one of the best ways to determine its value. If the tax information the city has on file says you have four bedrooms, for instance, and you only have three, it’s important that someone be able to obtain the correct information. If you used to have a shed and now it’s gone, they’ll want to know that too. A finished basement is different from a crawl space when it comes to property value. All of those factors can determine how much you pay in taxes each year.

“We really can’t lower [your tax bill] if we can’t see it,” Walsh explained. “If people file for an abatement, they must let us inspect the property, [or] we can’t change anything.” He said that the tax office will factor in depreciation when assessing the value of a property, but added that in most cases, people are better off letting the tax office know about property changes in order to make an accurate assessment.

Is Requesting a Property Tax Abatement Worth My Time?

Despite the potential savings, some people say taking the time to get a property tax abatement is more trouble than it’s worth. For one Massachusetts landlord, who spoke to MassLandlords on the condition of anonymity, the answer is no. This individual has more than 25 years’ experience in both property ownership and mortgage loan servicing, and has successfully sought property tax abatements in the past. However, his experience in one city in 2018 made him say “never again.”

“It’s a nightmare process,” he said. “They sucker you in to believing this is a fast process.” That year, this landlord saw his property taxes jump on two rental units—one by approximately 10 percent, but the other one by a whopping 30 percent. It was this second property that he sought an abatement for, collecting comps and allowing an assessor access to his property.

“I know appraisals in my sleep,” he told MassLandlords. “I went in with data.” He said he was looking for a compromise on the much higher tax bill, but after his property was assessed by the city, he was denied any abatement. He said he felt taken advantage of by the assessor photographing his property, something that blindsided him, and does not believe that the city closely looked at the information he sent in.

“I get that [the city] wants more money, and they do deserve it,” he said, mentioning the many infrastructure improvements his city has seen in recent years. “But I was hoping for a compromise. You don’t just file [an abatement] because you’re mad the taxes went up.”

At the end of the day, this landlord was dissatisfied with the city’s answer, and is unsure why he was denied any abatement. He said his comps may not have been perfect, or that perhaps the fact that his rents went up factored in to the denial, but regardless, after past successes, he will not be seeking future abatements.

“I’ll take my lumps,” he said.

However, he has had success with property tax abatements in the past. Was this a fluke? Getting a property tax abatement can mean a lot of time and energy spent filing forms, gathering information, and getting your property assessed. However, with taxes rising all the time (Prop 2.5 or no), if you have an inaccurate property value on file with the city, an abatement can only save you money. Contact your local tax office to see what your property is assessed at, and what factors are contributing to that amount. If you see something amiss, take the time to get the right information on file with your municipality.