Homeowners Beware: New Law Exempts BlueHub, Lenders from Consumer Protection, Usury Laws, Despite 20% APRs.

| . Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

On Nov. 20, Gov. Maura Healey signed the state’s $4 billion economic development bill into law as Chapter 238 of the Acts of 2024, and exempted the nonprofit BlueHub Capital from the state’s consumer protection laws.

10 Malcolm X Blvd. in Roxbury, the address BlueHub Capital calls home. (Image: Google Earth)

This legislation seems aimed to dismiss a lawsuit against BlueHub. It’s a move that has raised concerns from the state attorney general’s office and angered housing advocates who say BlueHub has practiced predatory lending practices in the past and did not disclose key information about their mortgages.

What is BlueHub Capital?

BlueHub Capital, formerly known as the Boston Community Loan Fund and Boston Community Capital, is a Roxbury-based nonprofit that claims to help homeowners remain housed when they are on the brink of foreclosure. They do this by buying the at-risk houses from lenders who hold the title and selling them back to the homeowners with an apparently new, affordable payment.

According to BlueHub testimonials, this practice has helped many people, who might have otherwise lost their homes, remain in the property they purchased. But the service is not free by any means. Homeowners who closed on a mortgage with BlueHub may have reasonably expected higher interest rates. But many claim they were surprised when they went to sell or refinance their home and learned they had a second loan on the property. This second loan, called a shared appreciation mortgage (SAM), required BlueHub homeowners to pay the nonprofit a percentage of their accrued equity – sometimes more than half of it – before they could sell, refinance, or otherwise access their home equity.

The alleged lack of disclosure about these shared appreciation mortgages led to the 2020 lawsuit against BlueHub. We briefly wrote about the lawsuit earlier this year, when it appeared that the economic development bill was not going to be signed as part of the most recent legislative session. We recommend reading that article to get a better idea of the actions that led to the lawsuit.

We also have to wonder if an organization that solicits third-party investors, as BlueHub does, can be called a nonprofit, or if it’s a front organization at that point.

No Litigation Against Shared Appreciation Mortgages with “Full Disclosures”

The new legislation, which was one of many policies tacked onto the economic development bill, is highly specific. It not only formally defines and codifies the use of shared appreciation mortgages into law, but also states that lenders cannot be litigated against for offering said mortgages as long as the homeowners received “full disclosure” of the practice.

“If an entity obtains from a person acquiring or re-acquiring a residential property a shared appreciation mortgage…then the entity and the maker, lender, grantor or holder of the new first priority mortgage loan shall not be liable for monetary relief, injunctive relief or other equitable relief at common law or by statute, including chapter 93A, chapter 140D, chapter 183C and section 49 of chapter 271 for the use of or the terms of said shared appreciation mortgage or shared appreciation promissory note,” the law states.

This effectively makes BlueHub litigation-proof. The law doesn’t explicitly say that someone who has issues with their shared appreciation mortgage may not sue the lender, but that’s splitting hairs. It prohibits receiving any kind of monetary judgment or award, any kind of injunction, or even a recognition of wrongdoing under any statute one might reference when making their case, as long as they received a “full disclosure” of the shared appreciation mortgage. Chapter 93A is the chapter governing consumer protection laws in Massachusetts. Chapter 140D governs disclosing the cost of consumer credit. Chapter 183C and section 49 of chapter 271 cover predatory lending and criminal usury, respectively.

The “full disclosure” portion of law is full of optional verbiage.

This legislation defines full disclosure as a notice received in writing in advance of the closing of the property sale informing the homeowner of their obligations. Specific verbiage is included for the information that must “substantially” be conveyed, but other language is apparently optional.

For instance, the legislation merely suggests, rather than mandates, the written notice include verbiage that encourages the borrower to discuss the terms of the agreement with “family, community service providers, housing counselors or others” prior to signing. (We assume “others” is meant to include attorneys, who are otherwise not specifically mentioned.)

It also merely offers the option that lenders include a deadline of seven days to have the notice signed and returned, among other suggested allowed verbiage.

Though the law does not specifically mention BlueHub, as of this article’s publication they are the only nonprofit offering shared appreciation mortgages in Massachusetts.

We have created a plain-language explainer of this portion of the economic development bill to ensure everyone understands exactly how egregious it is.

Homeowners Speak Out: BlueHub was Predatory

After Gov. Healey signed H.5100 into law, we spoke with Nardella Thomas and Jonandria Jones-Booker, two women who state BlueHub did not disclose anything about a shared appreciation mortgage when they refinanced to keep their homes.

In 2013, Jonandria Jones-Booker and her husband were facing financial hardship. They found themselves unable to keep up with the mortgage on their Brockton home, originally purchased in 2007 and financed through Bank of America. The bank suggested the Bookers contact the attorney general – at the time, Martha Coakley – because they knew programs existed for struggling homeowners.

It was at that time that the attorney general’s office referred the Bookers to BlueHub, then known as Boston Community Capital.

“They told us they could help us,” Jones-Booker recalled, “and that we didn’t have to worry about anything.”

The couple began working with BlueHub to try and save their home. Eventually, BlueHub bought the Bookers’ mortgage from Bank of America for $67,000, according to public records, and sold it back to the homeowners for $90,000. This represented an immediate profit of $23,000 to BlueHub, a 34% increase over the sale price from Bank of America. The Bookers’ interest rate for their mortgage was 6.9%. At the time, the prime interest rate was 3.25%, and the average 30-year fixed mortgage rate was 3.98%.

When it came time for the closing, Jones-Booker says she and her husband asked more than once if they needed an attorney present, and were told no by BlueHub representatives. On closing day, the Bookers reportedly found themselves sitting alone in a room. One man came back and forth with papers, asking them to sign. Jones-Booker says at no point was she told about anything resembling a shared appreciation mortgage.

“[Eventually] they said, ‘you’re all set, this is your monthly payment,’” she recalled. She and her husband left the office and began making their payments to BlueHub.

Everything went according to plan until 2019, when the Bookers, now in a better financial situation, decided to take advantage of lower interest rates and refinance their home. The Mansfield Co-Operative Bank was willing to help them refinance their mortgage, which at the time was $83,000. The Bookers planned to use a modest amount of their equity to perform some upkeep on the house.

But just before closing, the bank called them, asking about a second loan on the property. The Bookers were confused. As far as they knew, the only loan on the property was their mortgage with BlueHub. The closing process halted until the matter could be cleared up.

Jones-Booker reached out and spoke with Adam Beattie, who is still listed as an operations manager for BlueHub. She explained they were planning to refinance the property. Beattie asked her if there had been a recent appraisal done on the home. Yes, there had been. She sent the appraisal to Beattie, and received an email with her payoff amount.

Besides the $83,000 from the mortgage, Beattie explained, the Bookers also owed $95,585, representing 60% of the accrued equity in the home. It was the first they had heard of it, though Beattie assured Jones-Booker the couple had signed a paper allowing them to put a second mortgage on the home.

By MassLandlords’ math, the shared appreciation component of their obligation to BlueHub made their annual percent rate (APR) effectively 25%, equivalent to buying the house with a credit card and never making a single payment.

“We were devastated,” Jones-Booker said.

Mansfield Co-Op informed the Bookers that they could continue to refinance the home and pay off BlueHub in full, but doing so would max out the Bookers’ equity. There would be nothing left for property upkeep.

“I was depressed,” Jones-Booker said. “I felt misled. We felt like we were taken advantage of in our most vulnerable state.”

The Bookers went through with the refinancing to get a lower interest rate and be done with BlueHub. But Jones-Booker wasn’t done. She filed a complaint with the attorney general’s office. That’s when she learned about the lawsuit filed against BCC/BlueHub, and met Nardella Thomas, who has been a prominent voice in the case against the nonprofit.

“She was my saving grace,” Booker said. “She knew exactly what I was going through.” She felt similar camaraderie with the other plaintiffs.

“We’re all victims of predatory lending.”

Higher than Average Interest Rates; Major Profits

One part of Booker-Jones’ story that stood out was the interest rate she was paying once she refinanced with BlueHub: 6.9%. The average 30-year mortgage rate in 2013 was 3.98%. BlueHub’s rate for the Bookers was nearly double that. This represents a substantial amount of additional income for the nonprofit, before the shared appreciation component is even calculated.

But remember, interest isn’t the nonprofit’s only – or even greatest – moneymaker. When homeowners sell or refinance their homes, the shared appreciation mortgage (SAM) comes due, and the amounts can be staggering. Court documents show that BlueHub purchased one Everett home in 2012 for $125,000, and sold it back to the original homeowners on the same day for $171,000. The initial profit to BlueHub was $46,000, but there was also the SAM, which demanded 50% of the homeowners’ eventual equity. Casino developers wanted to purchase the property for $800,000 in 2019, but the homeowners first had to hand BlueHub $314,000 to satisfy their second mortgage. As with the Bookers, the APR on this loan was probably well over 20%. (To calculate the APR as precisely as for the Bookers, we would need to know the loan term and interest rate.)

At what point does this stop being a helping hand to keep people in their homes, and start looking like predatory lending? No matter, because the new law ensures that no one will be able to sue BlueHub for these actions and win, as long as the SAM is disclosed ahead of time.

BlueHub CEO Elyse Cherry discussing fraud before the legislature at a hearing in 2023. (Image: Public Domain)

Attorney General Holds Some Power Over New Law

The legislation does include a line that the attorney general may “promulgate rules and regulations to implement this section.” Attorney General Andrea Campbell expressed her concerns about the legislation before it was signed.

Elyse Cherry reportedly told WGBH that this portion of the legislation was the “most important.” However, before any rules could be promulgated, BlueHub’s legal team wasted no time in attempting to get the case against them thrown out.

When the legislation was signed, the parties involved in the lawsuit against BlueHub were waiting for a summary judgment from the judge presiding over the case. BlueHub lawyers filed a motion almost immediately to stop the lawsuit against the nonprofit. Lawyers for the plaintiffs filed a rebuttal and the matter remains open as of publication.

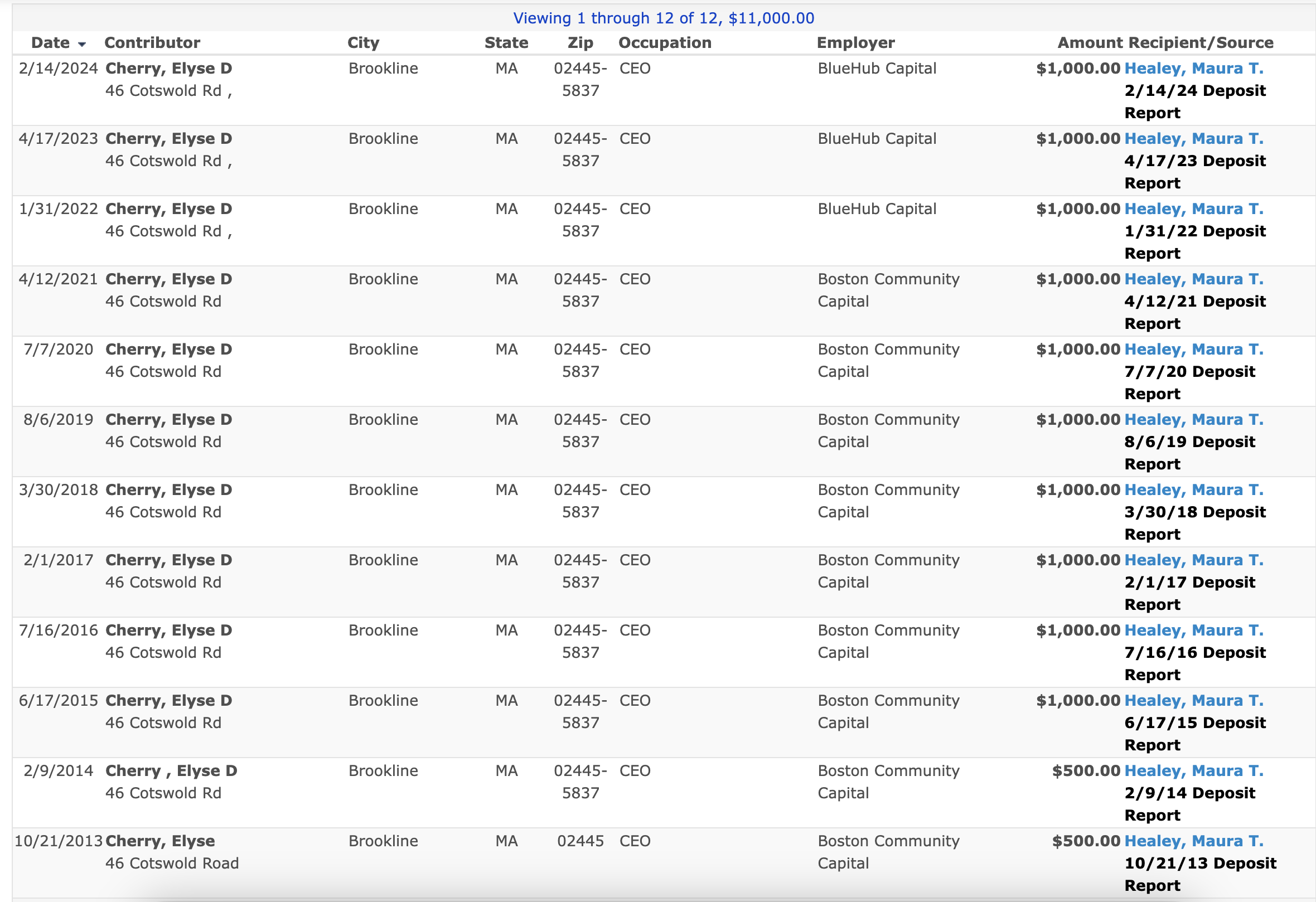

Public records show that Elyse Cherry has repeatedly made the maximum allowable donation to longtime friend Gov. Maura Healey (Lic: Public Domain)

Friends in High Places: Healey’s Signature Helps Longtime Donor and Friend

BlueHub CEO Elyse Cherry has faced criticism for her high salary (nearly $1 million in 2022, according to public filings), but her longstanding friendship and political donations with Maura Healey have also come into question with the signing of this legislation.

Public donation records show that for the past 10 years, Cherry has donated $1,000 annually to Healey’s political campaigns, the maximum allowed under the law. They are also longtime personal friends, according to a 2022 Boston Globe article titled “Maura Healey could be the nation’s first openly lesbian governor. Here’s how her identity has shaped her.” In that article, Cherry talks about how “down to earth” the now-governor is, and is reported as having held fundraisers to benefit Healey, including a 2014 event to support her run for attorney general.

We have also been unable to find BlueHub or Elyse Cherry registered as lobbyists through the state website. Lobbying firm Smith, Costello & Crawford lists them as clients in their lobbying disclosures as recently as 2023, but it was Cherry who testified in front of the joint committee on the judiciary in 2023 defending what was then S.1104, “An Act Protecting Homeowners From Unnecessary Foreclosures.” A version of that bill would eventually be what was signed into law in 2024. Does this not count as lobbying? And if so, why is BlueHub not being fined for not registering?

Conclusion

When it comes to this legislation, we find it corrupt that any nonprofit can somehow promote legislation that exempts them from any and all consumer protection laws, including the ones surrounding predatory lending and usury.

It’s also worth noting that similar legislation had been introduced and shut down multiple times before this bill was signed into law. (A prior version of the bill included language that would make the legislation apply retroactively.) The fact that it made it through under Gov. Healey may be a coincidence, but it’s certainly worth noting that a personal acquaintance of hers, who maxes out her personal political donations to Healey, is the one who stands to benefit the most from this legislation. Only BlueHub offers shared appreciation mortgages in Massachusetts, and only BlueHub is at the center of a lawsuit alleging that their practices were deceptive and predatory.

Whether those practices were predatory is ultimately up to the judge to decide. However, it is worth noting that it is only recently the phrase “shared appreciation mortgage” started appearing on BlueHub’s website. Internet archive screen shots of various BlueHub pages show no mention of the practice in the earliest versions we could find, and later versions called it an “agreement.” The inclusion of the word “mortgage” is relatively new, certainly post-lawsuit.

And while this new legislation may not specifically stop anyone from suing BlueHub, that’s relatively meaningless. Anyone can file a lawsuit against anyone or anything, but that doesn’t mean they’ll win or receive any litigatory award. This legislation removes any leg a plaintiff would have to stand on if they felt misled by BlueHub’s structure.

“If they’re so great, why would they need legislation in the first place?” Nardella Thomas asked in her discussion with MassLandlords. “This is how the government is doing favors for their special donors.”

Tell us when you first spoke to BlueHub, who referred you and what happened then.