New ‘Junk Fee’ Regulations Prohibit Undisclosed Fees in Rental Housing

. Posted in News - 0 Comments

By Eric Weld, MassLandlords, Inc.

A regulation recently implemented by the Massachusetts attorney general added further clarity to limitations on fees that landlords may charge their tenants.

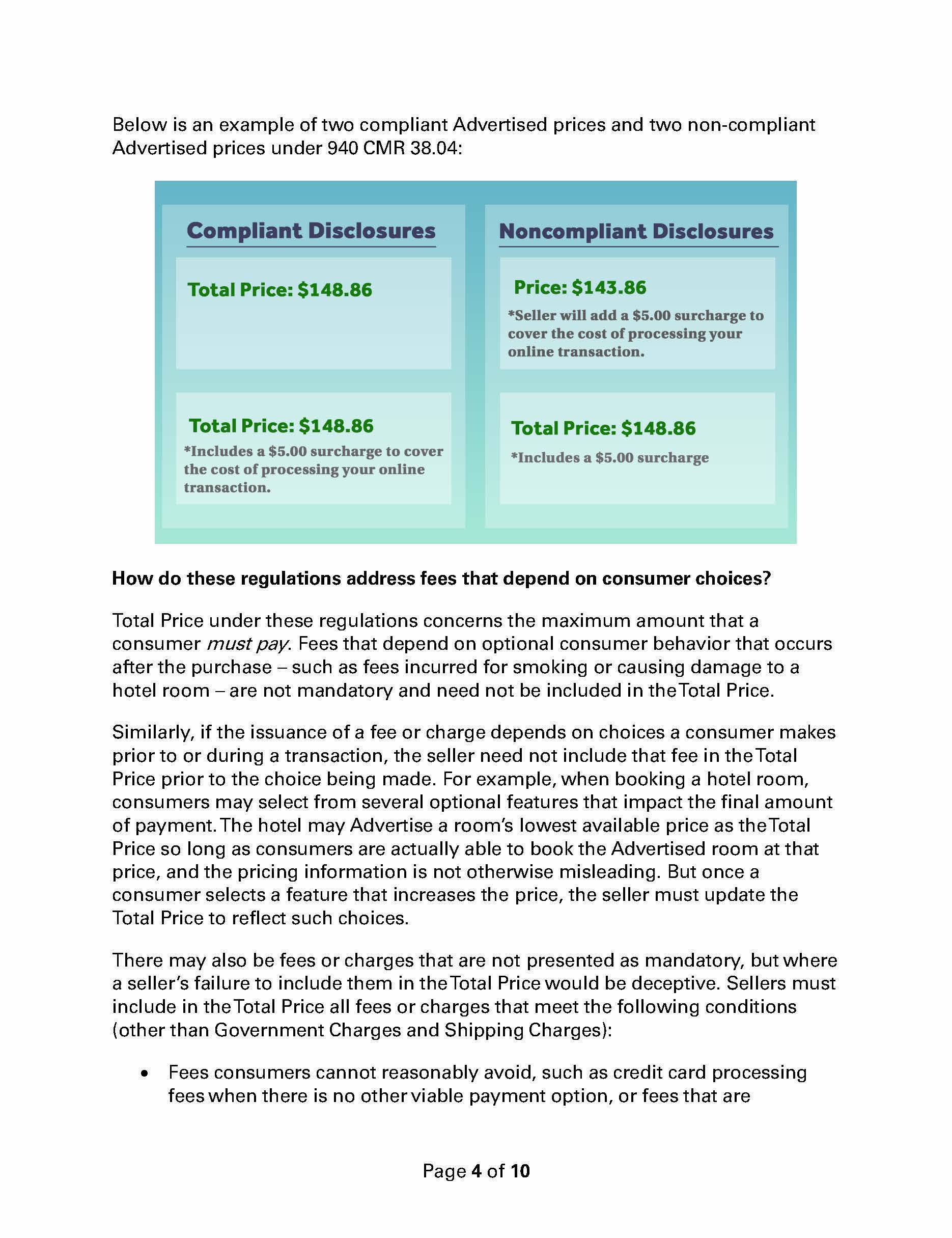

This illustration demonstrates the correct and incorrect ways to advertise a product in compliance with regulation 940 CMR 38.00, which requires advertisements for any product, including rental housing, to include the total price of the product. The so-called “junk fee” regulation prohibits charging tenants and other consumers any fees that have not been disclosed before or upon entering a contract, such as a lease. As illustrated, if a fee is to be charged for processing online payments, like rent, then that must be disclosed in the ad. Image: Mass.gov

The regulation, 940 CMR 38.00, codifies the requirement for merchants and sellers of any product, including rental housing, to divulge upfront the total cost of a product. For landlords, that means informing prospective renters of any potential costs and fees associated with renting a dwelling at or before the signing of a lease. The intent is to enable potential renters to see definitively and in advance what they will be required to pay to live in a rental unit. The regulation prohibits the practice of charging or adding on undisclosed fees during a tenancy that were not agreed upon before a lease began.

It has become common among some landlords (particularly corporate landlords) to charge any of an array of fees not included in a lease after tenants have moved in. Such fees might include amenity or “community” fees, rent payment processing fees, subletting or new roommate fees, or periodic charges for parking, trash pickup, pets, pest extermination or automatic lease renewal. These fees have come to be known as “junk fees” because they are extra, sometimes hidden and often unnecessary, and add little or no value to the original product (the rental unit).

Other fees, such as application fees and hold fees, were already illegal. In fact, as we frequently reiterate in this space, collecting any fees before tenants move in, other than security deposit, first and last month’s rent and payment for changing door locks, is illegal. M.G.L. Chapter 186 Section 15B clearly states the four pre-move-in fees allowed, and has been backed up by court cases emphasizing the illegality of charging fees beyond the four listed in the law.

The new junk fees restriction tends to extend the prohibition of charging extra fees beyond move in through the duration of the tenancy.

Attorney General Andrea Campbell added 940 CMR 38.00, the so-called “junk fees” regulation, to the Massachusetts Consumer Protection Act, M.G.L. Chapter 93A, the state’s Consumer Protection Law, in an effort to curtail unfair and deceptive behavior in marketing and selling all products, rental housing included. A violation of the junk fees regulation is a violation of Chapter 93A. The statute took effect on Sept. 2, 2025.

A Massachusetts law passed in July 2025 also codified the prohibition on charging tenants for brokers’ fees that were procured by the landlord. Though it was already illegal to do so – as stated in Chapter 186 Section 15B – it had become common practice for some landlords to hire brokers, for services such as advertising, finding and screening tenants and processing applications, and charge their tenants for that service. The so-called brokers’ fee ban requires that the party who hires a broker, be it a landlord or tenant, pays the broker.

If access to a gym, like this one, is available to your renters for an extra fee, such as an amenity or community fee, you must disclose that fee in your ads, according to Massachusetts’ new junk fee regulations. Any fees, like a gym fee, pet fee, late payment fees or trash pickup fee, must be disclosed to prospective renters before signing a lease. Image: cc by-sa unsplash

List All Fees in Advertising, Including Payment Processing

Those most impacted by 940 CMR 38.00 will include landlords who were in the habit of advertising apartments without all fees listed. Compliance with the law is a simple matter of including any fees that will be charged as part of tenancy with the initial advertised price of rental. If tenants will be charged for trash pickup, add the monthly cost for that service into the total rental price listed. If your tenants will be required to pay rent via an online platform that charges a usage fee, you must disclose what that fee will be on or before lease signing.

A proper apartment listing will prominently include a total price followed by a breakdown of extra monthly fees, as shown on the Mass.gov site outlining the regulation. If a fee is not included in that total price, it may not be charged or added during the tenancy.

Advertising aside, the easiest way to avoid the junk fees regulation from coming into question is to list and charge a rent price that includes all services. If your tenancies include access to a gym on-site, add a commensurate amount to the rent to reflect that benefit, but don’t call it an amenity, community or gym fee. You can include compensation for trash pickup. Just build it into the rent price, don’t break it out and charge a separate fee.

The regulation is also intended to end the practice of automatically signing tenants up for a charged service without informing them. In some cases, for example, tenants have been enrolled in and required to use an online rent-payment platform, which charges a usage fee, without being informed about it. The junk fees regulation mandates that landlords fully disclose any such requirements before lease signing.

Common Practice Among Corporate Landlords

It’s no secret that the attorney general’s junk fees regulation is aimed mostly at large, corporate landlords, particularly REITs (Real Estate Investment Trusts), which seek to increase profits for their investors.

Small and mom-and-pop landlords are far less likely to add extra fees during tenancy than large and absent landlords. Small landlords often have a direct relationship with tenants that allows for negotiation and mutual agreement around conditions and fees during tenancies.

Corporate landlords and REITs have in some cases tempted the need for regulation with an assortment of unfair charges to tenants.

Several states have responded with laws against junk fees like the Massachusetts regulation. Colorado, Connecticut and Rhode Island have all passed legislation curtailing junk fees. Georgia, Illinois, Minnesota, Virginia and Washington all have versions of junk fee regulations in legislative process.

Other states continue to allow extra, sometimes hidden, fees, and do not require advertised rents to be all-inclusive. As an example of what can happen in states lacking junk fee regulation, one can look at Missouri. Deca Property Management, a company that manages about 1,400 rental units in St. Louis, has become notorious for its junk fees. Deca charges all tenants a monthly fee of around $45.95 to enroll them in a mandatory “resident benefits package” that includes renters insurance, a fee for changing HVAC filters and for reporting their on-time or late rent payments to credit agencies (i.e., charging renters, in effect, for a service that potentially harms them). Deca also charges a $60 fee to apply for rental consideration, a common practice in many states.

Charging application fees is not legal in Massachusetts, according to Ch. 186 S. 15B. Any other fees, such as those Deca charges, now must be disclosed to renters before they sign a lease, or built into the rent price, in Massachusetts.

State and Federal Junk Fee Bans

Alongside the surge in state laws prohibiting junk fees has been a federal clampdown. The Federal Trade Commission implemented the Rule on Unfair or Deceptive Fees, which took effect on May 12, 2025. The rule requires businesses to inform consumers of the entire price of a product in advertising and other marketing, seeking to curtail deceptive bait-and-switch practices and hidden add-ons.

The rule specifically targets short-term rental and event ticketing markets but pertains to long-term rentals as well.

In Massachusetts, advertising of rental units must show any and all fees that will be charged during tenancy. If you will charge your tenants fees for late rent payments, you must disclose that before entering into contracts with them. The same applies for cleaning fees, pest extermination or any other service during or at the end of a tenancy.

The 2025 rash of bans on junk fees and brokers’ fees, both at the federal and state levels, make it clear that deceptive, misleading, hidden and undisclosed charges for products is illegal.

Junk Fees Regulation FAQ

Q: Can I charge pet rent?

A: Yes, read this article for more details. But you now must disclose pet rent or fees you’ll charge for having a pet in your rental in your ads.

Q: Can I require a renter to use a payment processing service that charges the renter a fee?

A: Yes, but now you must disclose the service fee in your ad.

Q: Can I charge renters late fees, trash fees, or other costs for noncompliance?

A: Yes, but now you must disclose those fees in your ad.

Q: Do I have to include utilities in the rent?

A: Probably not. There is nothing in the regulation or guidance that addresses utilities one way or another. Best practice would be to make it clear in the listing whether utilities are included, and if known, to indicate what prior renters actually paid during an average month or total lease.