2025 Insurance Underwriting Losses Top $108 Billion, Accelerating; Budget for Premium Increases at 7%; Climate Change a Major Factor

. Posted in News - 0 Comments

By Kimberly Rau, MassLandlords, Inc.

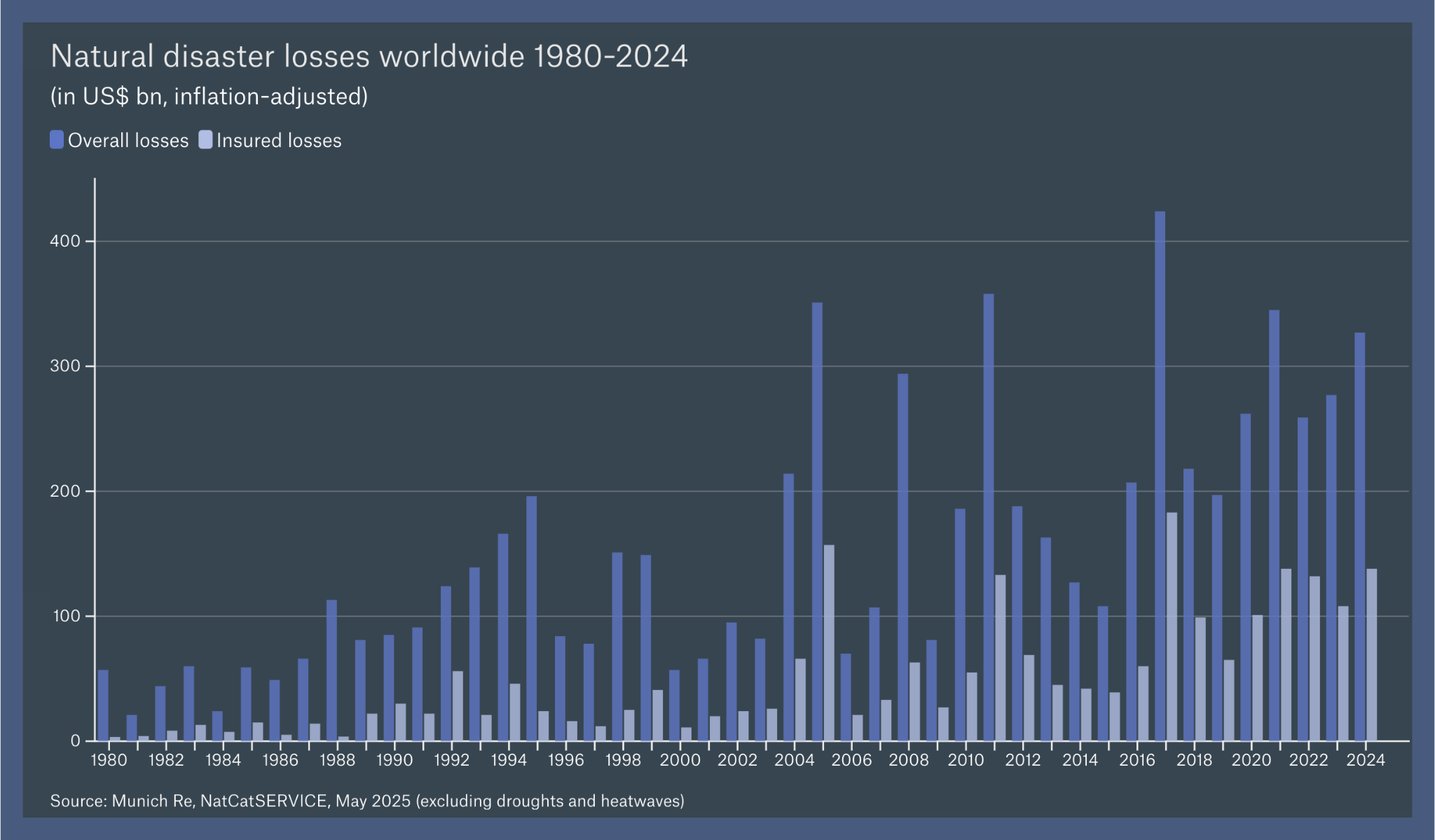

A report from the risk management firm Munich Re shows that insured losses reached USD $108 billion in 2025. This marks the sixth year in a row that costs topped $100 billion (after removing price changes from inflation) and the 44th year of a trend. Wildfires, flooding and severe thunderstorms, all on the increase due to climate change, account for 97% of insured losses for 2025.

The Palisades wildfire in early 2025 cost an estimated $20-$25 billion in insured damages. (Image License: Jessica Christian for Unsplash)

Worse, that dollar amount represents only what insurance companies paid out for damages. Total damages amounted to approximately $224 billion. This is less than 2024, which saw total losses of $368 billion (adjusted for inflation), and insured losses of $147 billion. But experts attribute that to the fact that this 2025 is the first year in a decade that the United States did not have a direct hurricane hit.

We thought perhaps the costs of natural disasters as the result of climate change might be overstated. The data show the opposite: It’s accurate, and ever-increasing.

Climate change warms the earth and creates more opportunity for major weather events. Reinsurance company Gallagher Re publishes a quarterly Natural Catastrophe and Climate Report. Its October publication for Q3 of 2025 offers the same message as Munich Re: It’s getting expensive to pay out for the destruction caused by natural disasters.

Economic losses from natural disasters have climbed over the years. The past six years have seen insured losses over $100 billion. All amounts shown were adjusted for inflation. (Image: Munich Re, Fair Use)

Decades of Data Show Costs Are Going Up Faster; Premiums Expected to Climb a Yearly Average of 7% Indefinitely

Munich Re regularly publishes data about insurance costs, including losses as a result of natural disasters. When it does, it typically adjusts prior year dollar amounts for inflation, making it easy to compare.

What we see is that as the earth warms, it’s getting a lot more expensive to clean up after natural disasters.

For instance, 1980 saw a total of $57 billion in natural disaster losses, of which $3.4 billion were insured losses. By 1995, that number had jumped to $196 billion in total losses, and $24 billion in insured losses (all figures adjusted to remove the impact of inflation). Nearly every year since 2004 has seen more than $100 billion in total losses. And now, for the past six years, the insured loss has topped $100 billion, with total losses nearly always exceeding $200 billion.

As costs go up for insurance companies, the burden gets passed on to consumers in many ways.

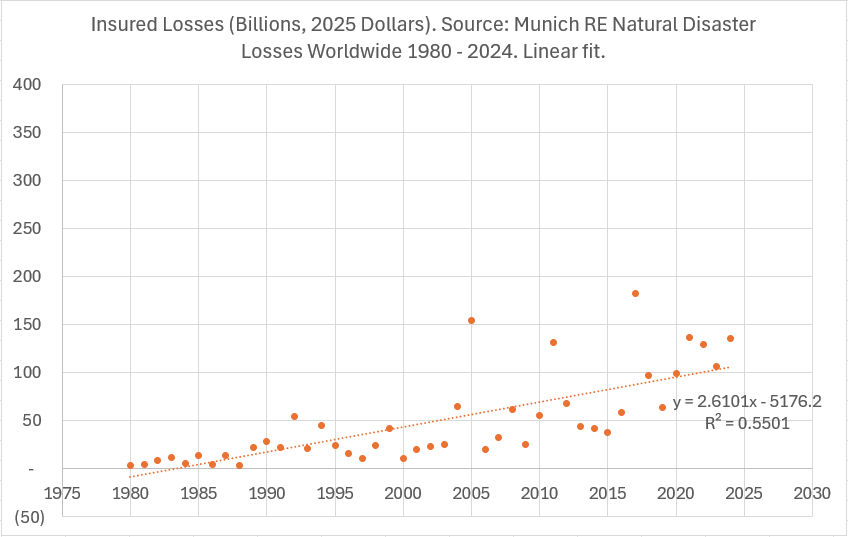

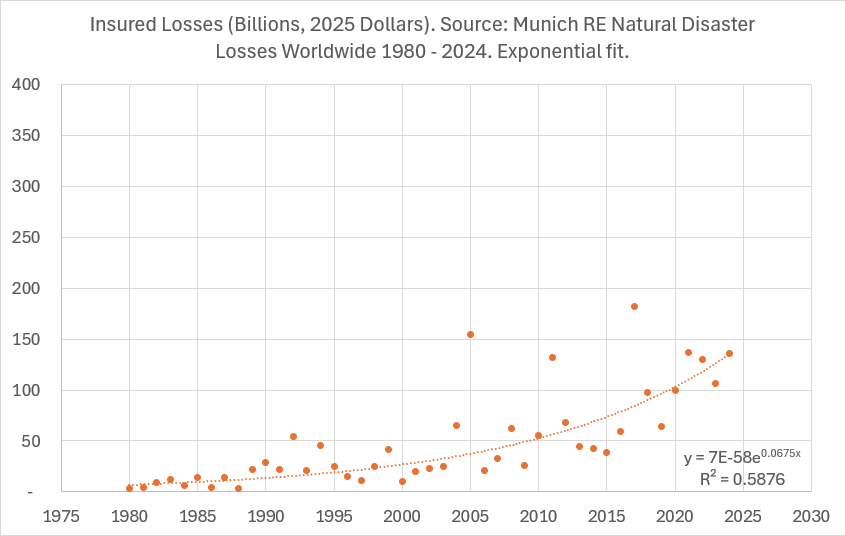

Disturbingly for us housing providers paying increasing insurance premiums, the trend the last 44 years indicates that underwriting losses are accelerating.

MassLandlords extracted the Munich Re data to fit our own trendlines. A linear model was unrealistic because it required negative underwriting losses in the 1970s. An exponential model was a better fit and explained more than half of the variance. The data are noisy.

Despite the noise, the trendline indicates that we should expect underwriting losses to increase by an additional $10 billion per year on average through the 2020s, and $20 billion per year on average through the 2030s. Absent major policy change, we will pay these higher premiums.

The data indicate that budgeting for average insurance premium increases of 7% per year in the long-term would now be the prudent way to approach a budget. It should be noted in case it’s not clear: insurance premiums are expected to increase faster than inflation across the board for all structures.

You don’t need to be a rocket scientist to see these numbers are taking off. Insurance losses are increasing every year, at an accelerated rate. Plan and budget accordingly. (Image License: cc BY-SA 4.0 MassLandlords, Inc.)

Climate Change Increases Insurance Costs Across the Board

As insurance companies are paying out higher damages and seeing greater losses, customers also pay the price for natural disasters, even if they are not personally affected.

When you make a claim against your homeowners insurance, you expect your premiums to go up afterward. If the claim is great enough, your insurance company may decline to re-insure you once your contract is up. But even without any claims, you’ve likely seen your premiums increase over the past several years, as insurance companies scramble to cover costly natural disasters.

Policies Being Canceled For 20-Year-Old Roofs

In 2025, we wrote an article about insurance companies canceling policies for roofs deemed to be too old or in disrepair. In some cases, those roofs were just 20 years old, below the average maximum 30-year lifespan of traditional asphalt shingles (though this can vary based on a variety of factors).

The bottom line is roofs are expensive, and insurance companies appear to be shying away from risking major payouts. This trend appears to be industry-wide: If one insurance company wants you to repair or replace your roof, others may require the same.

That is if you can find another insurance carrier. Over the past few years, major insurance carriers have been cutting back coverage in high-risk areas, and leaving some areas altogether.

Major Carriers Are Exiting High-Risk Markets

Insurance plans work because everyone pays premiums. Most people will not make a claim on their insurance in a given year, so when disaster strikes, the pool everyone pays into is used to pay out claims.

This works until a large-scale disaster depletes an insurance carrier’s resources. Simply stated, if they can’t pay out, they can’t offer insurance. Insurance carriers may raise premiums, or require extra insurance for properties in high-risk areas. But sometimes even that isn’t enough. Some major carriers are choosing to not insure properties in disaster zones, or refusing to offer coverage in some areas altogether.

As insurance carriers refuse to insure an increasing number of high-risk properties, more property owners are forced to purchase expensive plans from last resort insurers.

Last Resort Insurance Programs Are Even More Expensive

If you cannot find another insurance carrier, you will likely have to get insurance through a state program, typically Fair Access to Insurance Requirements (FAIR) plans. However, this is considered last-resort coverage. It’s very expensive, and may not cover as much as a private policy did.

A story published by Commonwealth Beacon reported that FAIR Plan premiums increased 11% between 2019 and 2023 (and remember, these were already more expensive than other plans). In 2024, the Massachusetts FAIR Plan saw its highest year ever of new enrollees.

New enrollees must also purchase a plan that covers at least 90% of their home’s reconstruction cost, up from the previous requirement of 80%.

It’s a situation that is becoming ever more expensive. The only way natural disasters will slow down is if we can get ahead of climate change.

Numbers don’t lie. This graph uses the information provided by Munich Re to show insured losses due to natural disasters are increasing 7% per year, faster than the rate of inflation. (Image License: cc BY-SA 4.0 MassLandlords Inc.)

Conclusion: Climate Change Is Real, and Expensive

We thought, and hoped, that the numbers would show the costs of climate change and its resulting natural disasters were somehow exaggerated. We couldn’t have been more wrong. Those numbers are correct, and growing.

Climate change is a global issue, and one that requires all of our efforts. It’s easy to point to major corporations as the biggest contributors to global warming (and you’d be right), but that doesn’t let us off the hook either.

“All in all, two things are therefore necessary to limit the damage,” wrote Munich RE. “[L]oss-reducing adaptations to the risk, such as more stable buildings and avoiding construction in high-risk areas, and halting climate change as far as possible.”

Voting for climate-stabilizing initiatives is a major first step. Utilizing programs like Mass Save to make your rental properties as carbon neutral as possible is another. Depending on the type of rentals you have, and where they are located, you could get full coverage for heat pumps as well as other environmentally friendly upgrades.