Rent Control Ballot 2026: Content and Analysis

| . Posted in News - 0 Comments

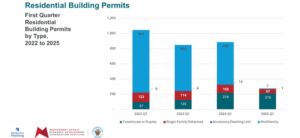

A rent control ballot initiative has been filed with the attorney general and certified, meaning proponents are gathering signatures now to put this question to the voters statewide in November 2026. If rent control were to pass, it would have far-reaching consequences, not least of all because of what it deletes. This article reviews the deletion conceptually and explains what the proposed system would be like.

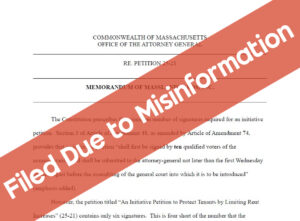

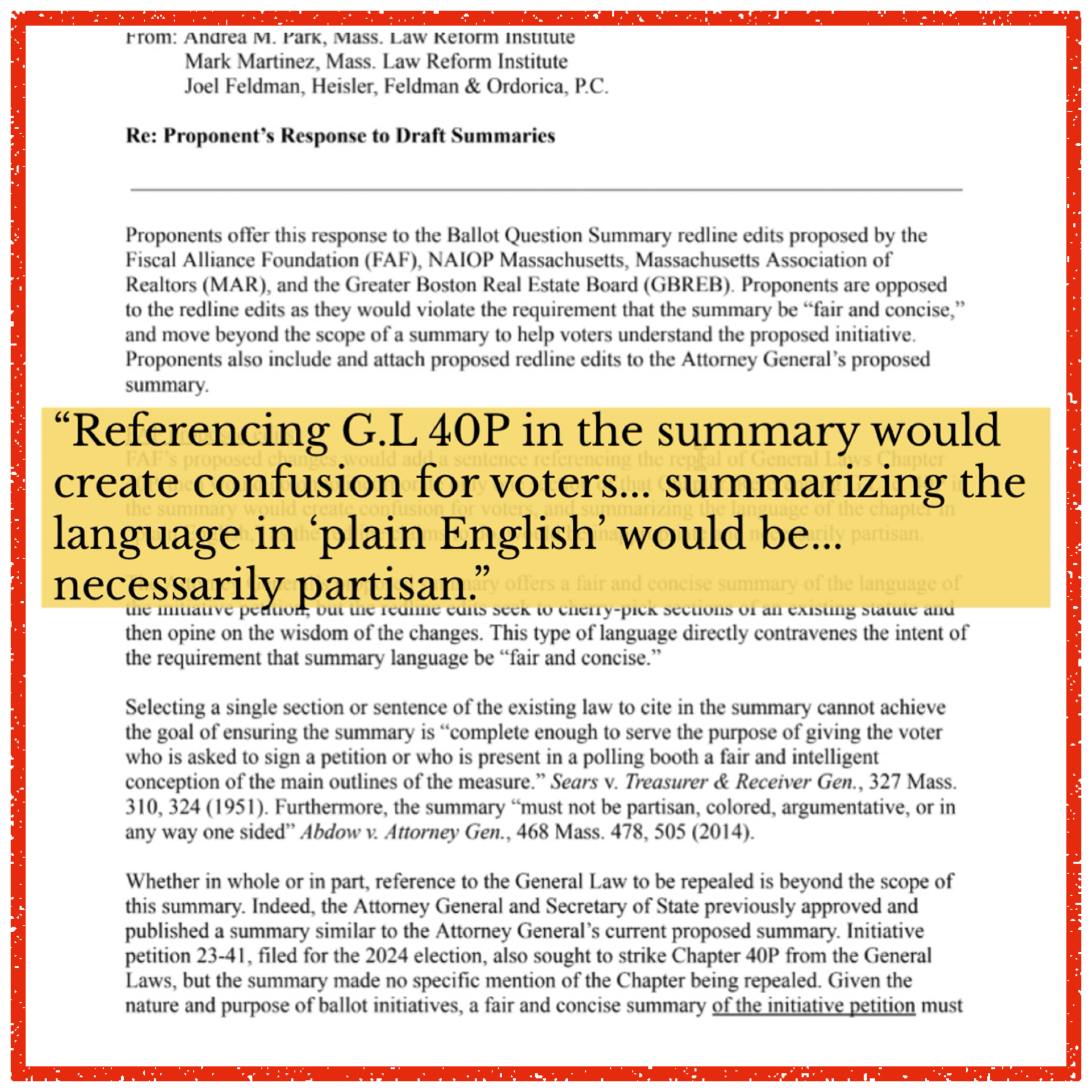

As part of the Attorney General certification process, landlord advocates pressed renter advocates on the ballot summary, which we said should mention they’re deleting Chapter 40P. Andrea Park, Mark Martinez and Joel Feldman said, “no.” They don’t want the public to know. This is manifestly unfair, and unlawful under Article 48.

Deleting the Current Chapter 40P’s Right to Compensation

Chapter 40P as it stands today is The Massachusetts Rent Control Prohibition Act. This act was approved by statewide ballot initiative in 1994. Contrary to its name, it allows rent control under specific circumstances. That’s right! Any town or city could have rent control today if it wanted, provided:

- Landlords must opt in;

- Rent control regulations enacted by the town may not regulate who can live in a unit, services, evictions, condo conversion, or who gets to leave rent control;

- Rent cannot be controlled if the owner has fewer than 10 rental units;

- Rent cannot be controlled if the market rent is more than $400; and

- The town must compensate owners for the difference between the controlled rent and the market rent.

There are two things of note here.

First, the drafters made an error and forgot to specify what time period was in mind when the $400 rent figure was written. $400 per week? We’d be fine with $400 per day, because of the second point:

Second, there is a right to compensation under 40P. Housing isn’t free. The voters in 1994 knew that as surely as the voters today. If you want to control the price, absent cost control to match, someone needs to pay the difference or housing will decline and disappear.

Chapter 40P is explicit that there should be compensation, and that this should be funded as a common burden (paid for out of general town revenue). Rent control cannot be paid for by any subset of taxpayers.

Under 40P, with compensation and good PR for days, many landlords would opt in to the current form of rent control. It would amount to Section 8, a program many landlords have willingly participated in for 90 years. Section 8 reimburses the owner the difference between market rent and what the renter can afford, and provides a mechanism to ensure that rent is reasonable.

Lack of funding is presumably one reason towns have not enacted 40P. Another reason could be that 40P isn’t mean enough to landlords. Enter the ballot initiative.

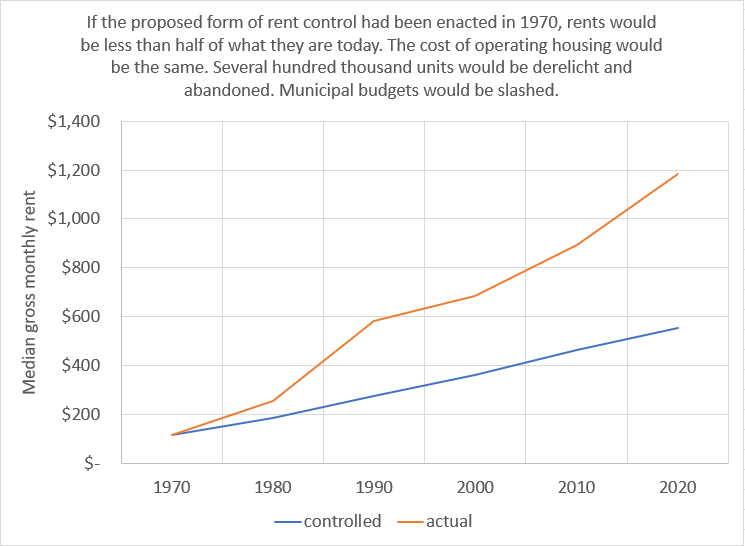

We made a graph back testing this version of rent control through the high-inflation 1980s.

Replacing 40P With an Uncompensated System

The proposed law deletes what voters approved in 1994, including the compensation provisions, and puts a draconian system in its place. Under the new system, if rents fall behind market rent, the owner will not be reimbursed. The math controlling rents is brutal in its simplicity:

The text says that rent must be calculated from the value of the apartment on Jan. 31, 2026. Forever after, rent may increase at either the rate of 5% or one of the consumer price indices, whichever is lower. The intent is to cram owners down, to hold rents below true inflation. In a year with low inflation, rents will increase by inflation. In a year with high inflation, rents will increase by less, by only 5%. Over time, rents will fall behind inflation.

Under this proposed scheme, no one will reimburse owners for the difference between controlled rents and market rents. There is no one to appeal to for an exemption.

The proposal is staggering in its brevity. Many landlords have asked us about various scenarios, but we can hardly answer. It seems as if no more thought went into the text than would go into making a peanut butter and jelly sandwich.

What follows are a list of frequently asked questions, and our best attempt to answer.

A screenshot from RentControlHistory.com shows the bottom line for policy makers: rent control costs towns tax revenue.

How can they delete the compensation provision? Isn’t that protected under Article 48?

It would be up to us to raise the legal challenge. Ballot initiatives may not pertain to compensation for property, but the attorney general certified the initiative anyway, despite this issue being specifically raised during the certification debate.

Which CPI did they pick?

They didn’t specify. It could be CPI-U, if they want to help urban workers, or CPI-W, or a farm-based metric, or seasonally adjusted. No one knows.

Does a city or town have to adopt the measure?

No, it would be instantly statewide.

Who has the authority to clarify this?

No one. The attorney general was granted enforcement power, but cannot set which CPI.

Does the unit get reset to market when a renter leaves?

No.

Is there an exemption so I can renovate?

No.

What happens if my unit is vacant in January 2026?

The last rent charged will be the base rent for the calculation.

What if my unit has been vacant for years?

Look back up to five years for the base rent. That last rent is the base rent, regardless of whether you’ve spent the time renovating it.

What if I raise my rents during 2026, and this passes?

Your rents will reset to January 2026 levels.

What will be the real dollar impact over time?

We cannot predict, but if this system had been put in place during the rise of rent control during the 1970s, rents would be half of today’s value, but expenses would be the same.

Are there any exemptions?

Yes:

- Owner-occupy buildings with four or fewer units;

- Public housing (not Section 8);

- Hotels;

- Dorms, churches and nonprofits;

- Units built from the ground up (new certificate of occupancy) in the last 10 years.

What if I’m exempt now, then I sell to a non-exempt owner?

The non-exempt owner would have to recalculate their rents from January 2026. The rents you get are not the rents they get. The exemption applies to owners, not time periods. Your forecast market value may be substantially less.

What if I buy a property with leases in place at exempt rents, and I’m not exempt?

No one knows.

What will happen to rents?

Rents will fall in real dollar terms over time.

What will happen to assessed values?

Assessed values will fall in real dollar terms over time.

What will happen to municipal tax revenue?

Municipal tax value will fall in real dollar terms over time.

How will we decarbonize all this housing if we can’t charge market rents?

We cannot.

Where can I learn more about rent control?

Visit RentControlHistory.com.

Are landlords already raising the rent?

Yes, in anticipation of the January 2026 cutoff. We do not recommend this.

What can I do?

Please join as a member and then become a property rights supporter.